Vertiv Holdings Co. (VRT)

Vertiv Rises 13% in a Month: Time for Investors to Buy the Stock?

Vertiv shares ride on strong prospects, driven by solid AI-driven order growth and expanding market share in the thermal management space.

Wall Street Analysts See Vertiv (VRT) as a Buy: Should You Invest?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Investors Heavily Search Vertiv Holdings Co. (VRT): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Vertiv (VRT). This makes it worthwhile to examine what the stock has in store.

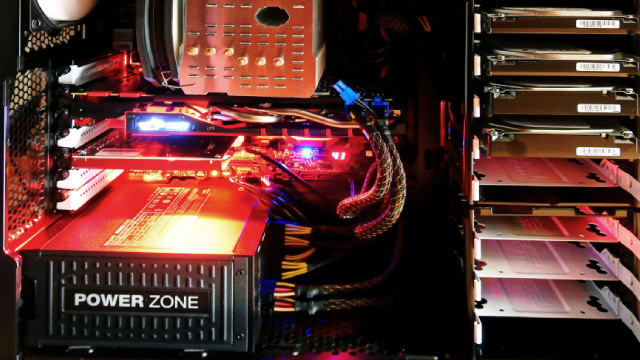

Data Center Supplier Vertiv Stock Surges As AI Powers Red-Hot Demand

Vertiv stock has surged as the AI boom has Wall Street betting on continued demand for the data center infrastructure provider. The post Data Center Supplier Vertiv Stock Surges As AI Powers Red-Hot Demand appeared first on Investor's Business Daily.

Vertiv: The Blow-Off Top Could Inflict Pain On Latecomers

Vertiv's AI infrastructure investment thesis doesn't seem to be stopping anytime soon. However, is the market dumb? VRT has outperformed the market significantly over the past year, corroborating the market's optimism. Management upgraded its backlog as the hyperscalers and data center colocation operators continue to lift their AI growth CapEx.

This Data Center Stock Could Go Parabolic Following Nvidia's Blackwell Launch

Early signs indicate that Nvidia's Blackwell GPUs are going to be a big winner for the company.

Vertiv: A Strong Buy Amid Rising Cloud Infrastructure And Data Center Demand

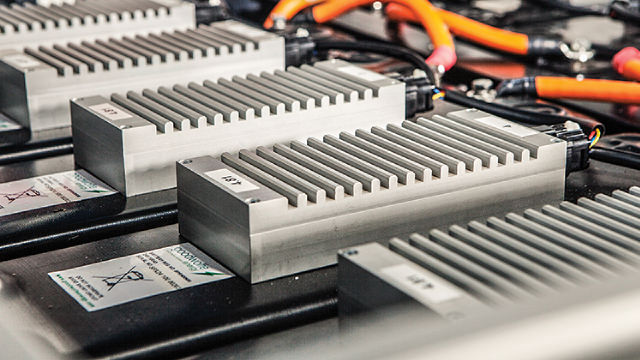

Vertiv Holdings is well-positioned to capitalize on AI-driven data center demand, liquid cooling technologies, and strong operational execution driving margin expansion. Q3 2024 results show 19% YoY net sales growth, 41% increase in adjusted operating profit, and 20.1% operating margin, reflecting robust financial performance. Demand for Vertiv's liquid cooling technology and strategic expansion, including a new manufacturing facility, positions it advantageously for future growth in AI infrastructure.

How Much Is Vertiv Stock Really Worth?

A discounted cash flow valuation reveals my intrinsic value for Vertiv stock.

Here is What to Know Beyond Why Vertiv Holdings Co. (VRT) is a Trending Stock

Vertiv (VRT) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

3 IT Services Stocks to Buy From a Prospering Industry

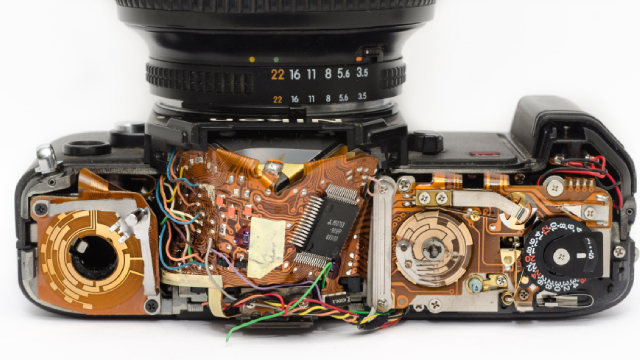

The Zacks Computers - IT Services Industry participants like Vertiv (VRT), Check Point Software (CHKP) and CyberArk Software (CYBR) are benefiting from ongoing digitization, strong demand for hybrid working solutions and improving IT spending.

Vertiv Stock Analysis: Is This an Artificial Intelligence (AI) Stock to Buy Right Now?

Vertiv reported increased ordering activity as it benefits from the rising demand for artificial intelligence.

Vertiv: Still A Cheap AI Buying Opportunity

VRT has once again raised their FY2024 guidance, sustaining the third quarter of beat and raise performances, thanks to the expanding pipeline over the next 18 months. The same has been reported by numerous generative AI infrastructure players, with "the ever-increasing demand for data centers continuing to outpace infrastructure." Combined with the growing profit margins, healthier balance sheet, and expanding manufacturing capacities, we believe that VRT remains well positioned to outperform.