Rio Tinto Plc Sponsored ADR (RIO)

Rio Tinto wants new CEO to be open to big M&A deals - report

Rio Tinto Ltd (LSE:RIO, ASX:RIO, OTC:RTNTF) is reportedly nearing the appointment of a new chief executive officer, with a decision expected later this month following final candidate presentations in London. Chair Dominic Barton is prioritising candidates who are open to major merger and acquisition opportunities and focused on improving internal cost discipline, according to a Reuters report citing sources familiar with the search process.

Rio Tinto Jointly Invests $1.6B in Hope Downs 2 Project in Pilbara

RIO commits $800M to the Hope Downs 2 project in Pilbara, targeting 31Mtpa output and 1,000 long-term jobs by 2027.

Rio Tinto Secures ARENA Support to Advance Decarbonisation Project

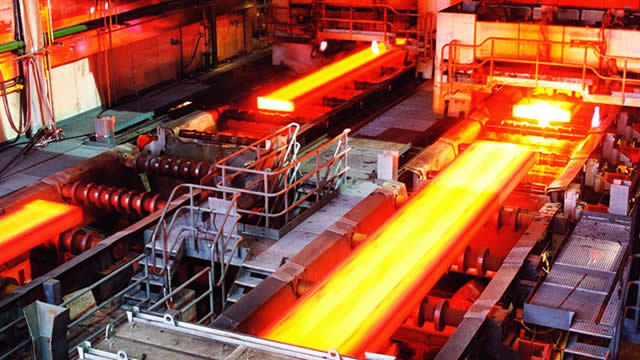

RIO's NeoSmelt venture wins ARENA backing for a pilot plant aiming to slash steelmaking emissions by up to 80%.

Brokers Suggest Investing in Rio Tinto (RIO): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Rio Tinto downgraded as Jefferies flags CEO transition, capex pressures

Jefferies has downgraded Rio Tinto Ltd (LSE:RIO, ASX:RIO, OTC:RTNTF) to 'Hold' from 'Buy', citing emerging headwinds including CEO succession uncertainty, increasing geopolitical risks, and concerns over rising capital intensity in the company's lithium investments. “Of the major diversified miners in our coverage, we prefer Glencore, Anglo American and Vale over Rio and BHP,” Jefferies wrote in a note.

Rio Tinto Agrees to New Management Plan in Area Where It Destroyed Ancient Caves

Rio Tinto has agreed to a new management plan with a local indigenous group that covers its iron-ore operations in an area of Australia's Pilbara region where it destroyed two ancient rock shelters five years ago.

Rio Tinto's lithium strategy: Analyst cautious despite expansion

Rio Tinto Ltd (LSE:RIO, ASX:RIO, OTC:RTNTF) is ramping up its lithium investments, notably with the recent US$6.7 billion acquisition of Arcadium, a leading lithium producer formed from the merger of Australia's Allkem and America's Livent. This substantial move follows the earlier US$825 million investment in Argentina's Rincon project, significantly enhancing Rio's lithium capacity.

Rio Tinto: A Copper Growth Engine Poised For Big Returns

Rio Tinto is evolving from an iron ore giant to a copper growth story, capitalizing on the global energy transition and electrification trends. Copper production is set to surpass 1 million tonnes by 2028, with major projects like Oyu Tolgoi and Kennecott driving volume growth. Rising copper prices and increased output should fuel significant EBITDA growth, while the stock trades below its historical valuation multiples.

RIO Selected as Preferred Partner by ENAMI for Chilean Lithium Project

Rio Tinto is the preferred partner of ENAMI for Chile's Altoandinos lithium project, strengthening its global lithium portfolio amid long-term demand growth.

Rio Tinto CEO succession underscores undervaluation and puts focus on value unlock strategy

Jakob Stausholm will step down as Rio Tinto Ltd (LSE:RIO, ASX:RIO, OTC:RTNTF) chief executive at the end of 2025, a move that JPMorgan believes strengthens the case for unlocking value in the miner's global portfolio and dual-listed structure. The bank reiterated its 'overweight' rating on the stock and sees up to 30% upside, underpinned by a £59.20 base case valuation.

Valuing Rio Tinto Stock In 2025

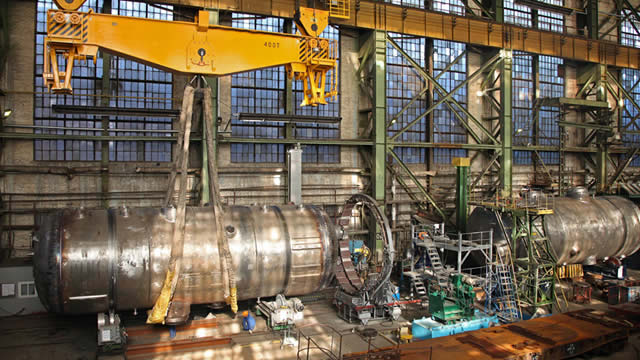

Rio Tinto (NYSE: RIO) has made important strategic decisions aimed at diversifying into critical minerals necessary for the energy transition, including lithium and bauxite. Rio Tinto operates as a vertically integrated mining company—managing the entire value chain from exploration and extraction to processing and export.

Wall Street Bulls Look Optimistic About Rio Tinto (RIO): Should You Buy?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?