Oneok Inc. (OKE)

ONEOK (OKE) Acquires Easton's NGL Pipeline System for $280M

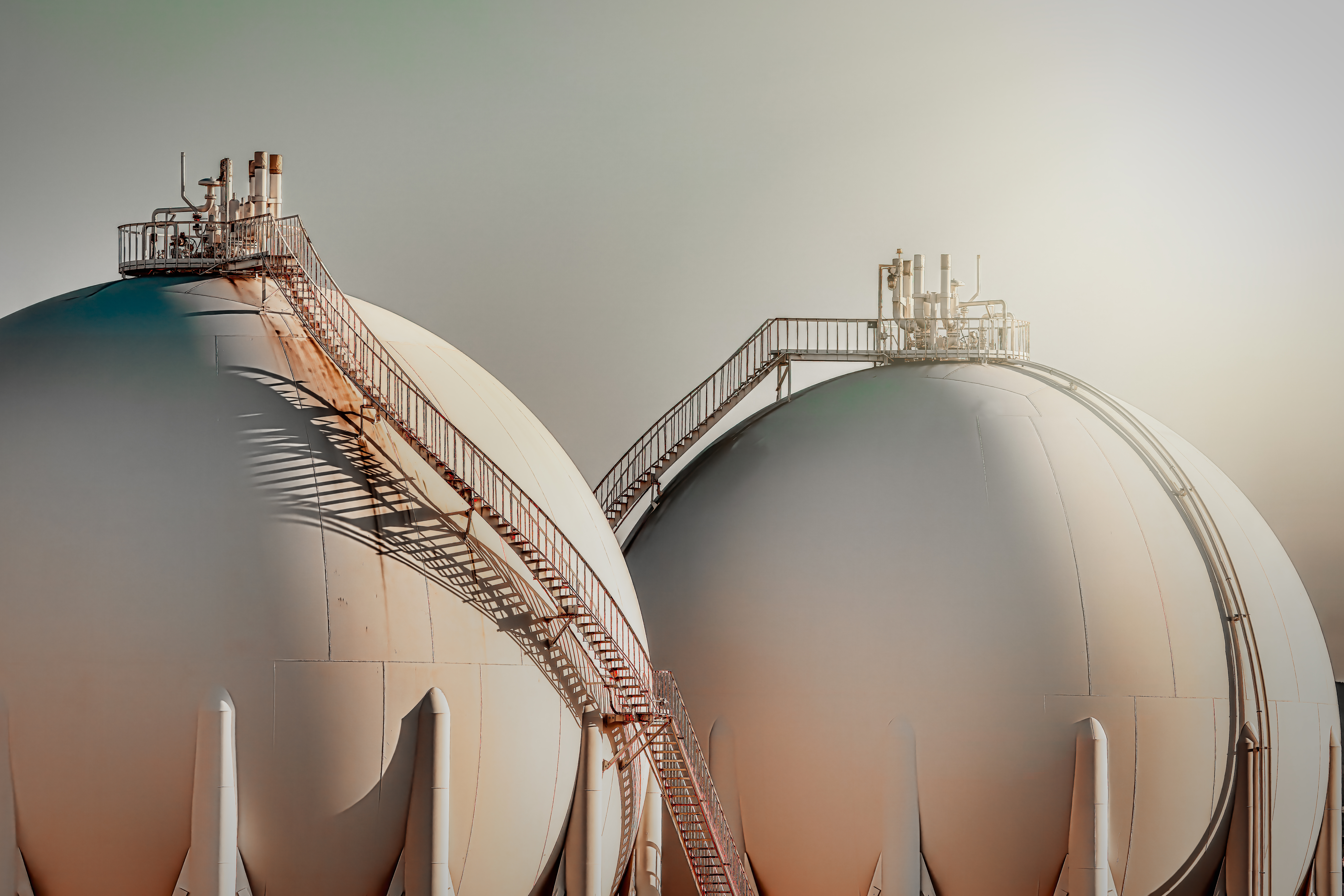

ONEOK (OKE) completes the acquisition of a system of natural gas liquids. This strategic acquisition provides immediate earnings and expands the company's natural gas liquids asset portfolio.

Oneok Inc. (OKE) Laps the Stock Market: Here's Why

Oneok Inc. (OKE) reachead $79.05 at the closing of the latest trading day, reflecting a +1.22% change compared to its last close.

