Sanmina Corporation (SANM)

Sanmina: Fairly Re-Rated After Stabilization Arrived

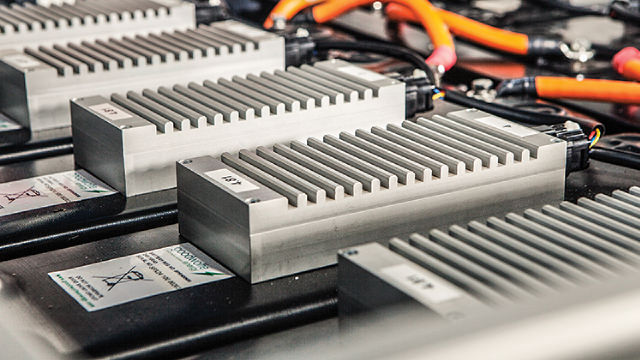

Sanmina has shown improved margins, earnings and significant buybacks, creating long-term shareholder value. The company provides end-to-end manufacturing solutions across diverse OEM segments, benefiting from long-term demand drivers but facing cyclicality and stable but low margins. 2024 was tough, but the company ended the year on a strong note, with prospects for growth in 2025 (ahead of the tariff discussions).

Is Sanmina (SANM) a Great Value Stock Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Sanmina (SANM) Moves to Strong Buy: Rationale Behind the Upgrade

Sanmina (SANM) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Should Value Investors Buy Sanmina (SANM) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Are Investors Undervaluing Sanmina (SANM) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Sanmina Corporation Q1: I Have Some Concerns Regarding Its Short-Term Outlook

Sanmina Corporation Q1: I Have Some Concerns Regarding Its Short-Term Outlook

Sanmina: A Speculative Bet On Cloud, Cash, And Capital Discipline

Sanmina Corporation, a leading integrated manufacturing solutions provider, has two main segments: Integrated Manufacturing Solutions and Components, Products, and Services. The stock has shown steady growth, gaining around 130% over five years, with recent Q1 2025 earnings beating estimates. Q1 2025 non-GAAP EPS of $1.44 and revenue of $2.01B both exceeded expectations, indicating strong performance.

Sanmina Corporation (SANM) Q1 2025 Earnings Call Transcript

Sanmina Corporation (NASDAQ:SANM ) Q1 2025 Earnings Conference Call January 27, 2025 5:00 PM ET Company Participants Paige Melching - SVP, Investor Communications Jure Sola - Chairman & CEO Jon Faust - EVP & CFO Conference Call Participants Ruplu Bhattacharya - Bank of America Steven Fox - Fox Advisors Anja Soderstrom - Sidoti Operator Good afternoon, ladies and gentlemen, and welcome to the Sanmina's First Quarter Fiscal 2025 Earnings Conference Call. At this time, all lines are in listen-only mode.

Sanmina (SANM) Beats Q1 Earnings and Revenue Estimates

Sanmina (SANM) came out with quarterly earnings of $1.44 per share, beating the Zacks Consensus Estimate of $1.37 per share. This compares to earnings of $1.30 per share a year ago.

Sanmina Corporation (SANM) Q4 2024 Earnings Call Transcript

Sanmina Corporation (SANM) Q4 2024 Earnings Call Transcript

Sanmina (SANM) Q4 Earnings and Revenues Top Estimates

Sanmina (SANM) came out with quarterly earnings of $1.43 per share, beating the Zacks Consensus Estimate of $1.37 per share. This compares to earnings of $1.42 per share a year ago.

Dialight plunges as it reviews jury verdict over Sanmina trial

Shares in Dialight PLC (LSE:DIA) fell 17% to 208p after the conclusion of the trial with its former manufacturing partner, Sanmina Corporation. After a mistrial was declared back in July, a rescheduled hearing began on 9 September, the judgments will be fully released by the court "in due course", the company said.