Walmart Inc. (WMT)

The Big 3: AVGO, WMT, SBUX

From A.I. to retail, @Theotrade's Don Kaufman is bearish on all of today's Big 3. He believes technicals are working against Broadcom (AVGO), braces volatility around Walmart's (WMT) earnings, and expects Starbucks' (SBUX) recovery story to take longer than investors expect.

Should You Buy, Hold or Sell Walmart Stock Before Q2 Earnings?

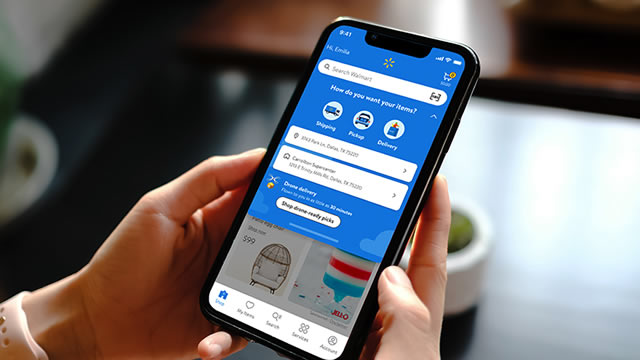

WMT prepares for Q2 earnings release with rising estimates, strong digital momentum and high-margin growth shaping investor decisions.

Walmart (WMT) Shares Near All-Time High Ahead of Earnings

With Wall Street maintaining a bullish outlook, a positive earnings surprise could drive shares of this leading retailer higher.

Wall Street Breakfast Podcast: FDA Reels In Radioactive Shrimp At Walmart

Walmart recalls shrimp in 13 states after FDA finds radioactive cesium-137 contamination; ongoing investigation and import alert issued for Indonesian supplier. AI startup Manus achieves $90M annual revenue run rate, positioning itself as a strong OpenAI competitor with advanced autonomous AI agents.

Walmart Earnings: 53% Win Rate, 3.6% Median Gain. But Will The Pattern Hold?

[Note: Walmart's Fiscal Year 2025 concluded on January 31, 2025]

Walmart recalls shrimp after radioactive material detected

Walmart Inc (NYSE:WMT, ETR:WMT) has recalled several batches of frozen shrimp in 13 US states after regulators found traces of radioactive Caesium-137 in a shipment from Indonesia. The Food and Drug Administration said one sample of breaded shrimp tested positive for the isotope, though the affected product did not reach store shelves.

FDA issues warning, investigating after radioactive shrimp bound for Walmart detected at major US ports

Shrimp from Indonesia contaminated with man-made Cesium-137 found at US ports, FDA warns consumers not to eat Great Value frozen shrimp.

Walmart & Target Earnings: Will Performance Disparity Continue?

The 2025 Q2 earnings season continues to slowly wind down, with this week's docket primarily dominated by retail. The period has been resilient, with earnings growth remaining strong and a strong number of companies exceeding quarterly expectations.

Retail Earnings Spotlight This Week: Walmart

One of the many big-name retailers reporting earnings this week is Walmart Inc (NYSE:WMT).

Walmart seen benefiting from eCommerce profitability, ancillary business growth in Q2

Walmart Inc (NYSE:WMT, ETR:WMT) is set to report its second quarter earnings this week, with Bank of America analysts expecting the discussion to center less on headline numbers and more on the forces shaping the retailer's longer-term trajectory. For Q2, the analysts project adjusted EPS of $0.70 and US comparable sales growth of 3.5% for the quarter, in line with the Wall Street consensus.

Walmart: Tariff Fears Fuel Cry Wolf Rally

Walmart's stock surged past $100 in 2025, driven by defensive positioning amid recession fears and strong investor demand. Tariffs are creating a regressive tax environment, squeezing Walmart's core lower-income customers but potentially attracting middle-income shoppers seeking value. Despite economic resilience, consumer sentiment is weakening, and inflationary pressures may compress Walmart's margins even as sales could exceed expectations.

Costco vs. Walmart: Which Retail Stock Should You Buy Now?

Looking to invest in retail? Discover how Costco and Walmart compare on growth, strategy and investor appeal today.