ONEOK Broadens Its Horizons

ONEOK, Inc. has strong growth and cost savings potential as the firm integrates Magellan and smaller acquisitions. AI factories may drive up demand for dedicated power sources, benefiting gas midstream operators like ONEOK. O&G recovery continues to improve as producers optimize well performance through EOR techniques, bringing more flow through ONEOK's interstate pipelines.

ONEOK: Increased Volumes In The Williston Driving Underlying EBITDA Growth In 2024

ONEOK is a midstream infrastructure operator focused on natural gas markets. The company is a direct beneficiary of growing natural gas output in the US and plans significant capacity expansion projects. ONEOK currently offers a 5% dividend yield, backed by long-term fixed-fee contracts. NGL capacity expansion will enable the business to grow this dividend.

Oneok Inc. (OKE) Stock Falls Amid Market Uptick: What Investors Need to Know

In the most recent trading session, Oneok Inc. (OKE) closed at $79.64, indicating a -0.47% shift from the previous trading day.

Oneok (OKE) Up 3.5% Since Last Earnings Report: Can It Continue?

Oneok (OKE) reported earnings 30 days ago. What's next for the stock?

Who Should Buy ONEOK Instead Of Enbridge

Both OKE and ENB are high-quality midstream infrastructure businesses that offer attractive yields and dividend growth. However, there are a few key differences that we highlight in this article. We share who should buy OKE instead of ENB.

For Midstream, It Pays To Have Natural Gas Storage

HAYKIRDI Storage tends to be a less exciting business line for energy infrastructure. Companies simply rent space in a tank or cavern for a fee typically with a term of around three years. However, current market conditions and forward expectations are reinforcing the benefits of natural gas storage. Today, companies with storage capacity can command higher rates in contract renewals or can directly benefit from arbitrage opportunities afforded by the futures curve. Longer term, natural gas storage will be important for meeting incremental demand for power generation from data centers (read more) and for liquefied natural gas (LNG) exports. Currently, Henry Hub natural gas prices are in a fairly steep contango, which means future prices are noticeably higher than current prices. Specifically, the June 2024 contract is trading at ~$2.50 per Million British Thermal Unit (MMBtu), while the January 2025 contract is trading at $3.85/MMBtu. While it’s normal for natural gas prices to be seasonally higher in the winter due to heating demand, other factors are contributing to the wider time spread. Another warm winter has led to a glut of natural gas, which is pressuring current prices. Meanwhile, future prices are being supported by expectations for stronger demand from the start-up of new LNG export capacity (read more). Removing the noise from seasonality, the June 2025 contract is trading at $3.25/MMBtu. The contango in the curve makes storage more valuable, as companies can buy gas today and sell it in the future at a higher price. The management team at Williams (WMB) highlighted the benefits of contango for their storage business on their recent earnings call. Management noted that they are renewing storage contracts at better rates than expected when they acquired a suite of gas storage assets from Hartree Partners for $1.95 billion earlier this year. The strength in storage rates has even led Williams to consider expansion projects at existing facilities. Management has highlighted the underinvestment in storage as natural gas demand has grown. With demand likely to see a step change from LNG facilities and power generation for data centers, more storage capacity is likely needed and could be a growth opportunity. ONEOK (OKE) also noted strong natural gas storage demand on its first-quarter earnings call. The company is reactivating idled storage capacity in Texas and adding to its capacity in Oklahoma. Both storage projects are supported by firm contracts that stretch beyond 2030. Storage is also useful when regional natural gas prices see extreme weakness. In West Texas, natural gas prices have been mostly negative since the end of March due to oversupply and insufficient natural gas pipeline takeaway capacity. While frustrating for producers, midstream companies with storage capacity or extra space in their pipelines can profit from these temporary pricing events. Kinder Morgan (KMI), Enterprise Products Partners (EPD), and Energy Transfer (ET) discussed how their assets position them to benefit from the weakness in natural gas prices in West Texas on their recent earnings calls. ET, WMB, KMI, EPD, and OKE are among the top ten holdings in the Alerian Midstream Energy Select Index (AMEI), which is the underlying index for the Alerian Energy Infrastructure ETF (ENFR). Companies that primarily make money from midstream activities related to natural gas account for over 70% of the index by weighting. Disclosure: © VettaFi LLC 2024. All rights reserved. This material has been prepared and/or issued by VettaFi LLC ("VettaFi") and/or one of its consultants or affiliates. It is provided as general information only and should not be taken as investment advice. Employees of VettaFi are prohibited from owning individual MLPs. For more information on VettaFi, visit VettaFi. Original Post Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.