Peloton Interactive Inc. (PTON)

Peloton stock more than doubles in 2 months: is the growth sustainable?

Peloton Interactive Inc (NASDAQ: PTON) has had a difficult time adjusting to the post-pandemic world – but it looks like things are finally starting to change for the better. Shares of the connected fitness company have more than doubled over the past two months as financials improved on the back of its turnaround efforts.

Peloton's Golden Cross: A Short-Term Sprint Or Long-Term Ride?

Peloton Interactive Inc PTON stock just hit a major technical milestone — the Golden Cross.

David Einhorn's #1 New Buy That Is Paying Off Big: PTON vs. CPRI

Noted short-seller David Einhorn rose to prominence betting against Allied Capital, a private equity firm that offered debt and equity capital to finance leveraged buyouts, acquisitions, and corporate restructurings.

Here's Why Investors Should Retain Peloton Stock Now

PTON focuses on strategic partnerships and cost optimization efforts to drive growth. However, the discontinued Bike Rental Program poses concerns.

Is It Too Late to Buy Peloton Interactive Stock?

Peloton's stock soared to $167 per share during the 2020 home gym boom, but has plummeted 97% from that COVID-era peak. Cost-cutting measures and debt refinancing are part of Peloton's turnaround strategy.

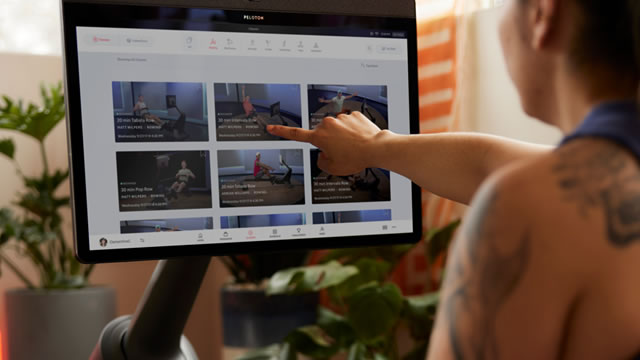

Peloton's New Marketing Campaign to Promote Breadth of Fitness Offerings

Peloton's upcoming marketing campaign will reportedly promote the company's full range of services and target audiences the firm hasn't been reaching.

Peloton: I'm Buying This Stock, You Should Too

I'm confident that Peloton's current valuation at 9x this year's free cash flow is a rare opportunity. The company's debt maturity in 2029 allows ample time for restructuring and securing better terms. Subscriber churn is stabilizing, meaning Peloton can focus on growth and retention moving forward.

Peloton's Rebound Ride - Time To Hop Back On

Peloton's stock jumped 34% after Q4 FY24 earnings release, but remains down 27% year-to-date. Management expects $75 million in free cash flow for FY2025 through a $2 billion cost-cutting plan and aims for $200–250 million in EBITDA. The company's subscription revenue is three times greater than its closest competitor, Apple Fitness.

Peloton: Selling Treadmills On Their Race To Profits

Peloton's leadership change and focus on treadmills present a promising turnaround, with potential profitability driven by high-margin software upsells. Despite high risks and ongoing losses, Peloton's leaner operations and positive revenue growth signal a favorable risk/reward ratio. Analysts' bearish outlook contrasts with Peloton's improving fundamentals, suggesting a potential 25% upside if market sentiment shifts.

Peloton Interactive, Inc. (PTON) Goldman Sachs Communacopia + Technology Conference (Transcript)

Peloton Interactive, Inc. (NASDAQ:PTON ) Goldman Sachs Communacopia + Technology Conference September 11, 2024 1:10 PM ET Company Participants Liz Coddington - Chief Financial Officer Conference Call Participants Eric Sheridan - Goldman Sachs Eric Sheridan All right. I think in the interest of time, we're going to get going with our next fireside chat.

Has Peloton Turned Things Around and Become a Good Growth Stock to Buy Again?

Peloton achieved positive revenue growth for the first time in multiple years last quarter. The company also strengthened its margins and reduced its expenses.