Ultra Clean Holdings, Inc. (UCTT)

Ultra Clean Holdings: Consider Buying The Dip After Tepid Q1 Results

Ultra Clean Holdings has seen a significant stock price drop due to tariff threats and missed Q1 2025 revenue and EPS expectations. Despite macroeconomic challenges, UCTT's services are essential for the semiconductor industry, making it a potential buy-the-dip opportunity. UCTT's valuation metrics indicate the stock is trading near historical lows, suggesting a potential bottom and future recovery.

Ultra Clean Holdings (UCTT) Q1 Earnings and Revenues Lag Estimates

Ultra Clean Holdings (UCTT) came out with quarterly earnings of $0.28 per share, missing the Zacks Consensus Estimate of $0.31 per share. This compares to earnings of $0.27 per share a year ago.

Ultra Clean Holdings, Inc. (UCTT) Q4 2024 Earnings Call Transcript

Ultra Clean Holdings, Inc. (UCTT) Q4 2024 Earnings Call Transcript

Ultra Clean Holdings (UCTT) Q4 Earnings and Revenues Beat Estimates

Ultra Clean Holdings (UCTT) came out with quarterly earnings of $0.51 per share, beating the Zacks Consensus Estimate of $0.44 per share. This compares to earnings of $0.19 per share a year ago.

Ultra Clean Holdings: Reliable, Cost-Effective And Downright Undervalued

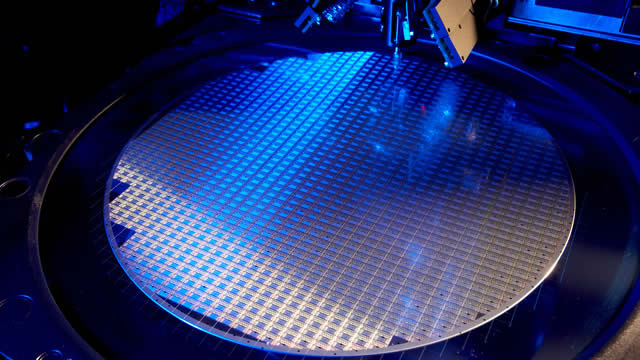

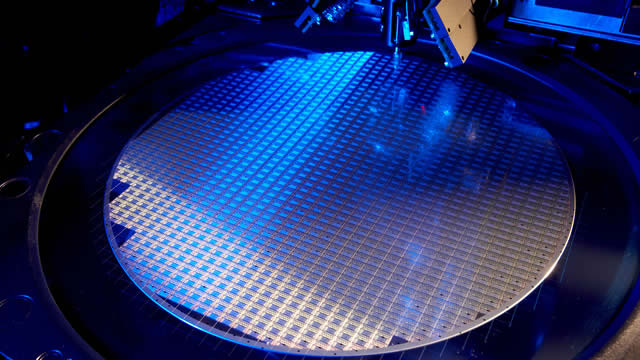

Ultra Clean Holdings is poised for a 55.5% upside over the next 12 months due to margin recovery and strong market fundamentals. UCTT's business model, divided into Products and Services, benefits from high-margin service segments and strong relationships with major semiconductor OEMs. Despite historical volatility, UCTT's revenue growth, driven by acquisitions and international expansion, positions it well for future stability and diversification.

Ultra Clean Holdings: Time To Buy The Cyclical Trough On AI Strength

Ultra Clean Holdings is a contract manufacturer for semiconductor equipment, with significant upside potential during market strength. UCTT's main customers, Lam Research and Applied Materials, and a growing number of other clients, bolster its strong growth prospects. The company has a reasonable valuation and has reached a buy point for the next 2–4 years due to a new semiconductor cycle.

Ultra Clean Holdings, Inc. (UCTT) Q3 2024 Earnings Call Transcript

Ultra Clean Holdings, Inc. (NASDAQ:UCTT ) Q3 2024 Earnings Conference Call October 28, 2024 4:45 PM ET Company Participants Rhonda Bennetto - Investor Relations Jim Scholhamer - Chief Executive Officer Sheri Savage - Chief Financial Officer Conference Call Participants Charles Shi - Needham Edward Yang - Oppenheimer Christian Schwab - Craig-Hallum Capital Group Robert Mertens - TD Cowen Operator Good afternoon, ladies and gentlemen, and welcome to the UCT Q3 2024 Earnings and Webcast Conference Call. At this time, all lines are in a listen-only mode.

Ultra Clean Holdings Stock Before Q3 Earnings: To Buy or Not to Buy?

UCTT's third-quarter 2024 results are likely to reflect the benefits of strong AI demand and an expanding portfolio.

Ultra Clean Holdings Inc (UCTT) Stock Price Up 5.17% on Oct 2

Shares of Ultra Clean Holdings Inc (UCTT, Financial) surged 5.17% in mid-day trading on Oct 2. The stock reached an intraday high of $39.88, before settling at $39.81, up from its previous close of $37.85.

Ultra Clean Holdings, Inc. (UCTT) Q2 2024 Earnings Call Transcript

Ultra Clean Holdings, Inc. (NASDAQ:UCTT ) Q2 2024 Results Earnings Conference Call July 25, 2024 4:45 PM ET Company Participants Rhonda Bennetto - Senior Vice President, Investor Relations Jim Scholhamer - Chief Executive Officer Sheri Savage - Chief Financial Officer Cheryl Knepfler - Managing Director of Marketing Conference Call Participants Krish Sankar - TD Cowen Charles Shi - Needham & Company Christian Schwab - Craig-Hallum Capital Group Operator Good afternoon, ladies and gentlemen, and welcome to the Ultra Clean Technology Q2 2024 Earnings Call and Webcast. At this time, all lines are in listen-only mode.