RTX Corporation (RTX)

Is Raytheon the Best Defense and Aerospace Stock to Own in 2025?

Defense stocks have been in a downdraft heading into the new year. President Trump's intent to de-escalate geopolitical conflicts and end the war in Ukraine with funding cuts is causing concern throughout the aerospace sector.

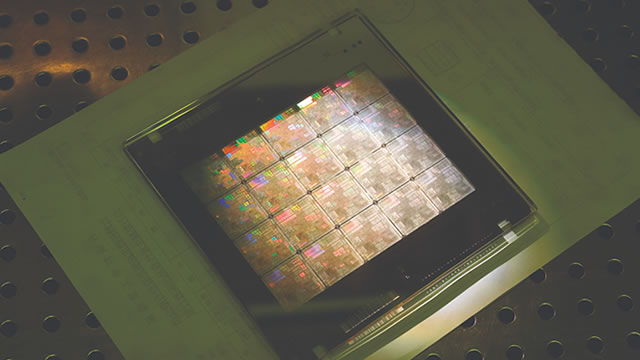

Nvidia unveils RTX 5090 GPU

As anticipated, Nvidia Monday kicked off its CES 2025 keynote by unveiling the new RTX Blackwell family of GPUs. The centerpiece of the line is the RTX 5090.

Nvidia unveils GeForce RTX 50 Series graphics cards with big performance gains

Nvidia launched its much-awaited Nvidia GeForce RTX 5000 series graphics processing units (GPUs), based on the Blackwell RTX tech.

RTX (RTX) Stock Slides as Market Rises: Facts to Know Before You Trade

In the most recent trading session, RTX (RTX) closed at $114.10, indicating a -1.53% shift from the previous trading day.

RTX's Unit Secures Contract for Tomahawk Missile Modernization

RTX's unit, Raytheon, secures a modification contract for the recertification and modernization of 257 Tomahawk Block IV All-Up-Round Missiles.

Investors Heavily Search RTX Corporation (RTX): Here is What You Need to Know

Zacks.com users have recently been watching RTX (RTX) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

RTX Corporation: A Low-Risk, Potential Long-Term Upside Trade For 2025

RTX Corporation, a leading aerospace and defense conglomerate, has seen significant growth, with Q3'24 sales up 49.21% YoY and EBITDA of $2.99 billion. The company benefits from geopolitical tensions, a $221 billion project backlog, and strong capital deployment, positioning it well for future growth. RTX's stock has outperformed the defense sector and broader market, driven by strong financials, undervaluation, and a robust organic growth trajectory.

RTX (RTX) Suffers a Larger Drop Than the General Market: Key Insights

In the latest trading session, RTX (RTX) closed at $115.22, marking a -1.28% move from the previous day.

RTX Clinches a $946M Contract to Support Patriot Missile Program

RTX is set to offer hardware, software and services for the production of the Patriot missile program.

RTX (RTX) Advances But Underperforms Market: Key Facts

In the most recent trading session, RTX (RTX) closed at $116.83, indicating a +0.17% shift from the previous trading day.

RTX Clinches a $43M Deal to Support ESSM and NSMS Programs

RTX gets a contract from the Naval Sea Systems Command, WA, D.C., to provide technical support to the ESSM and NSMS Programs.

RTX (RTX) Rises But Trails Market: What Investors Should Know

In the most recent trading session, RTX (RTX) closed at $116.63, indicating a +0.13% shift from the previous trading day.