NVIDIA Corporation (NVDA)

Wall Street Analysts Believe Nvidia (NVDA) Could Rally 25.29%: Here's is How to Trade

The mean of analysts' price targets for Nvidia (NVDA) points to a 25.3% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.

Analysts revise Nvidia stock price target

Nvidia (NASDAQ: NVDA) is back in the spotlight ahead of its third-quarter earnings report scheduled for November 19. This comes as Wall Street updates its Nvidia stock price targets and raises the 12-month NVDA price forecast across multiple firms.

Wall Street Doubles Down On Nvidia Amid AI Stock Slump

Wall Street analysts are expressing confidence in Nvidia stock to regain its mojo ahead of the AI chip leader's earnings report next week.

Insights Into Nvidia (NVDA) Q3: Wall Street Projections for Key Metrics

Besides Wall Street's top-and-bottom-line estimates for Nvidia (NVDA), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended October 2025.

Top Robotics Stocks to Add to Your Portfolio for Impressive Returns

Robotics is poised for robust long-term growth. Consider NVDA, TRMD and TER for potential market dominance across sectors.

Nvidia (NASDAQ: NVDA) Bull, Base, & Bear Price Prediction and Forecast (Nov 14)

The trade war with China was tough on Nvidia Corp. (NASDAQ: NVDA) investors.

3 Forces That Could Shake Nvidia Stock

NVIDIA (NVDA) has faced challenges in the past. Its stock has dropped over 30% within less than 2 months on 8 occasions in various years, erasing billions in market value and eliminating substantial gains in a single correction.

NVIDIA Poised for a Q3 Earnings Surprise: Buy Before the Beat?

NVDA eyes a potential Q3 beat as soaring data center demand and broad segment recoveries fuel expectations ahead of its results.

AI Frenzy: Everybody Wants NVIDIA's Magical GPUs

Day in and day out, companies continue to clamor for the NVIDIA GPUs that are powering the AI revolution. Here are some of the big collaborations and partnerships that the company has announced (so far) in 2025.

This Tech Stock Expert Just Got More Bullish About Nvidia Ahead of Earnings. Here's Why

One Nvidia bull just got more bullish.

Nvidia's stock has a strong setup ahead of next week's earnings, this analyst says

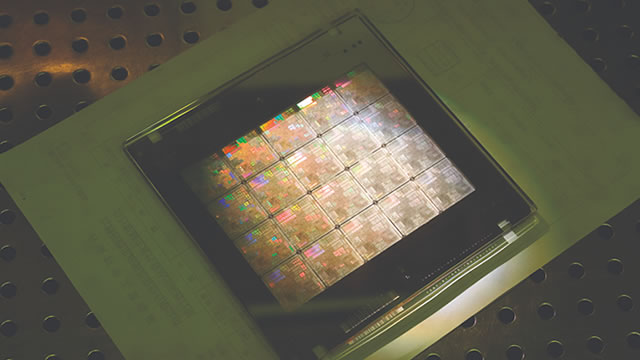

Nvidia may have big beat-and-raise potential when the company reports results next week, thanks to the continued ramp-up of its Blackwell rack-scale system and recent commentary around visibility into more than $500 billion in revenue through the end of next year.

Nvidia Teed Up For A Strong Q3 Earnings Report (Earnings Preview)

Nvidia Corporation is poised for significant growth ahead of its Q3 '26 earnings, supported by robust AI infrastructure demand and a strong industry position. Hyperscalers like Microsoft, Alphabet, and Amazon are driving record capital outlays for compute capacity, reinforcing NVDA's durable growth trajectory despite some competition from custom chips. NVDA's dominance in both the U.S. and China is bolstered by licensing wins and technical challenges faced by Chinese competitors, supporting optimistic revenue forecasts for eFY27.