Parker Hannifin Corporation (PH)

Are You Looking for a Top Momentum Pick? Why Parker-Hannifin (PH) is a Great Choice

Does Parker-Hannifin (PH) have what it takes to be a top stock pick for momentum investors? Let's find out.

Parker-Hannifin (PH) is a Top-Ranked Growth Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Parker-Hannifin Corporation (PH) Hits Fresh High: Is There Still Room to Run?

Parker-Hannifin (PH) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Parker-Hannifin: Shares Continue Flying, But Still Grounded In Solid Fundamentals

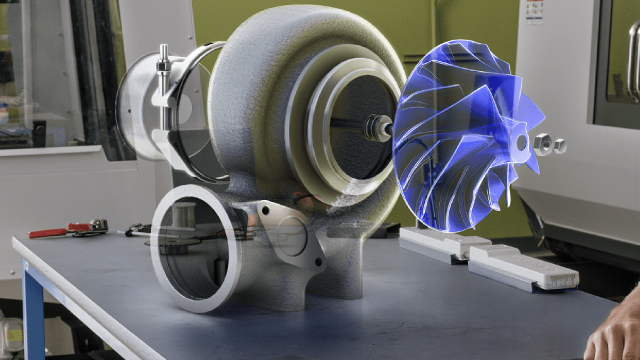

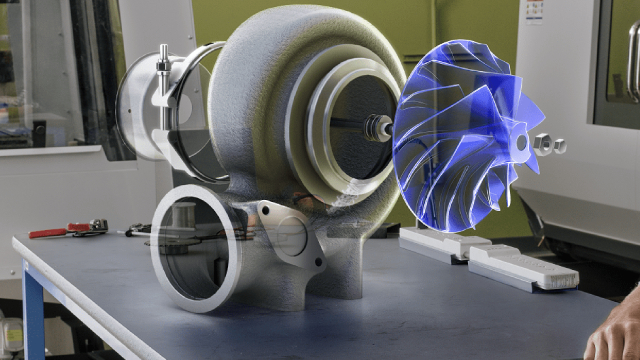

Parker-Hannifin's shares are up nearly 22% since my initial write-up, thanks to strong Q3 and Q4 results, exceeding analyst expectations. The Aerospace Systems segment saw a record year with 19% organic growth, while the Diversified Industrial segment experienced a slight decline but still improved margins due to operational efficiencies. The company's growing aftermarket business is crucial, expected to represent 85% of revenues by FY'29, enhancing margin expansion and contributing significantly to earnings growth.

Here's Why You Should Add Parker-Hannifin Stock in Your Portfolio Now

PH benefits from strength across its end markets, solid product portfolio and shareholder-friendly policies.

Is ParkerHannifin (PH) Outperforming Other Industrial Products Stocks This Year?

Here is how Parker-Hannifin (PH) and Clear Secure (YOU) have performed compared to their sector so far this year.

3 Reasons Why Growth Investors Shouldn't Overlook Parker-Hannifin (PH)

Parker-Hannifin (PH) possesses solid growth attributes, which could help it handily outperform the market.

Here's Why Parker-Hannifin (PH) is a Strong Momentum Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

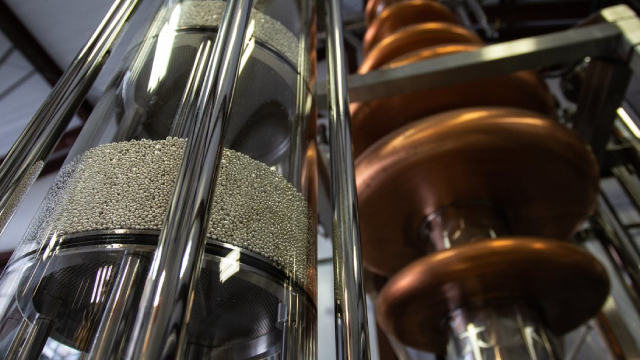

Parker Hannifin: A Boring Business Printing Money

Peter Lynch's "One Up On Wall Street" remains one of the best investing books ever written for beginners. Among other teachings, one of the greatest lessons for investors is that one does not have to look for flashy things when it comes to finding the right investments.

Here's Why Parker-Hannifin (PH) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Parker-Hannifin: The Swiss Army Knife Of Industrial Stocks

The current market is mixed, with declining manufacturing sentiment but strong services. This puts the economy in a precarious but not dire situation. Parker-Hannifin excels amid this uncertainty, driven by its diverse growth, record cash flow, and strong aerospace segment performance. Despite its higher valuation, PH's path to sustainable growth, dividends, and reduced cyclicality make it an attractive long-term investment.

Here's Why It is Appropriate to Retain Parker-Hannifin (PH)

Parker-Hannifin (PH) is poised to gain from strength across the Aerospace Systems segment. The company's measures to reward its shareholders are encouraging.