O'Reilly Automotive Inc. (ORLY)

O'Reilly Automotive (ORLY) Lags Q3 Earnings and Revenue Estimates

O'Reilly Automotive (ORLY) came out with quarterly earnings of $11.41 per share, missing the Zacks Consensus Estimate of $11.53 per share. This compares to earnings of $10.72 per share a year ago.

Countdown to O'Reilly Automotive (ORLY) Q3 Earnings: A Look at Estimates Beyond Revenue and EPS

Get a deeper insight into the potential performance of O'Reilly Automotive (ORLY) for the quarter ended September 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

O'Reilly Automotive: Overvalued And With Risks, But Long-Term Prospects Are Good

O'Reilly Automotive, Inc. is a leading auto parts retailer with over 6,000 stores and $16 billion in revenues, boasting a market cap of $66.8 billion. Investors favor O'Reilly Automotive for its strong revenue and cash flow, with impressive returns of 25.9% over the last year and 196.0% over five years. ORLY's valuation is stretched with a forward P/E ratio of 28.4x, posing risks amid a tougher macro environment for consumer discretionary stocks.

Here's Why O'Reilly Automotive (ORLY) is a Strong Growth Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Here's Why O'Reilly Automotive (ORLY) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Best Stocks To Buy Now: SPSC Commerce Might Set Up New Buy Point; Here's Why

Looking for the best growth stocks to buy now for the long term? Start with these stock ideas on IBD's Long-Term Leaders list.

Why Is O'Reilly Automotive (ORLY) Up 3.2% Since Last Earnings Report?

O'Reilly Automotive (ORLY) reported earnings 30 days ago. What's next for the stock?

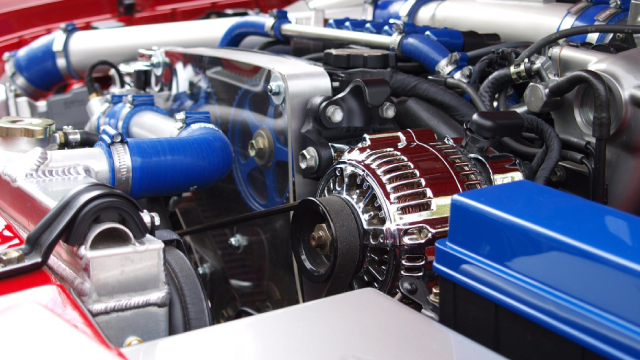

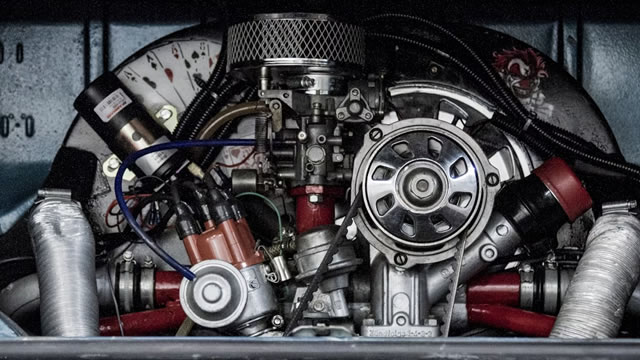

Why O'Reilly Automotive Stock Could Be a Long-Term Winner

The automotive sector aftermarket industry is projected to reach a staggering $400 billion valuation by 2025, which presents a compelling investment opportunity. Several factors propel this growth, including a progressively aging vehicle fleet, a steady rise in miles driven, and a consistent escalation in demand for vehicle maintenance and repairs.

1 Phenomenal Stock That Tripled in the Past 5 Years

This boring business doesn't invite much disruption, leading to its durable competitive position. Strong revenue and earnings growth, coupled with aggressive share buybacks, have pushed up the stock price.

O'Reilly Automotive's Q2: Gaining Market Share In A Tough Environment (Rating Downgrade)

O'Reilly Automotive Inc. slightly missed expectations in its Q2 results but outperformed its competitors and continues gaining market share. Despite margin decrease due to acquisitions and changing revenue composition, inventory turnover improved, and store growth remains on track. Share buybacks accelerated in Q2 due to a temporary decrease in valuation multiples.

These Analysts Revise Their Forecasts On O'Reilly Automotive After Q2 Results

O'Reilly Automotive, Inc. ORLY reported worse-than-expected second-quarter financial results and issued FY24 guidance below estimates, after the closing bell on Wednesday.

O'Reilly (ORLY) Q2 Earnings Miss Mark, 2024 Profit View Cut

O'Reilly (ORLY) expects 2024 earnings per share in the range of $40.75-$41.25, down from the previous estimate of $41.35-$41.85.