Qualcomm Inc. (QCOM)

Here is What to Know Beyond Why QUALCOMM Incorporated (QCOM) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Qualcomm (QCOM). This makes it worthwhile to examine what the stock has in store.

Qualcomm (QCOM) Stock Declines While Market Improves: Some Information for Investors

The latest trading day saw Qualcomm (QCOM) settling at $170.05, representing a -0.05% change from its previous close.

Qualcomm stock price analysis: technicals point to a big dive

Qualcomm (QCOM) stock price remains in a deep bear market even as the company considers making a bid for Intel, the giant semiconductor company. It has dropped by over 27% from its highest point this year, giving it a market cap of over $184 billion.

Brokers Suggest Investing in Qualcomm (QCOM): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Forget Nvidia: Here's a Better Top Artificial Intelligence (AI) Stock to Buy Right Now

This company remains indispensable to its industry despite efforts by top companies to supplant it. Revenue growth appears poised to ramp up again as a new upgrade cycle begins.

Is Trending Stock QUALCOMM Incorporated (QCOM) a Buy Now?

Recently, Zacks.com users have been paying close attention to Qualcomm (QCOM). This makes it worthwhile to examine what the stock has in store.

Chipmaker Qualcomm lays off hundreds of workers in San Diego

Qualcomm, which makes chips for smartphones, said it will lay off 226 workers in San Diego later this year, according to a California WARN notice published this week. The layoffs, which were first reported by the San Diego Union-Tribune, will take effect the week of November 12.

EU court trims Qualcomm fine to 238.7 mn euros

An EU court on Wednesday largely upheld an antitrust fine against US chipmaking giant Qualcomm but reduced the penalty slightly to 238.7 million euros ($265 million).

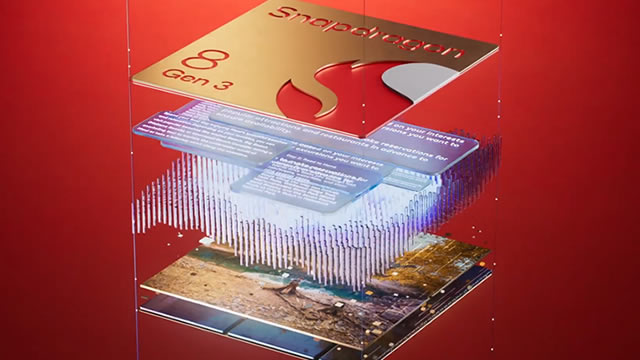

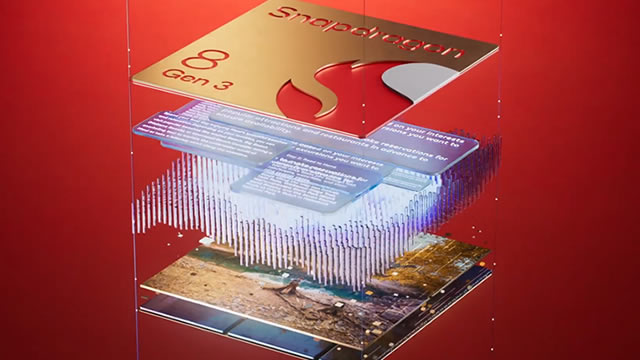

Qualcomm: A Good Opportunity In The AI Handsets Market

Qualcomm's strong modem technology and integration of modems, RF, and CPUs into single chipsets position it as a leader in smartphones and emerging technologies. Expansion into automotive, IoT, and AI PCs, with the Snapdragon Digital Chassis and a significant share of the $1.1 trillion IoT market by 2028. Valuation suggests a price target of $363.1 per share, a 116.5% premium over the current price, indicating a strong buying opportunity.

EU court largely confirms Qualcomm's EU antitrust fine

Europe's second-top court largely confirmed on Wednesday an EU antitrust fine imposed on U.S. chipmaker Qualcomm , revising it down slightly to 238.7 million euros ($265.5 million) from an initial 242 million euros.

Qualcomm: The AI Growth Inflection Point Is Close (Rating Upgrade)

Qualcomm stock endured a 35% bear market before bottoming in August 2024. However, it has struggled to replicate its recent success. Its entry into AI PCs and potential share gains in AI smartphones should underpin its return to topline growth. Qualcomm's automotive diversification efforts have delivered a solid performance recently amid a growth normalization phase in EVs.

QCOM Boosts Digital Transformation in Saudi Arabia: Stock to Gain?

Qualcomm and Aramco team up to accelerate digital transformation in industrial operations leveraging Advanced AI and 5G technologies.