T-Rex 2x LNG NVIDIA Daily Target Fund (NVDX)

NVDX: A Leveraged Play On Nvidia's AI Dominance

The T-Rex 2X Long Nvidia Daily Target ETF offers leveraged exposure to Nvidia's AI-driven growth and dominant GPU market position. NVDX aims to deliver 200% of NVDA's daily performance, appealing to investors confident in Nvidia's continued outperformance and expanding profitability. Recent major deals with Intel, OpenAI, and CoreWeave, plus surging AI CapEx, support a bullish outlook for NVDA and NVDX returns.

NVDX Aims To Deliver 2x Nvidia, Here's How I'd Use It (Technical Analysis)

Nvidia Corporation has been very bullish as of late, and momentum indicators show that this may continue. T-Rex 2X Long NVIDIA Daily Target ETF, a 2x leveraged ETF on NVDA, could be used tactically to benefit from the continued momentum of the stock. NVDA's chart shows bullish momentum continuing, but there are also signs of an imminent pullback.

NVDX: How To Bet Strongly On Nvidia's AI Firepower

Owning small amounts of T-REX 2X Long NVIDIA Daily Target ETF (NVDX) can be beneficial, but it carries high volatility and risk. NVDX aims to deliver twice the daily performance of NVIDIA (NVDA), making it a high-octane holding with significant potential for capital destruction. A moving-average strategy can mitigate risks, suggesting holding NVDX when NVDA trades above its 200-day moving average and selling when below.

NVDX: Key Nvidia Volatility Catalysts To Begin 2025, Wait For A Pullback

Nvidia Corporation stock has traded sideways for six months, returning just 1.4%, and I outline why the T-Rex 2X Long NVIDIA Daily Target ETF is a hold. NVDA's forward P/E ratio is high at 47.4x, but the PEG ratio of 1.19 is attractive, though the stock's choppy trend warrants caution with a leveraged product like the NVDX ETF. NVDX, a 2x long ETF, has high volatility and should be used for short-term trading, not long-term investment, despite its strong return since October 2023.

NVDX: Take Advantage Of This Leveraged Play On Nvidia

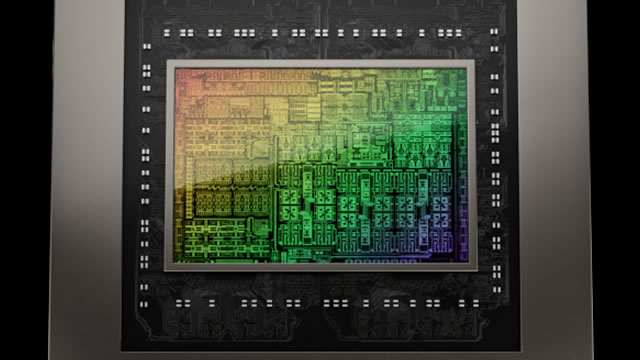

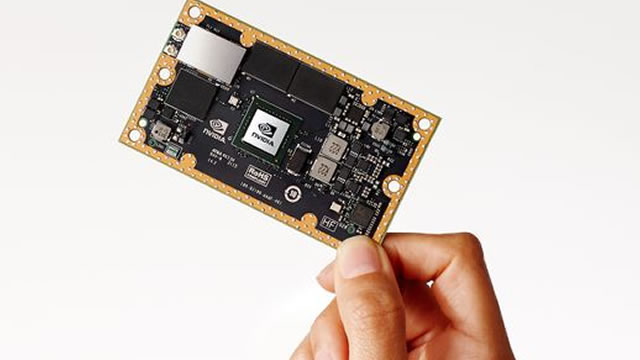

Nvidia Corporation is the innovation leader in the AI revolution and the GPU space. The T-Rex 2X Long NVIDIA Daily Target ETF is one ETF that can deliver amplified gains on Nvidia by aiming to deliver 200% of the daily performance of NVDA stock. High NVDA volatility and longer holding periods can significantly impact returns due to compounding effects.

One Strategy, Three Outcomes? Why NVDX May Be Better

Leveraged NVDA ETFs like NVDL, NVDU, and NVDX offer 200% daily returns but come with compounding risk and volatility decay over longer periods. Historical performance shows NVDX outperforming, but recent leverage adjustments align NVDL, NVDU, and NVDX returns closely. NVDX demonstrates superior execution with a more consistent 2.0x leverage ratio and lowest standard deviation, making it the best choice.

Down 10.5% Today, Is It Time to Buy NVDX and NVDL ETFs?

NVIDIA (NASDAQ:NVDA) is getting hit on 2 fronts today as the stock drops 5% as of 1:45 p.m.

Dear Nvidia stock buyers: Buy the NVDX ETF too

The Nvidia (NASDAQ: NVDA) stock price has done well in the past decade as it evolved into one of the most important companies globally. Its stock has surged by over 301k since going public, a move that has pushed its market cap to over $3 trillion.