Onto Innovation Inc. (ONTO)

ONTO Wins $69M DRAM Deal & Boosts 3D Process Control, Stock Rises 6%

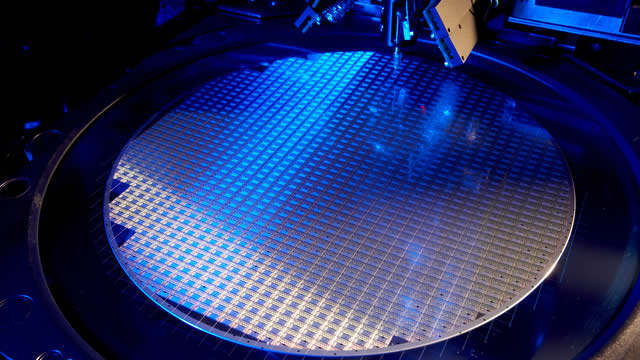

Onto Innovation secures orders for 3Di technology on Dragonfly G3. The launch of Iris G2 expands the metrology suite for the $400 million critical films market.

Onto Innovation named 2025 Top Pick, added to Conviction List at Needham

Onto Innovation -2.615 (-1.36%) TSMC +1.25 (+0.60%) Cadence Design -3.68 (-1.22%)

Why the Market Dipped But Onto Innovation (ONTO) Gained Today

In the latest trading session, Onto Innovation (ONTO) closed at $193.56, marking a +0.61% move from the previous day.

Onto Innovation: Strong Demand From Advanced Packaging Customers

Onto Innovation's Specialty Devices & Advanced Packaging segment drives growth, increasing its revenue share from 40% in 2020 to 67% in 2024, with a 34% annual growth rate. Strong demand from the power device market, particularly SiC power devices for EVs, boosts Onto's growth, supported by advanced metrology and inspection technologies. Onto's comprehensive product offerings and strategic acquisitions provide a competitive edge, with major advanced packaging customers like TSMC and Samsung expanding production, driving sustained demand.

Wall Street Analysts See Onto Innovation (ONTO) as a Buy: Should You Invest?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Onto Innovation: A Much Anticipated Setback Arrived

Onto Innovation has seen sequential revenue growth this year, but the performance still lags compared to 2022. Shares have tripled in the meantime, driven by AI-excitement, but have come down since the summer. Sequential growth, interesting M&A action and a pullback increase appeal, but do not make shares necessarily appealing yet.

Onto Innovation's Q3 Earnings & Revenues Beat, Up Y/Y on Solid Demand

ONTO's Q3 2024 performance gains from continued momentum across all segments, including higher demand for its Dragonfly platform.

Onto Innovation Inc. (ONTO) Q3 2024 Earnings Call Transcript

Onto Innovation Inc. (NYSE:ONTO ) Q3 2024 Earnings Conference Call October 31, 2024 4:30 PM ET Company Participants Sidney Ho - Investor Relations Michael Plisinski - Chief Executive Officer Mark Slicer - Chief Financial Officer Conference Call Participants Brian Chin - Stifel Vedvati Shrotre - Evercore ISI Edward Yang - Oppenheimer Charles Shi - Needham Mark Miller - The Benchmark Company David Duley - Steelhead Securities Operator Ladies and gentlemen, good day, and welcome to the Onto Innovation Third Quarter Earnings Release Conference Call. Today's conference is being recorded.

Onto Innovation (ONTO) Q3 Earnings and Revenues Beat Estimates

Onto Innovation (ONTO) came out with quarterly earnings of $1.34 per share, beating the Zacks Consensus Estimate of $1.31 per share. This compares to earnings of $0.96 per share a year ago.

Onto Innovation Set to Report Q3 Earnings: What's in Store?

ONTO's Q3 2024 performance is expected to have benefited from continued demand for its Dragonfly inspection system.

Are Computer and Technology Stocks Lagging Onto Innovation (ONTO) This Year?

Here is how Onto Innovation (ONTO) and CI&T Inc. (CINT) have performed compared to their sector so far this year.

Onto Innovation (ONTO) Advances While Market Declines: Some Information for Investors

Onto Innovation (ONTO) closed at $204.39 in the latest trading session, marking a +0.74% move from the prior day.