Vertiv Holdings Co. (VRT)

Trade Tracker: Steve Weiss buys more Vertiv

Steve Weiss, founder and managing partner at Short Hills Capital Partners ,joins CNBC's “Halftime Report” to explain why he's buying more Vertiv.

Forget Nvidia: 1 Other Data Center Stock to Buy Hand Over Fist Right Now That Virtually No One Talks About

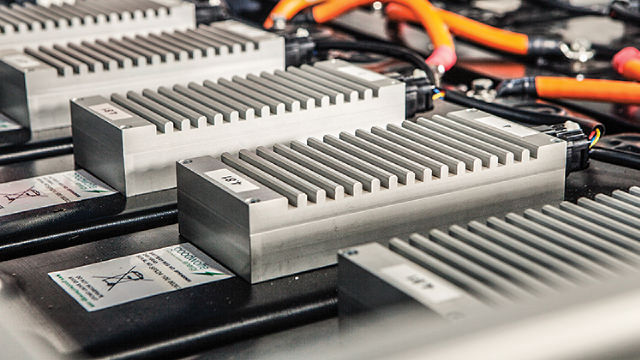

The need for data center services has been on the rise as demand for artificial intelligence (AI) products soars. One of the biggest costs associated with data center infrastructure is related to energy consumption.

Why Vertiv Holdings Co. (VRT) Outpaced the Stock Market Today

In the most recent trading session, Vertiv Holdings Co. (VRT) closed at $86.99, indicating a +1.43% shift from the previous trading day.

Vertiv Holdings Co. (VRT) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Vertiv (VRT) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Vertiv Holdings Co. (VRT) Rises Higher Than Market: Key Facts

In the latest trading session, Vertiv Holdings Co. (VRT) closed at $75.47, marking a +1.33% move from the previous day.

Is VRT Stock's Premium Valuation Justified by its Dividend Potential?

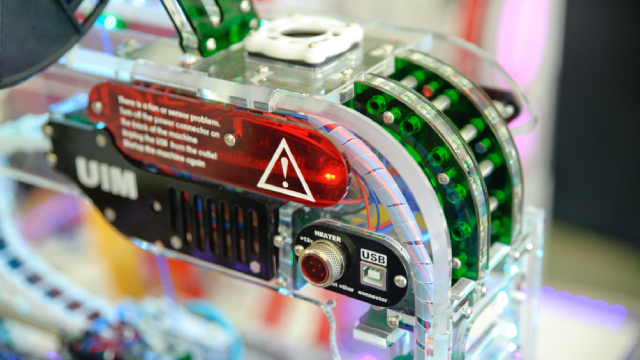

Vertiv's dividend payout is sustainable, given strong prospects driven by solid AI-driven order growth and expanding market share in the thermal management space.

Vertiv Holdings Co. (VRT) Falls More Steeply Than Broader Market: What Investors Need to Know

Vertiv Holdings Co. (VRT) closed at $75.06 in the latest trading session, marking a -0.19% move from the prior day.

Vertiv: Plenty Of Operating Leverage

Vertiv, a former Emerson subsidiary, successfully transitioned from a turnaround to a growth story driven by high demand for data center infrastructure and AI applications. Operating leverage on pricing power and cost dilution may drive EBITDA margins to 23% by 2026 vs. 17% in 2023. Cash earnings may grow at over 30% a year with an FCF of US$1.3bn by 2026.

Investors Heavily Search Vertiv Holdings Co. (VRT): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Vertiv (VRT). This makes it worthwhile to examine what the stock has in store.

Vertiv: Compelling Valuation And Impressive Fundamentals

My initial bullish thesis didn't hold up well, but my updated analysis suggests that the pullback over the last three months isn't related to the company's fundamentals. The company is efficiently absorbing AI tailwinds, as its operating profit and free cash flow demonstrate strong growth. The valuation seems compelling, and leading Wall Street analysts are also quite bullish about Vertiv's stock.

Does Vertiv (VRT) Have the Potential to Rally 33.24% as Wall Street Analysts Expect?

The average of price targets set by Wall Street analysts indicates a potential upside of 33.2% in Vertiv (VRT). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

Vertiv Rises 62% Year to Date: Should Investors Buy VRT Stock?

Vertiv's (VRT) prospects benefit from strong AI-driven order growth and expanding market share in the thermal management space.