Perrigo Company plc (PRGO)

Perrigo Paves The Way For Recovery With Margin Focus

Perrigo is a focused OTC consumer healthcare player, slimming down operations and enhancing margins under new management, with a 4.6% dividend yield. Despite short-term pressures from a weak cold-and-flu season and infant formula production issues, PRGO is positioned for recovery and growth by 2026. The company is exploring new markets with a 'disruptive growth' team, focusing on women's health and GLP-1 side effect relief, aiming for mid-single-digit growth.

Perrigo (PRGO) Up 5.6% Since Last Earnings Report: Can It Continue?

Perrigo (PRGO) reported earnings 30 days ago. What's next for the stock?

Perrigo Company: Great Combination Of Future Growth With A Low Valuation

Perrigo's long-term growth is driven by strategic initiatives like Project Energize, aiming for $140-$170 million in annualized savings by 2026. The company's reinvestments in leadership and IT, adding 200 years of consumer experience, are crucial for sustainable growth. Perrigo's supply chain reinvention program has already achieved $72 million in gross savings, enhancing cash flow and operational efficiency.

Perrigo (PRGO) International Revenue Performance Explored

Review Perrigo's (PRGO) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

Perrigo's Q3 Earnings Fall Short of Estimates, Sales View Updated

PRGO reports weaker-than-expected third-quarter 2024 results. Though management updates top-line guidance for 2024, it reaffirms the bottom-line outlook.

Perrigo Company plc (PRGO) Q3 2024 Earnings Call Transcript

Perrigo Company plc (NYSE:PRGO ) Q3 2024 Earnings Conference Call November 6, 2024 8:30 AM ET Company Participants Bradley Joseph - Vice President of Global Investor Relations Patrick Lockwood-Taylor - President & Chief Executive Officer Eduardo Bezerra - Chief Financial Officer Conference Call Participants Susan Anderson - Canaccord Keith Devas - Jefferies Korinne Wolfmeyer - Piper Sandler Daniel Biolsi - Hedgeye Operator Good morning, ladies and gentlemen and welcome to the Perrigo Third Quarter 2024 Financial Results Conference Call. At this time, all lines are in a listen-only mode.

Perrigo (PRGO) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

The headline numbers for Perrigo (PRGO) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Perrigo (PRGO) Q3 Earnings and Revenues Lag Estimates

Perrigo (PRGO) came out with quarterly earnings of $0.81 per share, missing the Zacks Consensus Estimate of $0.82 per share. This compares to earnings of $0.64 per share a year ago.

Perrigo to Report Q3 Earnings: Here's What to Expect

PRGO's Q3 top line is expected to have been affected by lower net product sales in the United States and unfavorable currency movements in the quarter.

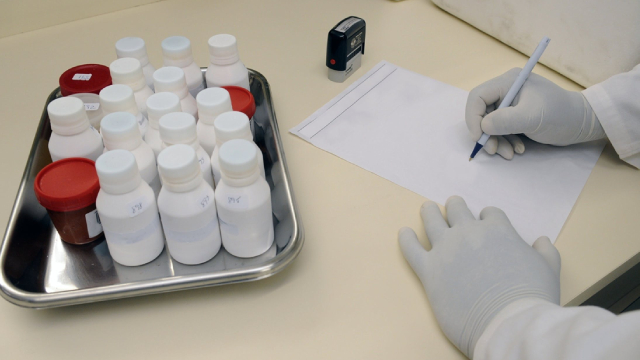

Perrigo is voluntarily recalling 16,500 cans of baby formula because of high levels of Vitamin D

Perrigo Co. Plc PRGO, +0.54% said Friday it's voluntarily recalling 16,500 cans of store brand Premium Infant Formula with iron milk-based powder because of levels of Vitamin D that exceed permitted levels. The Dublin-based provider of self-care and over-the-counter health and wellness products said the cans were shipped to H-E-B Grocery Company LP in Texas, and to CVS Health stores in Texas, Florida, California, South Carolina, Virginia, Indiana, Tennessee, New Jersey, Michigan, Pennsylvania, Rhode Island and Missouri.

Perrigo recalls 16,500 cans of its infant formula

Perrigo has initiated a voluntary recall of three lots within one batch, or 16,500 cans, of its infant formula sold at H-E-B Grocery Company and CVS , a regulatory filing showed on Friday.

Interpreting Perrigo (PRGO) International Revenue Trends

Evaluate Perrigo's (PRGO) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.