PPL Corporation (PPL)

PPL (PPL) Advances While Market Declines: Some Information for Investors

PPL (PPL) reached $37.86 at the closing of the latest trading day, reflecting a +1.12% change compared to its last close.

How Is PPL Empowering Customers Through Energy Efficiency?

PPL boosts grid reliability and customer savings with nearly $200M invested in energy efficiency programs in 2024.

PPL vs. FirstEnergy: Which Utility Stock Powers Up Stronger Returns?

Both PPL and FE are regulated electric utilities and investing in infrastructure improvements to cater the rising demand from data centers.

Can PPL's Diversified Fuel Mix Drive Growth & Decarbonization?

PPL aims to enhance grid reliability, reduce carbon emissions and lower costs for customers.

Will PPL's Infrastructure Upgrades Boost Its Reliability & Earnings?

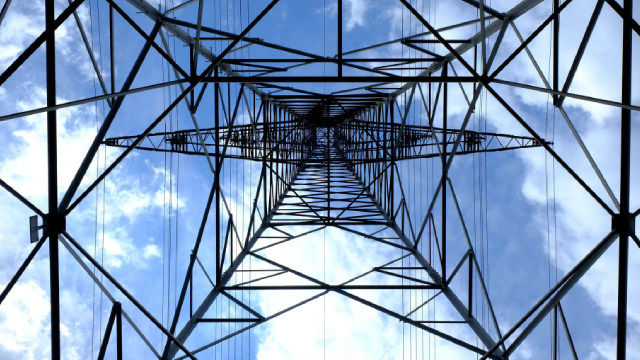

PPL is investing heavily in transmission and distribution upgrades to improve service reliability.

How Should Investors Approach PPL Stock After Q2 Earnings Miss?

PPL's Q2 earnings miss estimates, but strong data center demand and $20B investment plans are powering the stock higher.

Investors Heavily Search PPL Corporation (PPL): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to PPL (PPL). This makes it worthwhile to examine what the stock has in store.

Here's What Key Metrics Tell Us About PPL (PPL) Q2 Earnings

Although the revenue and EPS for PPL (PPL) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

PPL Corporation (PPL) Q2 2025 Earnings Call Transcript

PPL Corporation (NYSE:PPL ) Q2 2025 Earnings Conference Call July 31, 2025 11:00 AM ET Company Participants Andrew Ludwig - Vice President of Investor Relations Joseph P. Bergstein - Executive VP & CFO Vincent Sorgi - President, CEO & Director Conference Call Participants Agnieszka Anna Storozynski - Seaport Research Partners David Alexander Paz - Wolfe Research, LLC Jeremy Bryan Tonet - JPMorgan Chase & Co, Research Division Paul Andrew Zimbardo - Jefferies LLC, Research Division William Appicelli - UBS Investment Bank, Research Division Operator Good day, and welcome to the PPL Corporation Second Quarter 2025 Earnings Conference Call.

PPL (PPL) Q2 Earnings Miss Estimates

PPL (PPL) came out with quarterly earnings of $0.32 per share, missing the Zacks Consensus Estimate of $0.37 per share. This compares to earnings of $0.38 per share a year ago.

PPL (PPL) Reports Next Week: What You Should Expect

PPL (PPL) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

How Should You Play PPL Stock Ahead of Q2 Earnings Release?

PPL's Q2 earnings are likely to have gained from rising data center demand, cost cuts, and infrastructure upgrades driving growth.