Uber Technologies, Inc. (UBER)

Why Uber Bounced Back Today

Shares of ride-hailing leader Uber Technologies were rallying today, up 5.8% as of 3:39 p.m. ET. While the overall markets were also having a good day in the wake of the Trump administration backing down from its most maximal tariff posture, Uber outperformed, with a return of more than twice that of the Nasdaq Composite.

Uber, Volkswagen pair up to launch robotaxi service in US with self-driving, electric microbuses

Volkswagen of America and Uber on Thursday unveiled an ambitious plan to launch a commercial robotaxi service — using autonomous electric VW ID. BUZZ vehicles — in multiple U.S. cities over the next decade.

2 Tariff-Resistant Growth Stocks to Buy With $120 Ahead of May

A tariff is a financial penalty imposed on imported products to protect or promote domestic manufacturing. For example, some countries produce steel at a far lower cost than American manufacturers, so the U.S. could place a high tariff on imported steel from every country in the world to level the playing field for domestic producers.

Uber Technologies (UBER) Stock Falls Amid Market Uptick: What Investors Need to Know

In the most recent trading session, Uber Technologies (UBER) closed at $73.74, indicating a -0.94% shift from the previous trading day.

Uber: Tesla Fears Overblown, Now Is The Perfect Time To Buy

Despite fears over AV competition, Uber's partnerships with major AV players and its unique technology platform create a strong competitive edge. Trump's tariffs benefit Uber by increasing car ownership costs, driving more consumers to ride-hailing services. Uber's current valuation and projected growth make it an attractive investment, with potential for significant stock price appreciation.

Uber Stock Slides as FTC Sues, Alleging 'Deceptive' Uber One Practices

Uber (UBER) shares fell Monday as the U.S. Federal Trade Commission filed a lawsuit alleging “deceptive billing and cancellation practices” related to the company's Uber One subscription service.

Why Uber Stock Was Down Today

Shares of ride-hailing and delivery leader Uber (UBER -3.51%) were initially doing much better than the plunging stock market today, with only moderate declines as of midday. However, in the afternoon, shares sank as much as 5.3% at one point, before recovering to a 4.4% decline by 2:26 p.m.

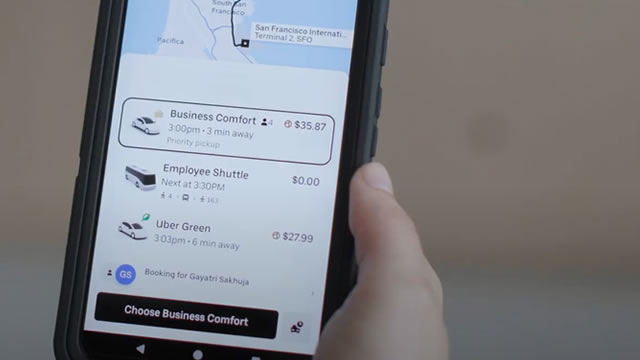

Uber: Dominating Ride-Sharing and Delivery

Uber Technologies has morphed into a fundamental market leader with consistent profitability. In today's commentary, Stock Strategist Andrew Rocco profiles the ride-sharing leader.

Feds accuse Uber of charging customers for subscriptions without consent

The Federal Trade Commission filed a lawsuit Monday against Uber, alleging the ride-hail and delivery giant charged customers for its Uber One subscription service without their consent. The lawsuit also claims Uber failed to deliver the savings promised in its subscription service and made it unreasonably difficult for users to cancel despite its “cancel anytime” promises.

Uber deceiving customers about $9.99 Uber One service, making it hard to cancel: FTC lawsuit

Uber falsely claimed that users would save about $25 a month through the service, the FTC said.

Uber Faces FTC Lawsuit Alleging Deceptive Billing, Cancellation Practices

The FTC's suit alleges that some customers who signed up for a free trial were automatically charged for the service before their trial ended.

Uber Technologies, Inc. (UBER) Is a Trending Stock: Facts to Know Before Betting on It

Uber (UBER) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.