Occidental Petroleum Corporation (OXY)

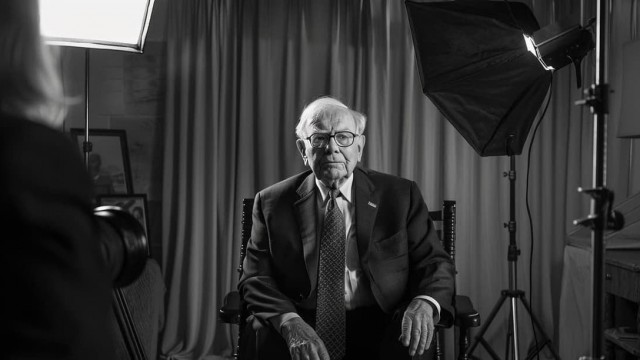

Warren Buffett Now Has an Almost 29% Stake in Occidental Petroleum (OXY) Stock

When legendary investor Warren Buffett is exceptionally bullish about a market opportunity, Wall Street listens. That's why the spotlight is currently on hydrocarbon exploration and production specialist Occidental Petroleum (NYSE: OXY ).

Occidental Stock: Buffett's 9-Day Buying Spree Lifts Stake to 29%

The typical advice in the financial market is to never blindly follow a whale investor like Warren Buffett. However, these investors' reverse-engineering investment decisions can often prove helpful.

Warren Buffett's Berkshire Hathaway ups stake in Occidental Petroleum

Warren Buffett's investment firm Berkshire Hathaway has purchased additional shares of Occidental Petroleum Corp (NYSE:OXY) this month bringing its stake in the Houston-based oil and gas producer to nearly 29%. Regulatory filings showed the firm purchased shares worth about $176 million in shares since last Thursday.

Occidental Petroleum stock: Why is it declining despite Berkshire's continuous buying?

Warren Buffett's Berkshire Hathaway has been on a buying spree, accumulating shares of Occidental Petroleum (NYSE: OXY). Over the past month alone, Berkshire has invested a staggering $434.82 million in Occidental, bringing its stake in the oil company to nearly 29%.

Warren Buffett buys Occidental shares for 9 straight days, pushes his stake to nearly 29%

The Omaha, Nebraska-based conglomerate purchased Occidental shares every trading day from June 5 to Monday.

Occidental Petroleum Corporation (OXY) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Occidental (OXY). This makes it worthwhile to examine what the stock has in store.

Occidental Petroleum Is Turning Green

Occidental Petroleum is embracing the green revolution for future profitability. Berkshire Hathaway has partnered with Occidental for lithium production. Occidental is focusing on growth projects and potential acquisitions for long-term success.

Big Warren Buffett Purchase Highlights Recent Insider Buying

24/7 Insights Warren Buffett has purchased more of his favorite energy stock.

Occidental Petroleum (OXY) Stock Declines While Market Improves: Some Information for Investors

Occidental Petroleum (OXY) reachead $59.80 at the closing of the latest trading day, reflecting a -0.83% change compared to its last close.

Warren Buffett Keeps Doubling Down on Occidental Petroleum (OXY) Stock

Warren Buffett's Berkshire Hathaway (NYSE: BRK-A , NYSE: BRK-B ) first bought shares of Occidental Petroleum (NYSE: OXY ) during the third quarter of 2019 before completely selling out in Q2 2020. However, the “Oracle of Omaha” had a change of heart, as he bought back a position in the energy company during Q1 2022.

Massive insider trade: Warren Buffett's $100M bet on this stock

As the stock trades of Warren Buffett have become the stuff of legend, the Oracle of Omaha does not shy away from insider trades, buying up massive amounts of stock in companies where he already has a substantial stake, including Occidental Petroleum (NYSE: OXY).

Buffett Boosts Stake, Triggers Options Boom in Occidental Stock

Options traders are known as either the smartest of the bunch out there or the most willing to take on increased risks. When someone buys an option – particularly a call option – that person is betting on the direction of a particular stock and the timing upon which that stock will reach a specific price.