USA Rare Earth, Inc. (USAR)

USAR Surges 52.5% YTD: How Should Investors Play the Stock?

USAR's stock jumps 52.5% YTD as its magnet plant progress, cash build and LCM acquisition shape long-term prospects amid ongoing losses.

USAR Enhances Rare Earth Supply Chain With LCM's Partnership Deal

USA Rare Earth deepens its mine-to-magnet strategy as LCM's new supply deal boosts rare earth security across the United States and Europe.

Can USA Rare Earth's Stillwater Facility Fuel Its Near-Term Momentum?

USAR advances its Stillwater plant toward commercial NdFeB magnet production, backed by fresh capital and a key acquisition.

USA Rare Earth: The Small Cap Sitting At The Center Of America's Rare Earth Competition With China

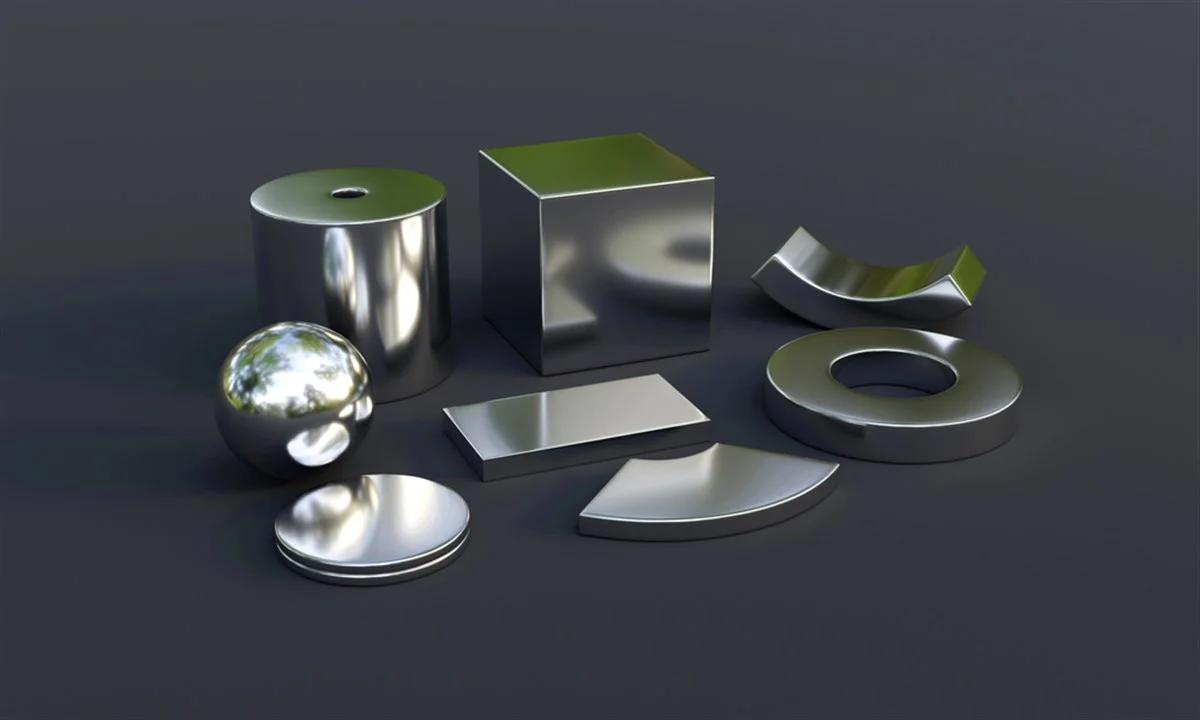

USA Rare Earth (USAR) is positioned as a vertically integrated mine-to-magnet player benefiting from US government support for domestic rare earth supply chains. USAR's Round Top project offers significant heavy rare earth resources, and its Stillwater magnet plant targets Q1 2026 startup, aligning with national security priorities. Despite near-term volatility and operational risks, USAR's strong cash position and strategic assets make it a compelling long-term investment opportunity.

Should You Buy, Hold or Sell USAR Stock Post Q3 Earnings?

USA Rare Earth rises 5% after Q3 results as investors cheer its LCM acquisition and steady progress toward full mine-to-magnet integration.

USA Rare Earth: Back To Earth

USA Rare Earth offers a bullish opportunity as it ramps up U.S. magnet production and expands via the LCM acquisition in the U.K. USAR aims for full vertical integration in rare earths, addressing U.S. supply chain vulnerabilities and national priorities amid ongoing China trade tensions. The company is pre-revenue, with major production and financial milestones expected from 2026 onward; current cash reserves and warrant redemptions support expansion.

USA Rare Earth, Inc. (USAR) Q3 2025 Earnings Call Transcript

USA Rare Earth, Inc. ( USAR ) Q3 2025 Earnings Call November 6, 2025 5:00 PM EST Company Participants Lionel McBee - Vice President of Investor Relations Barbara Humpton - CEO & Director William Steele - Chief Financial Officer Conference Call Participants Neal Dingmann - William Blair & Company L.L.C., Research Division George Gianarikas - Canaccord Genuity Corp., Research Division Derek Soderberg - Cantor Fitzgerald & Co., Research Division Subhasish Chandra - The Benchmark Company, LLC, Research Division Sujeeva De Silva - ROTH Capital Partners, LLC, Research Division Presentation Operator Good afternoon, and welcome to USA Rare Earth's 2025 Third Quarter Earnings Conference Call.

Why USA Rare Earth Stock Plunged 50%?

USA Rare Earth (USAR) stock reached day 11 of an ongoing losing streak, accumulating a total decline of -48% during this timeframe. The company has experienced a loss of approximately $1.4 billion in value over these 11 days, with its present market capitalization around $1.8 billion.

USA Rare Earth is Set to Report Q3 Earnings: Here's What to Expect

USAR is projected to post a Q3 loss of six cents per share, but the Zacks model signals a likely earnings beat.

Buy USA Rare Earth Stock, Says Analyst. This Is Why.

Monday, William Blair analyst Neal Dingmann launched coverage of USA Rare Earth with the equivalent of a Buy rating. He doesn't have a price target for shares.

Trump's Metals Bet Sends Rare Earth Stocks Soaring—Is USAR Next?

President Trump has made strengthening critical U.S. supply chains a clear priority. This is particularly true when it comes to rare earth metals and elements like lithium.

Rare Earth Stocks Soar on Speculation of More White House Deals To Come

Shares of USA Rare Earth (USAR) soared on Friday after its CEO said the supplier of rare earth magnets and minerals was in talks with the Trump White House.