Snap-on Inc. (SNA)

Snap-On (SNA) Lags Q1 Earnings and Revenue Estimates

Snap-On (SNA) came out with quarterly earnings of $4.51 per share, missing the Zacks Consensus Estimate of $4.81 per share. This compares to earnings of $4.75 per share a year ago.

Why Snap-On (SNA) is a Top Momentum Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Gear Up for Snap-On (SNA) Q1 Earnings: Wall Street Estimates for Key Metrics

Get a deeper insight into the potential performance of Snap-On (SNA) for the quarter ended March 2025 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

Snap-on Q1 Earnings on Deck: Will Strong Business Trends Drive a Beat?

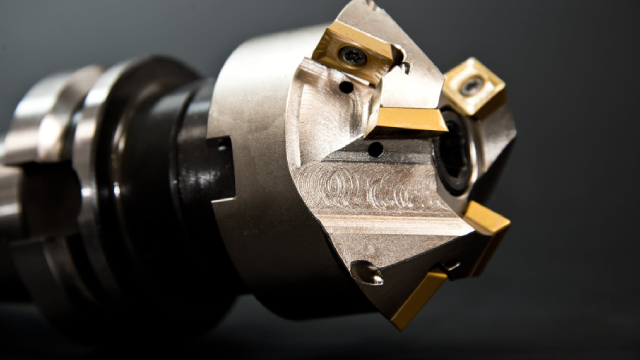

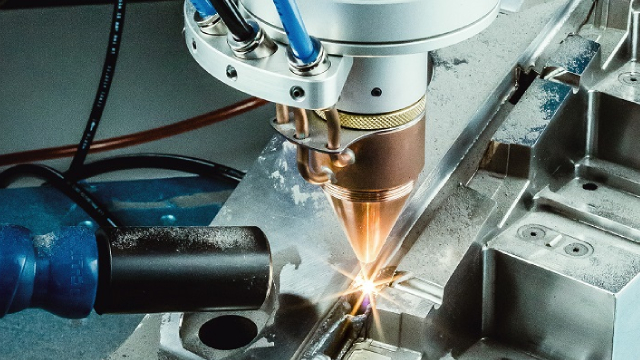

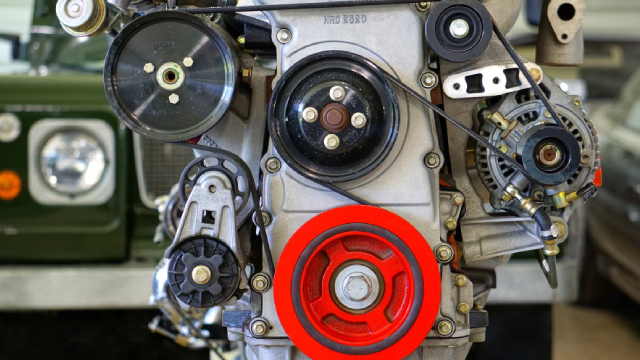

SNA's first-quarter results are likely to reflect the benefits of strong business trends, fueled by its value-driven strategy, ongoing innovation and strength in automotive repair.

Why Snap-On (SNA) is a Top Dividend Stock for Your Portfolio

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Snap-On (SNA) have what it takes?

Snap-on CEO Nick Pinchuk: We don't think the tariffs were necessary

Nick Pinchuk, Snap-on chairman and CEO, joins 'Squawk Box' to discuss the fallout from President Trump's global tariffs, how businesses are dealing with the sweeping new tariffs, and more.

Snap-on Up 17.7% in 6 Months: Should You Buy, Hold or Sell the Stock?

SNA's performance benefits from strategic initiatives such as enhancing the franchise network and expanding into critical industries in emerging markets.

Snap-on: Still An Incredible Company, Even After Decades Of Success

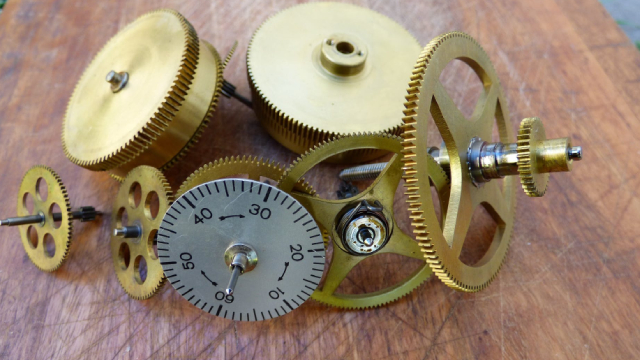

Snap-on Inc. has shown consistent growth with a 10.8% average annual net profit increase over the past decade. The company benefits from the aging car market and the growing complexity of EVs and hybrids, driving demand for advanced tools. Snap-on's capital expenditures have decreased as a percentage of net income, indicating efficient innovation without excessive costs.

Snap-On (SNA) is a Top Dividend Stock Right Now: Should You Buy?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Snap-On (SNA) have what it takes?

SNA's Value-Creation Processes & Other Efforts Aid: Should You Retain?

Snap-on's performance benefits from strategic initiatives such as enhancing the franchise network and expanding into critical industries in emerging markets.

This is Why Snap-On (SNA) is a Great Dividend Stock

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Snap-On (SNA) have what it takes?

Snap-on's Growth Strategies Progress Well: Apt to Hold the Stock?

SNA's performance benefits from strategic initiatives such as enhancing the franchise network and expanding into critical industries in emerging markets.