PayPal Holdings Inc. (PYPL)

PYPL or INTA: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Internet - Software sector might want to consider either Paypal (PYPL) or Intapp (INTA). But which of these two stocks presents investors with the better value opportunity right now?

PayPal Fined $27 Million for Contract Violations in Poland

A Polish regulator fined PayPal $27.3 million over allegedly “unprecedented” user agreement violations. The Office of Competition and Consumer Protection (UOKiK) said in a Monday (July 15) press release that it determined PayPal's contract language did not inform consumers which activities could cause them to incur penalties.

PayPal fined $27.3 mln by Polish watchdog for ambiguous clauses

Poland's antitrust and consumer protection watchdog imposed a fine of 106.6 million zlotys ($27.3 million) on PayPal Europe for failing to spell out to consumers in its contractual clauses activities for which they may be fined, UOKiK said on Monday.

PayPal: An Undervalued Profitable Growth Stock

PayPal's new management is refocusing the business to improve profitability. PayPal is diversifying into digital advertising and is in a prime position as merchants try to find alternative advertising channels. Fastlane can be the sustainable innovation PayPal needs to protect its market share against the competition.

PayPal: Why I Am Still Invested

PayPal has been underperforming, but has potential for long-term success. Braintree and unbranded solutions show growth potential. Margin expansion, emerging markets, and strong financial position indicate potential for turnaround.

Paypal (PYPL) Ascends While Market Falls: Some Facts to Note

In the most recent trading session, Paypal (PYPL) closed at $60.02, indicating a +1.89% shift from the previous trading day.

PayPal Declines 4.1% YTD: How Should You Play the Stock in 2H?

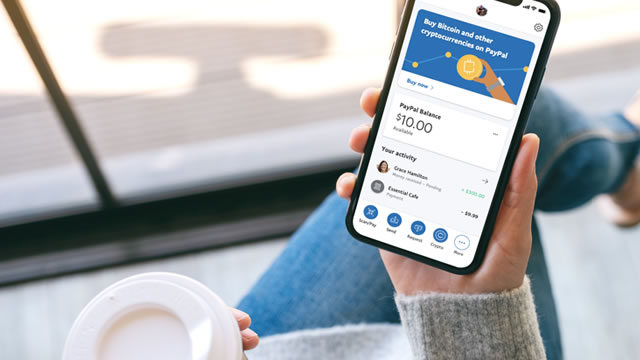

PayPal (PYPL) presents solid long-term prospects on the back of a strong portfolio, growing customer momentum and strength in cryptocurrency amid short-term headwinds.

3 Once-in-a-Lifetime Stocks to Buy Now: July 2024

Investing in the stock market can be daunting, but finding once-in-a-lifetime stocks can offer considerable rewards. Here, the exploration concentrates on three such stocks with high growth potential.

PayPal Stock: The Dip Should Be Bought

PayPal stock basically went nowhere for the past few weeks, while the S&P 500 continued to see new ATH. I think this should change shortly. Despite a drop in the total number of users, transaction volume is also growing, which is positive and allows the company to generate a substantial amount of free cash flow. PayPal's FCF should help surpass the pessimistic EPS consensus for 2024 if the company continues to repurchase shares at similar volumes and maintains its net income growth rate.

PayPal: Buy, Sell, or Hold?

PayPal's growth has slowed, but the trends are still encouraging. The stock's valuation is well below its past average.

The 3 Best Digital Payment Stocks to Buy in July 2024

Picking the best digital banking stocks is a little like picking your favorite shirt — different occasions demand different clothing, and different use cases require different digital payment processors. Still, today's best digital payment stocks proactively blend stable, ongoing operations with forward-thinking initiatives to capture new market segments and adapt to emerging digital payment processing trends.

PayPal Holdings: A Strong Prospect On Investor Pessimism

PayPal stock has dropped 10.1% since March 2024, but financial data shows revenue growth, active account stabilization, and increased payment transactions. Profits and cash flows have increased, with adjusted earnings per share expected to rise in the mid to high single digits for 2024. PayPal is undervalued compared to similar companies, with a strong net cash position, active share buybacks, and growth potential, making it a "strong buy."