True Corporation Public Company Limited (TCPFF)

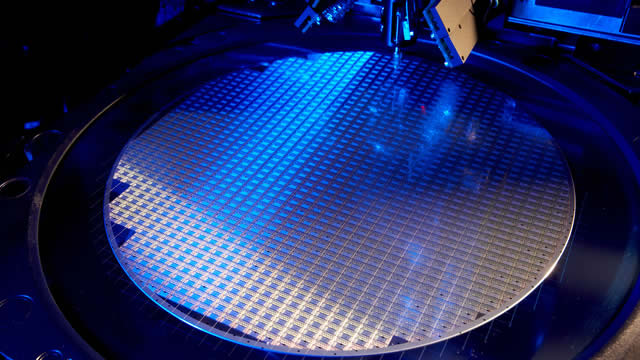

Marvell Technology Q3: A True AI Winner

Marvell's custom silicon business now comprises 73% of Q3 revenues, driven by a 5-year agreement with Amazon AWS for AI accelerators and optical interconnect products. The company reported strong Q3 results with adjusted EPS of $0.43 and revenue of $1.52B, significantly benefiting from a 98% YoY increase in data center revenue. Marvell's restructuring efforts and focus on AI have positioned it well for future growth, with strong Q4 guidance and a forecasted 26% revenue growth for fiscal 2025.

Friedman's Q2 2024 Is An Unusual Peek Into Its True Profitability, And It's Not Great

Friedman Industries' 2Q24 results reveal unprofitability at current production levels, with flat HRC prices exposing true operating margins. The company processed 160 thousand tons in 2Q24, showing an 8% decline in 1H24 volumes compared to 1H25. Gross margins at 4.5% led to a small operational loss, indicating the company is not GAAP profitable at current volumes.

True North: Strong Leasing Quarter Reduces Risk

True North REIT's Q3-2024 showed strong leasing activity, exceeding expectations with over 550,000 square feet leased. Interest rate headwinds loom, with 60% of debt maturing in two years. We go over the most important thing the REIT needs to focus on.

Are Zero-Fee ETFs too Good to Be True?

ETFs have exploded in popularity over the last several years. Since the ETF rule's onset in 2019, no launches have proliferated and assets have accrued at a growing pace.

Park Hotels & Resorts: If It Is Too Good To Be True, It Probably Is

In Q3, Park Hotels & Resorts generated $649 million, representing a year-on-year decline of 4.4% and missing expectations of $816.40k. For FY2024, the company has pulled its guidance due to uncertainty around the company's ongoing negotiations with labor unions. PK's largest portfolio exposure in Hawaii faces ongoing challenges as Japanese visitor numbers remain 50% below pre-pandemic levels, impacting financial performance.

These 13 Stocks Are True Dividend Kings

24/7 Wall Street Insights Dividend Kings are companies with an unbroken track record of dividend increases spanning a minimum of 50 consecutive years.

Mako Mining Intersects 22.88 g/t Au over 4.6 m (Estimated True Width) at Las Conchitas

VANCOUVER, BC / ACCESSWIRE / October 16, 2024 / Mako Mining Corp. (TSXV:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide additional exploration results from the 2024 reverse circulation ("RC") drill program at Mako's newest mining area, Las Conchitas, located immediately south of the Company's San Albino gold mine in northern Nicaragua. The main objective of the RC drill program is to test for new extensions of high-grade gold veins outside of the limits defined by the Company's 2023 mineral resource estimate ("MRE") for the San Albino Project (see press release dated December 6th, 2023).

Lowe's (LOW) Is Considered a Good Investment by Brokers: Is That True?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?