Perfect Corp. (PERF)

This Defense Stock Could Be Perfect for Patient Value Investors -- But Here's the 1 Big Catalyst It Needs

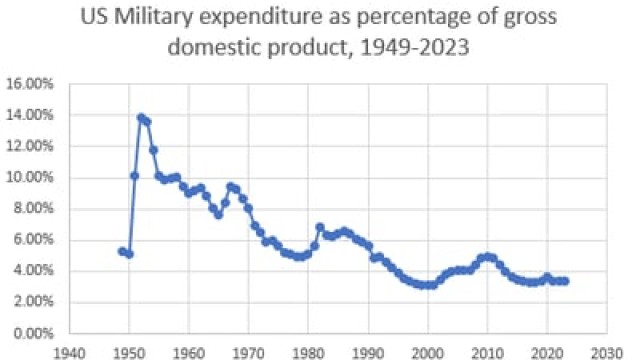

Since the end of WWII, U.S. military spending as a percentage of GDP -- 3.4% -- has almost never been lower than today. The U.S. shipbuilding industry and the U.S. Navy's submarine fleet are in a particularly sad state.

Perfect storm brewing for Lucid short squeeze

The underperformance of Lucid (NASDAQ: LCID) is a matter of concern not just for institutional investors but also for individual traders who have invested their hard-earned money. The recent quarterly earnings report revealed a decline in vehicle production and delivery, which has left many wondering if Lucid can reverse its fortunes.

Haverty Furniture Companies: A Perfect Fit For Conservative Dividend Investors

Revenues are falling significantly after a boost in 2021 and 2022 as the housing industry is being impacted by high interest and mortgage rates. Despite laudable efforts on the part of the management, inflationary pressures and lower volumes are putting significant pressure on profit margins. The balance sheet is very robust and the company is free of debt, which should allow it to overcome the clouds without significant difficulties.

2 Vanguard ETFs Perfect for the Lazy Investor

Vanguard ETFs are prized for their low fees, top performance, and shareholder-friendly policies. These two broad-based Vanguard ETFs should cover the bases for most Main Street investors.