Super Micro Computer, Inc. (SMCI)

Analyst revises SMCI stock price citing company has ‘cycled past uncertainties'

Super Micro Computer Inc. (NASDAQ: SMCI) is making a strong comeback in 2025 after a year marked by regulatory hurdles and market volatility.

SMCI Gathering Analyst Optimism as A.I. Skepticism Builds

Supermicro (SMCI) got an upgrade from JPMorgan Chase to neutral from underperform, giving the stock a bump higher this morning. Jeff Pierce notes the rally comes amid skepticism across the tech sector, as Supermicro itself recovers from its major sell-off following accounting uncertainties.

Super Micro Stock Is Upgraded After Filing Drama. The AI Player Faces a Challenging Path Forward.

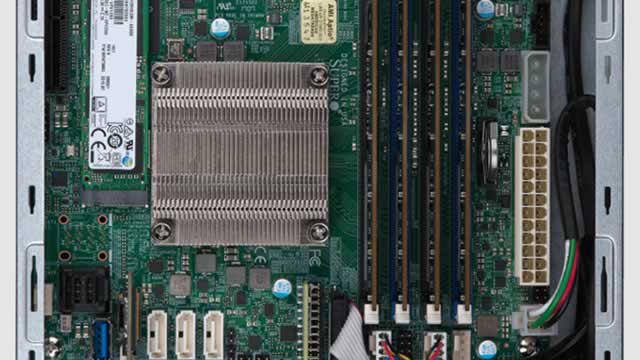

Super Micro is set to benefit from strong customer demand, though competition is building, analysts say.

SMCI stock soars on Nvidia Blackwell boost

In the first quarter (Q1) of 2024, Super Micro Computer (NASDAQ: SMCI) proved a major challenger to Nvidia (NASDAQ: NVDA) as the year's stock market superstar. Specifically, Supermicro equity soared 300% in Q1, while NVDA shares were up about 70% in the same time frame.

BA, SMCI Options Trades Ahead of FOMC

Kevin Hincks looks at today's news in Boeing (BA) as the aerospace company lands new orders from Japan Airlines. Then, following Nvidia's (NVDA) GTC event, he compiles an example options trade for Supermicro (SMCI).

S&P 500 Gains and Losses Today: Supermicro Stock Falls as Near-Term AI Outlook Wavers

Major U.S. equities indexes lost ground Tuesday, failing to maintain the momentum from two straight positive sessions. Trade-related uncertainties and concerns about economic growth persisted as the Federal Reserve kicked off its two-day policy meeting, with an interest-rate announcement set for Wednesday.

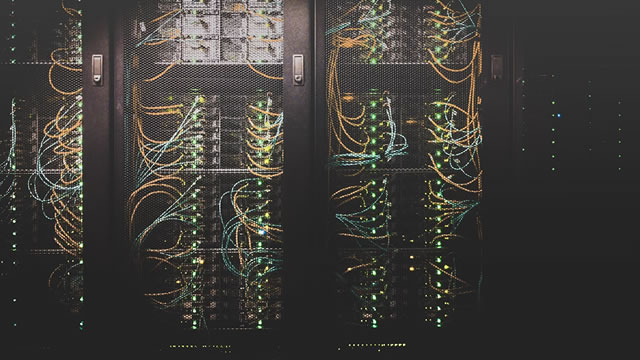

Super Micro's International Presence Makes It a Winning Stock

The technology sector in the United States has been the center of most of the attention and price action in the stock market. However, one stock in the semiconductor industry fell significantly behind its peers.

Super Micro Has Been Strong in a Weak Market. Can SMCI Keep It Going?

The S&P 500 entered correction territory last week. Here's how Super Micro stock held up.

Should You Forget Super Micro Computer and Buy 3 Artificial Intelligence (AI) Stocks Right Now?

Server systems builder Super Micro Computer (SMCI 7.91%) was a market darling a year ago. Is it time to turn away from this disgraced industry titan and seek more reliable investment avenues in the artificial intelligence (AI) market?

Super Micro Computer: Why It's Still Worth Having In Your Portfolio

Strong RPO (an indicator of revenue backlog) growth in recent quarters gives me confidence in SMCI's ambitious $40 billion FY26 revenue outlook. Margin erosion concerns are starting to be reflected in stock expectations, which I view as a positive sign as some sources of bad news gets priced in. Valuations have moderated sharply, and the stock seems attractive given the high-growth potential ahead. SMCI vs SPX500 also looks primed for an alpha-generating move.

How Super Micro Computer Stock Is Defying the Market Sell-Off

Price action is usually the raw opinion of the market on a particular stock or industry, which is why investors should always be aware of what is happening behind the scenes when it comes to risk-on and risk-off behavior throughout the market. Today, the technology sector, particularly semiconductor stocks, have become the poster child of the risk-on for the stock market.

Investors Heavily Search Super Micro Computer, Inc. (SMCI): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Super Micro (SMCI). This makes it worthwhile to examine what the stock has in store.