Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL: Yen Carry Trade Is Kryptonite

SOXL is a leveraged ETF offering high-risk, high-reward exposure to the semiconductor market, magnifying short-term trends and volatility. Recent events surrounding the Yen carry trade have led to massive unwinding, causing losses for investors and spiking market volatility. SOXL remains a strong sell due to the risks associated with the Yen carry trade unwinding and the potential for accelerated decay in volatile markets.

Semiconductors: Riding the AI Wave or Ready to Wipe Out?

Editor's note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods.

Direxion Rolls Out Leveraged Nuclear Energy ETF

Direxion today launched an ETF that offers leveraged exposure to companies operating in the nuclear energy industry. The Direxion Daily Uranium Industry Bull 2X Shares (NYSE Arca: URAA) aims to provide twice the daily performance of the Solactive United States Uranium and Nuclear Energy ETF Select Index.

SOXL ETF is overvalued but technicals point to a 25% upside

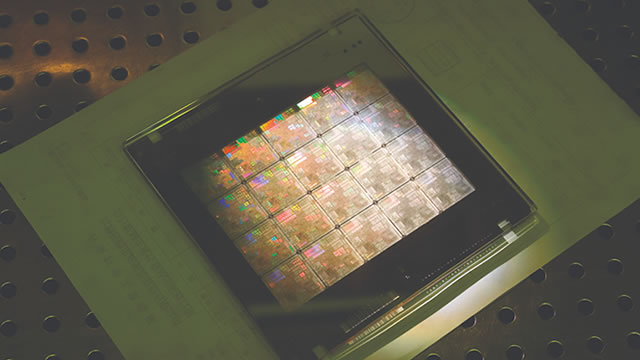

The Direxion Daily Semiconductor Bull ETF (SOXL) has done well in the past decade as it outperformed most popular funds like those tracking the Nasdaq 100 and S&P 500 indices. It has soared by over 564% in the past five years while the Invesco QQQ (QQQ) and the SPDR S&P 500 (SPY) ETFs.

SOXL: Mixed Risks Ahead Of Nvidia's Shareholder Event (Rating Upgrade)

I see mixed risks in the chip industry heading into the second half. Bullish news hit the tape on Tuesday as Bank of America added Micron to their US 1 list, boosting semiconductor stocks like NVIDIA. Semiconductor ETFs have reasonable valuations with strong EPS growth, but caution is advised due to momentum and technicals.

SOXL: After Doubling, Semi Bulls Should Consider Adjusting Their Leverage

Leveraged semiconductor ETF SOXL has seen significant gains due to the AI trend. Leveraged ETFs like SOXL can erode in value over time due to beta slippage, as warned by the SEC. Investors bullish on AI/semiconductors have alternatives to maintain exposure while avoiding the risks of leveraged ETFs.

Love Nvidia stock: Buy the Semiconductor Bull (SOXL) ETF too

Semiconductor companies are doing well this year, helped by the unprecedented demand by artificial intelligence (AI). Nvidia (NASDAQ: NVDA) stock price has soared by over 152% this year, pushing its total market cap of over $3 trillion.