Walmart Inc. (WMT)

Walmart Stock Slips Despite Earnings Beat, Tariff Warning

Walmart Inc (NYSE:WMT) stock is falling this morning, last seen 3.8% lower at $93.20 even after the retail giant beat quarterly earnings expectations and delivered its first-ever profitable quarter for e-commerce operations.

Here's What Key Metrics Tell Us About Walmart (WMT) Q1 Earnings

While the top- and bottom-line numbers for Walmart (WMT) give a sense of how the business performed in the quarter ended April 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Walmart's earnings could offer clues about how retail is weathering the tariff storm

Results from Walmart, a bellwether for the U.S. retail industry, will offer proof on Thursday why the Arkansas behemoth is best placed to navigate the uncertainty from the Trump administration's tariffs.

Walmart warns ‘unprecedented' price hikes are coming as tariffed goods start to hit shelves

The world's largest retailer warned it's facing a dynamic environment as it withheld a profit forecast for the current quarter.

WMT Raises Prices Due to Tariffs, DKS Acquires Foot Locker

Despite an earnings beat, shares of Walmart (WMT) have pulled back from after-hours highs. Alex Coffey looks at the company's unaltered guidance and plans to raise prices as it weighs the impact of tariff costs.

Walmart (WMT) Surpasses Q1 Earnings and Revenue Estimates

Walmart (WMT) came out with quarterly earnings of $0.61 per share, beating the Zacks Consensus Estimate of $0.57 per share. This compares to earnings of $0.60 per share a year ago.

Tariffs, Shmariffs: Walmart's Earnings Show The Consumer Is Strong

Walmart reported earnings before Thursday's open and over the next few weeks several other big retailers will be reporting earnings too. The big question investors are asking: Is the Consumer Still Strong?

Walmart says some price increases are possible in tariff 'uncertainty,' e-commerce sales grow

Walmart warns of potential price hikes due to tariffs, despite strong Q1 results and eCommerce growth. The retailer remains optimistic about future sales.

Walmart Tops Q1 Profit Estimates, Affirms Full-Year Forecasts

Walmart (WMT) shares rose in premarket trading Thursday after the retail giant's fiscal 2026 first-quarter profit came in better than analysts had expected and it backed its full-year projections.

Walmart gets a lift from Trump's trade chaos — but warns price rises are coming

Walmart reported first-quarter revenues of $168 billion, up 4% from last year. US sales were boosted by shoppers rushing to get ahead of tariff-related price hikes.

Walmart Weathers Trade War Storm With Strong Sales

The retail giant said its sales grew stronger during a quarter when President Trump enacted steep tariffs against the country's biggest trading partners.

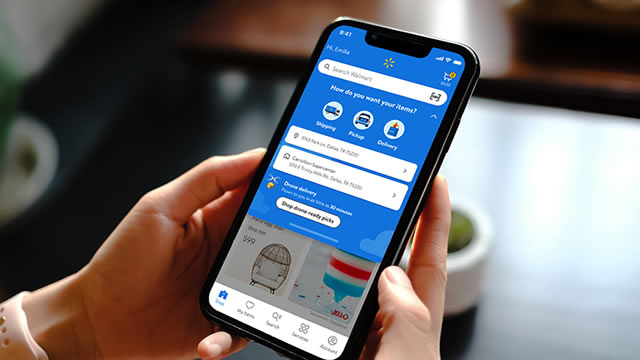

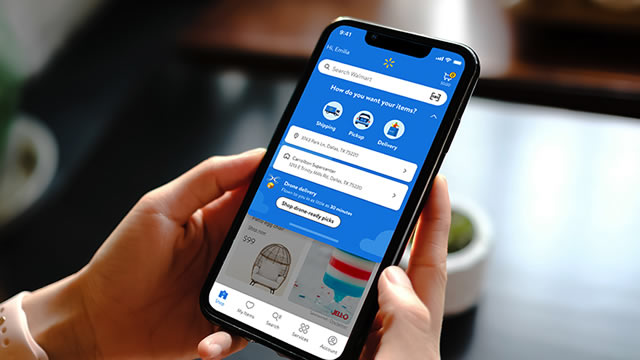

Walmart Is Preparing to Welcome Its Next Customer: The AI Shopping Agent

As consumers begin to use AI agents to do their shopping, retailers are trying to figure out how to market to bots in addition to humans.