NVIDIA Corporation (NVDA)

Nvidia: Stellar Q3 And Explosive Guidance Make The Bear Case Harder (Upgrade)

Nvidia Corporation is upgraded to a "cautious Buy" after strong Q3 earnings and stellar Q4 guidance reinforce its growth momentum. NVDA reported Q3 revenue of $57 billion, beating expectations, with Data Center revenue up 25% QoQ and robust guidance for continued growth. NVDA stock valuation remains reasonable at ~30x forward earnings, with optionality for further upside if current momentum persists, despite potential cycle risks.

Nvidia: Seismic Quarter Redefining AI Markets

Nvidia Corporation delivered exceptional revenue growth last quarter, fueled by robust demand from generative AI labs and hyperscalers. NVDA maintains strong pricing power and gross margin expansion as hyperscalers increase capital expenditures and AI demand remains steady. Medium-term risks include circular financing and the need for LLM companies to become self-sustaining, while automotive offers future growth potential.

Nvidia's revenue is bigger story than gross margins moving forward, says Susquehanna's Chris Rolland

Chris Rolland, Susquehanna senior semiconductor analyst, joins 'Fast Money' to talk Nvidia quarterly results and investors call.

Nvidia Stock: Time To Sell

Nvidia Corporation is primed to report earnings Thursday. With the U.S. economy teetering and AI sentiment turning bearish, a draw-down feels possible. Despite probably continued success in the near-term, NVDA is facing stiff headwinds in the years ahead.

Nvidia's record $57B revenue and upbeat forecast quiets AI bubble talk

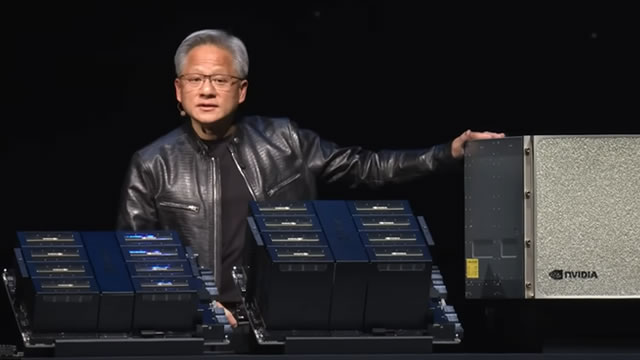

Nvidia founder and CEO Jensen Huang struck a bullish tone in the company's third-quarter earnings. And based on the company's results, there may be a reason to.

Nvidia Shares Jump After AI Juggernaut Beats Revenue Expectations

Get Forbes Breaking News Text Alerts: We're launching text message alerts so you'll always know the biggest stories shaping the day's headlines. Text “Alerts” to (201) 335-0739 or sign up here.

Nvidia forecasts stonger than expected fourth-quarter revenue

Nvidia forecast fourth-quarter revenue above Wall Street estimates on Wednesday, betting on booming demand for its AI chips from cloud providers against the backdrop of widespread concerns of an artificial intelligence bubble.

Nvidia shares rise as booming demand for chips, bullish forecast calm worries of AI bubble

Analysts and investors widely expected the underlying demand for Jensen Huang's AI chips, which has powered Nvidia results since ChatGPT's launch in late 2022, to remain strong.

Nvidia posts stellar Q3 revenue as data center demand soars

Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) reported third-quarter revenue that exceeded expectations, supported by increased demand for its AI-focused data center products. The chipmaker posted revenue of $57.01 billion for its fiscal third quarter, surpassing Wall Street expectations of $55.19 billion and marking a 62% increase from a year earlier.

Nvidia Earnings Pivot? 5 Best Stocks For Sector Rotation Out Of Tech

Nvidia earnings have cast a light on defensive areas, inducing a sector rotation that may accelerate in the short term. Looking beyond NVDA earnings, an economic environment characterized by slowing growth, persistent inflation, and tariff uncertainty is compelling investors to look beyond overbought tech. This shift favors sectors that offer resilience, stable cash flow, and intrinsic value over speculative future growth.

Elon Musk's xAI will be first customer for Nvidia-backed data center in Saudi Arabia

Nvidia and xAI said that a large data center facility being built in Saudi Arabia and equipped with hundreds of thousands of Nvidia chips will count Elon Musk's xAI as its first customer. Musk and Nvidia CEO Jensen Huang were in attendance at the U.S.-Saudi Investment Forum in Washington, D.C.

Nvidia's earnings are a bellwether moment, says Plexo Capital's Lo Toney

Lo Toney, Plexo Capital, and Jay Goldberg, Seaport Global Securities, join 'The Exchange' to discuss what can happen to keep Nvidia's train rolling, Goldberg's 'sell' rating on Nvidia and much more.