NVIDIA Corporation (NVDA)

Nvidia's China Defeat

China is in a brutal battle with the United States to gain the upper hand in artificial intelligence (AI) development.

NVIDIA (NASDAQ: NVDA) Price Prediction and Forecast 2025-2030 for November 4

Shares of NVIDIA Corp. (NASDAQ:NVDA) climbed 7.16% over the past five trading sessions after gaining 6.55%% the five prior.

Nvidia Stock Falls. ‘Big Short' Investor Michael Burry Is Betting Against AI—Again.

Burry's Scion Asset Management bought put options with a notional value of $187 million on Nvidia stock, a regulatory filing for the quarter ending Sept. 30 shows.

Beyond NVIDIA & AI Bubble Talk, Quantum Upside Builds for IonQ & RGTI

As AI valuations stretch thin, investors turn to the next frontier-quantum computing-where IonQ and Rigetti are emerging as standout leaders.

Top 3 Profitable AI Buys for November With NVIDIA Leading the Pack

NVDA, MU and VRT emerge as the top AI picks for November, boasting strong net income ratios and robust profitability metrics.

Dan Loeb bet on these international AI stocks, adding to winning Nvidia and TSMC plays

Third Point looked overseas to find a cheaper way to play the memory-chip boom.

Trump Officials Torpedoed Nvidia's Push to Export AI Chips to China

The president decided against discussing the matter with Chinese leader Xi Jinping after top aides opposed it.

Wall Street analyst sets new Nvidia Street-high price target

Nvidia (NASDAQ: NVDA) shares on Monday received a major vote of confidence after Loop Capital Markets set a new Wall Street-high price target of $350, up from $250, ahead of the chipmaker's upcoming third-quarter earnings on November 19.

This Is Why AI Is Not a Bubble and Nvidia will Reach $10 Trillion

AI has avoided bubble status because of immediate infrastructure usage, validating Nvidia‘s (NVDA) valuation. GPUs are fully monetized, unlike the dotcom era's “dark fiber.”

President Trump says China can't have Nvidia's top AI chips, US govt shutdown drags on

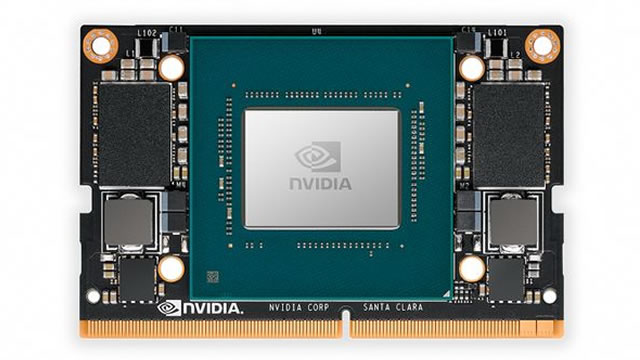

Morning Brief: Market Sunrise anchor Ramzan Karmali breaks down the latest market news President Trump said he wants Nvidia's Blackwell AI chips to be sold to US customers only and not to any other country. The US government shutdown is set to become the longest in history this week as lawmakers remain at an impasse, unable to reach a deal to reopen the government.

Nvidia shares up 2% in premarket as U.S. approves sales of its chips to the UAE

Microsoft's licenses enable the firm to ship Nvidia chips — involving its more advanced GB300 GPUs — to the United Arab Emirates.