Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

TSMC Sales Soar 42%. But a Threat Hangs Over the Chips Stock.

Taiwan Semiconductor Manufacturing, known as TSMC, reported a 42% rise in its first-quarter sales. However, a tariff threat hangs over the stock.

TSM 1Q Revenue Rises 41.6%, Ives Cuts MSFT Target

It's tale of two tech stories from Jenny Horne to kick off Morning Trade Live. TSMC (TSM) reported a 46.5% March revenue increase from last year's levels as the company looks for clarity on Pres.

Options Corner: TSM Revenue Rises

TSMC (TSM) reported Y/Y 1Q growth despite increasing uncertainty over U.S. trade and tariff policy. Rick Ducat and Tom White take a look at the technical trends and options open interest in the semiconductor stock.

Plenty of Time to Buy the Dip: Top Tech Stocks Still Down 30% and 50% to Buy

Investors didn't miss their chance to buy stocks at significant discounts. The two tech standouts we dive into today--TSMC and Vertiv--are still trading 30% and 50% below their respective highs.

1 Unstoppable Chip Company That Could Soar to a $1 Trillion Valuation

Although the market is in a downturn right now, I've still got my eyes on the horizon. Depending on the effects of tariffs, we could be in for some more stock market pain over the next few months, but if that timeline is stretched out to three or five years, today's stock prices start to make a lot more sense.

US may fine TSMC $1B over chip allegedly used in Huawei AI processor

Taiwan Semiconductor Manufacturing Company (TSMC) may have to pay a fine of $1 billion or more to resolve a U.S. export control investigation related to a chip it made that was used in a Huawei AI processor, according to a report by Reuters.

Taiwan Semiconductor Stock Sinks 26% YTD: Should You Hold or Exit?

Despite macroeconomic challenges, TSM's technological leadership and strategic investments make it a compelling long-term player in the semiconductor space.

TSMC Could Face $1B US Fine for Violating Export Control Rules, Report Says

Taiwan Semiconductor Manufacturing Company (TSM) could face $1 billion or more in fines to settle an investigation into a possible violation of U.S. export controls, Reuters reported Tuesday.

Why Taiwan Semiconductor Manufacturing Stock Is Falling Today

Taiwan Semiconductor Manufacturing (TSM -0.82%) stock is losing ground again in Tuesday's trading. The chip foundry leader's share price was down 0.4% as of 2 p.m.

Why TSMC (TSM) Dipped More Than Broader Market Today

In the closing of the recent trading day, TSMC (TSM) stood at $146.16, denoting a -0.44% change from the preceding trading day.

Taiwan Semiconductor Spared From New Tariffs: Bullish Path Ahead?

President Trump has announced the latest round of trade tariffs, targeting a wide range of goods from most of the United States' trading partners, with a particular impact on the retail sector.

Prediction: Taiwan Semiconductor Manufacturing Will Soar Over the Next 5 Years. Here's 1 Reason Why.

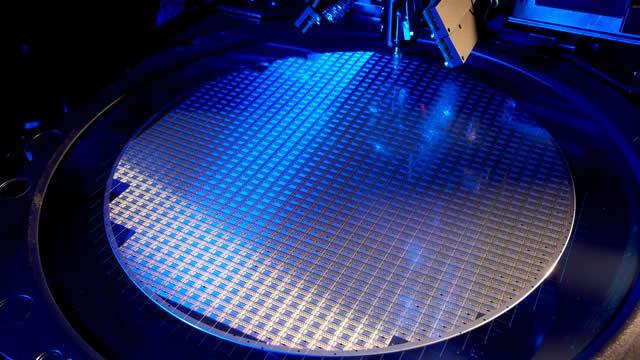

Taiwan Semiconductor Manufacturing (TSM -6.68%) is the world's leading semiconductor (chip) foundry. Its foundry business model means it makes chips tailored to its customers' specific needs, and key partners include Nvidia, Apple, and Advanced Micro Devices.