PPL Corporation (PPL)

PPL Set to Report Q1 Earnings: Should You Hold or Sell the Stock?

PPL's first-quarter results are expected to benefit from higher sales volume, smart investments to strengthen the grid and cost savings initiatives of the company.

PPL (PPL) Increases Yet Falls Behind Market: What Investors Need to Know

The latest trading day saw PPL (PPL) settling at $36.25, representing a +0.03% change from its previous close.

PPL (PPL) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

PPL (PPL) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

PPL Corporation: Good Prospects, But Appears Overvalued Right Now

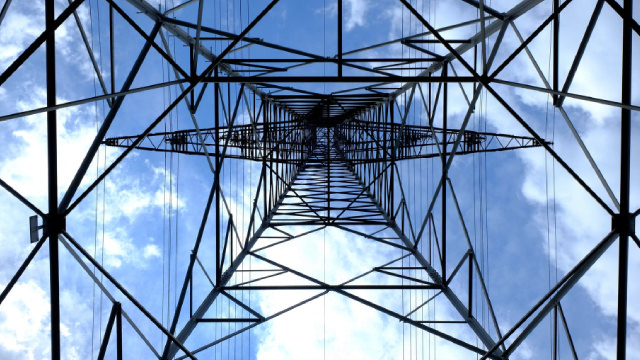

PPL Corporation operates as a regulated utility in Rhode Island, Pennsylvania, and Kentucky, with a large customer base and stable revenue growth. Kentucky is the largest earnings contributor, while Pennsylvania shows potential due to new data centers supporting AI deployment. The company is investing more money in Kentucky over the next four years than elsewhere, but it is not neglecting Pennsylvania.

The Zacks Analyst Blog PPL, Xcel Energy and American Electric Power

PPL, Xcel Energy and American Electric Power are included in this Analyst Blog.

PPL Stock Outperforms its Industry in Six Months: How to Play?

Despite PPL's rising estimates and systematic expenditure to strengthen operations, our suggestion for investors is to wait and look for a better entry point, as the stock is trading at a premium.

Should You Invest in PPL (PPL) Based on Bullish Wall Street Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Here's Why PPL (PPL) Gained But Lagged the Market Today

In the most recent trading session, PPL (PPL) closed at $34.16, indicating a +1.85% shift from the previous trading day.

PPL (PPL) Advances While Market Declines: Some Information for Investors

PPL (PPL) reachead $36.23 at the closing of the latest trading day, reflecting a +0.28% change compared to its last close.

PPL (PPL) Stock Dips While Market Gains: Key Facts

In the most recent trading session, PPL (PPL) closed at $36.06, indicating a -0.14% shift from the previous trading day.

PPL (PPL) Rises As Market Takes a Dip: Key Facts

PPL (PPL) reachead $34.60 at the closing of the latest trading day, reflecting a +1.53% change compared to its last close.

PPL Stock is Trading at a Premium: Should You Buy, Hold or Sell?

PPL stock is likely to continue benefiting from constructive regulatory jurisdiction, stable capital investment and rising demand in its service territories.