NVIDIA Corporation (NVDA)

Nvidia (NASDAQ: NVDA) Stock Price Prediction for 2025: Where Will It Be in 1 Year (Nov 19)

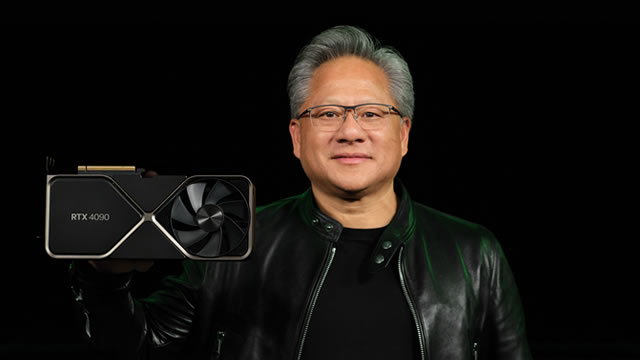

Shares of Nvidia Corp. (NASDAQ: NVDA) have retreated 6.4% in the past week on concerns about an AI bubble ahead of the chipmaker's third-quarter report.

Alger Concentrated Equity ETF Q3 2025 Portfolio Update

The Alger Concentrated Equity ETF outperformed the Russell 1000 Growth Index during the third quarter of 2025. NVIDIA Corporation (NVDA), Nebius Group N.V. (NBIS) and Astera Labs, Inc. (ALAB), were among the top contributors to performance. Netflix, Inc. (NFLX), GFL Environmental Inc (GFL), and Twilio, Inc. (TWLO), were among the top detractors from performance.

Nvidia earnings preview: Investors brace for AI reality check

Nvidia is set to report its third-quarter earnings after the bell Wednesday, with analysts forecasting a 56% year-on-year surge in sales. Richard Kelly, Head of Global Strategy at TD Securities, tells CNBC investors should be cautious around soaring AI valuations, but notes the tech sector's heavy investments haven't yet translated into significant GDP growth or affected the broader economy.

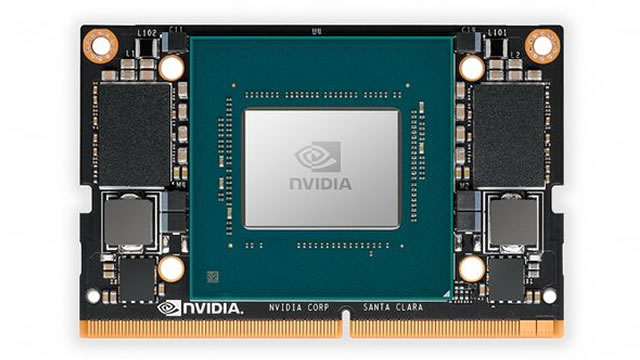

Nvidia chip shift to smartphone-style memory to double server-memory prices by end-2026 - Counterpoint

Nvidia's move to use smartphone-style memory chips in its artificial intelligence servers could cause server-memory prices to double by late 2026, according to a report published on Wednesday by Counterpoint Research.

European markets set for a soft open as investors await Nvidia earnings

European stocks are set for a soft open on Wednesday as questions continue over tech stocks.

Nvidia Results and Delayed Jobs Data Set Up Critical Test for Wall Street

The releases will provide key signals for investors after a significant market pullback.

Why Nvidia's Earnings Report Wednesday Is More Important Than You Think

A lot is at stake when the world's most valuable public company reports earnings Wednesday.

Stock market slips again as Nvidia, bitcoin, and other stars keep falling

The U.S. stock market is slipping again on Tuesday, following a global sell-off, as Nvidia, bitcoin and other Wall Street stars keep falling on worries that their prices shot too high. Home Depot is also dragging the market lower after saying it made less in profit during the summer than analysts expected.

What the Charts Say About Nvidia Stock Heading Into Earnings

Nvidia has been resting on an inflection point in recent session.

Nvidia earnings loom: Can the chip giant keep the AI momentum going?

As the AI sector braces for Nvidia Corp (NASDAQ:NVDA, XETRA:NVD)'s quarterly results on Wednesday, market eyes are fixated on the chipmaker that has become the backbone of the artificial intelligence revolution. Analysts expect a blockbuster quarter, with revenues forecast to hit $55.19 billion, a 57% increase year-over-year, and net income projected at $30.85 billion, up 55% from a year ago.

Nvidia's Not Alone -- The AI Infrastructure Trade Is Bigger Than You Think

AI infrastructure growth extends beyond Nvidia (NVDA) and chips, with networking and power sectors offering significant investment opportunities. High-speed networking is essential for AI data centers, benefiting companies like NVDA, Broadcom (AVGO), Marvell (MRVL), Celestica (CLS), and Arista Networks (ANET). Power infrastructure and utilities are critical bottlenecks; energy midstream (ET, EPD) and utilities (NEE, CEG, DUK, AEP, XLU) stand to gain from AI-driven demand.

Nvidia earnings: As AI stocks slide and Wall Street holds its breath, here's what top analysts expect

The most anticipated quarterly earnings of the month will be announced on Wednesday, November 19, as AI chip giant Nvidia Corporation (Nasdaq: NVDA) reveals financial results for its 2026 fiscal third quarter.