Pinterest, Inc. Class A (PINS)

Unveiling Pinterest (PINS) Q1 Outlook: Wall Street Estimates for Key Metrics

Besides Wall Street's top -and-bottom-line estimates for Pinterest (PINS), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended March 2025.

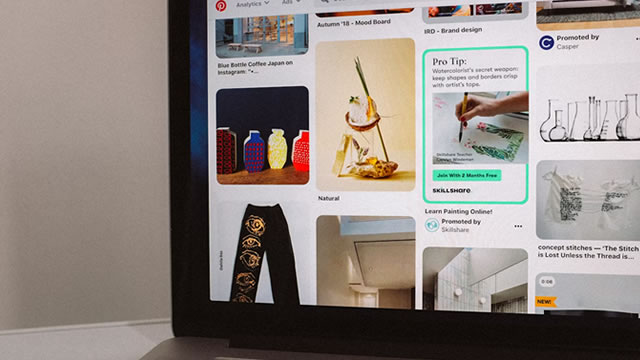

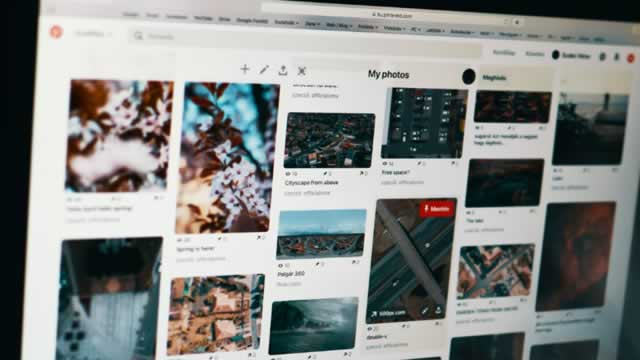

Pinterest updates visual search with more AI-powered features

Pinterest is upgrading its visual search feature with a handful of new capabilities. On Monday, the company announced it's rolling out new functionality to improve its feature that allows users to search using an image instead of text.

Why Pinterest (PINS) Outpaced the Stock Market Today

Pinterest (PINS) reachead $25.49 at the closing of the latest trading day, reflecting a +0.67% change compared to its last close.

Pinterest (PINS) Reports Next Week: Wall Street Expects Earnings Growth

Pinterest (PINS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Pinterest, Inc. (PINS) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Pinterest (PINS). This makes it worthwhile to examine what the stock has in store.

Pinterest: Underappreciated Media Bet (Rating Upgrade)

Pinterest offers an attractive growth narrative, with 2024 revenue of $3.65 billion (+19% YoY) and 11% MAU growth to 553 million. Analyst consensus projects 2025 revenue to grow 10-15% YoY to ~$4.2 billion, driven by AI-enhanced ad tools and partnerships with Amazon and Google. Profitability is at an inflection point, with a projected 300-400 bps margin expansion, leading to ~$1 billion in 2025 free cash flow.

Meta Faces an Advertising Shock. Why the Stock Is Still Superior to Pinterest, Snap.

The company is the most exposed of the major U.S. digital platforms to a pullback in spending by Chinese companies, according to Raymond James.

Pinterest (PINS) Surpasses Market Returns: Some Facts Worth Knowing

In the closing of the recent trading day, Pinterest (PINS) stood at $26.17, denoting a +0.42% change from the preceding trading day.

Buy the Stocks of Pinterest and 5 Other Companies That Are Buying Back Shares

Steady stock repurchases are an indicator of management confidence. Pinterest, Devon, AES, Trex, Bank of America, and Enphase are all scooping up shares.

Pinterest (PINS) Increases Yet Falls Behind Market: What Investors Need to Know

The latest trading day saw Pinterest (PINS) settling at $24.68, representing a +1.94% change from its previous close.

Pinterest: AI Should Drive Further Profitability And Shareholder Returns

In Q4 2024, Pinterest's revenue surged 17.64% y/y and 28.51% q/q to $1.15 billion, driven by a rise in global monthly active users and ARPU. PINS is likely to see continued topline acceleration and margin expansion due to the company's continued investment and implementation of artificial intelligence. Valuation analysis suggests that the current share price does not reflect the true value of PINS; there is a potential upside of 14.86% for investors to capitalize.

Pinterest: Don't Ignore Records

Pinterest, Inc. is undervalued, trading at a low EV/S multiple of 3.5x, compared to social media peers. The company reported record revenues of $3.64 billion in 2024 due to a focus on social commerce and shoppable ads boosting domestic ARPU. Pinterest's robust cash flow and share buyback strategy provide a cushion against macroeconomic uncertainties, making it an attractive buy despite trade war risks.