PDD Holdings Inc. American Depositary Shares (PDD)

PDD Holdings Inc. Sponsored ADR (PDD) Is Considered a Good Investment by Brokers: Is That True?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Temu pushes ‘local' products after Trump reverses trade loophole that helps Chinese companies avoid taxes

The Chinese-owned e-commerce site promoted so-called "local" products on its website after President Trump imposed a 10% tariff on China and revoked a longtime trade loophole.

Temu steers users to 'local' products after Trump shuts tax loophole

Temu is promoting items shipped from U.S. warehouses more prominently in its app after President Donald Trump's decision to revoke a popular trade provision called de minimis. De minimis helped propel Chinese e-commerce upstarts Temu and Shein to explosive growth in the U.S.

Temu parent PDD's stock tumbles as Trump tariffs close trade loophole

Shares of Temu parent PDD Holdings plunged after President Donald Trump announced new tariffs on the country's top three trading partners. Trump's order struck down the "de minimis" trade exemption, which allows packages under $800 to enter the U.S. duty free.

PDD Holdings Inc. Sponsored ADR (PDD) is Attracting Investor Attention: Here is What You Should Know

PDD Holdings Inc. Sponsored ADR (PDD) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Trump Tariffs Slam TEMU Stock- Is PDD in Free Fall?

Among the tech stocks most in focus heading into this headline-filled week is Temu parent PDD Holdings (NASDAQ:PDD).

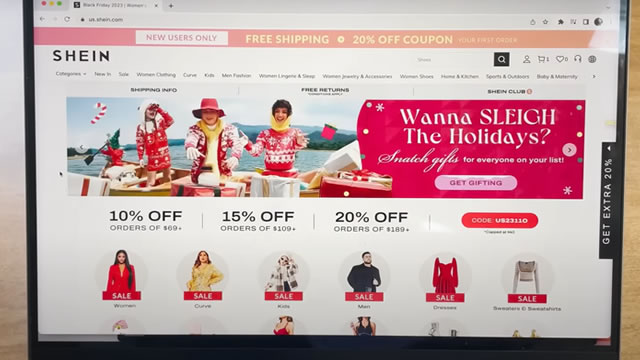

Trump tariffs take aim at trade loophole used by Chinese online retailers like Temu and Shein

President Donald Trump's tariffs against China, Canada and Mexico target a trade provision that helped spur the rise of low-cost retailers like Temu and Shein. Lawmakers have zeroed in on the "de minimis" provision in recent years, arguing it has helped Chinese e-commerce companies undercut competitors with lower prices.

PDD Holdings Inc. Sponsored ADR (PDD) Laps the Stock Market: Here's Why

PDD Holdings Inc. Sponsored ADR (PDD) concluded the recent trading session at $104.01, signifying a +0.9% move from its prior day's close.

Is It Worth Investing in PDD Holdings Inc. Sponsored ADR (PDD) Based on Wall Street's Bullish Views?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

PDD Holdings Inc. Sponsored ADR (PDD) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to PDD Holdings Inc. Sponsored ADR (PDD). This makes it worthwhile to examine what the stock has in store.

Investors Heavily Search PDD Holdings Inc. Sponsored ADR (PDD): Here is What You Need to Know

Zacks.com users have recently been watching PDD Holdings Inc. Sponsored ADR (PDD) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

PDD Holdings: Pushing Delivery Beyond Borders

PDD is expanding its free delivery to Japan, Singapore, Taiwan, Korea, and Macau, enhancing its global reach and offsetting domestic market weaknesses. PDD's low-cost leadership, superior supply chain, and strong user stickiness make it a share gainer against Alibaba and JD, especially with its Temu platform. PDD's free shipping policies are more generous than competitors, but the lack of a proper return mechanism could limit broader adoption.