Walmart Inc. (WMT)

Walmart Says Trump's Tariffs Have Added Uncertainty to Its Outlook

Executives at the largest retailer in the United States acknowledged the new environment, but told investors that they were confident in the company's strategy.

Walmart, Delta Air Lines warn of sales volatility, slower growth

Major corporations from retail to travel have already started to shift business plans as President Donald Trump's tariff plans against major trading partners continues to escalate.

WMT Offers Exclusive Member Perks and Savings for Walmart+ Week

Walmart is bringing back Walmart+ Week with exclusive member perks, including fuel savings, streaming bonuses, fast-food deals, free delivery and Walmart Cash.

Walmart vows to keep prices low — despite income being ‘harder to predict' after Trump tariffs

Walmart is at risk of taking a hit from Trump's tariffs, mainly on Asian countries that supply everything from clothing to toys to the retailer.

As warehouse clubs boom, Walmart-owned Sam's Club plans to open 15 stores per year

The warehouse club is speeding up its expansion plans, even as tariffs rattle Wall Street and injected fresh uncertainty about the economic outlook.

Is Walmart (WMT) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Walmart Retracts Income Guidance Over Tariff Concerns

Walmart is pulling its first-quarter operating income outlook due in part to tariff-related concerns.

Walmart Widens Its Forecast for Operating Income Growth as Tariffs Take Effect

Walmart (WMT) on Wednesday said its forecast for operating income is less certain as the Trump administration's tariffs go into effect.

Walmart withdraws Q1 profit forecast amid tariff uncertainty

Walmart Inc (NYSE:WMT, ETR:WMT) has pulled its operating income forecast for the first quarter of fiscal 2026 due to uncertainties surrounding the impact of US president Donald Trump's sweeping tariffs on imports from countries like China and Vietnam. These tariffs, which include rates as high as 104% on Chinese imports and 46% on Vietnamese goods, are expected to significantly affect Walmart's supply chain and pricing strategies.

Walmart Reaffirms 1Q Sales Ahead of Tariffs

Walmart reaffirmed its first-quarter sales guidance and widened its range for operating income growth to stay flexible on pricing as tariffs go into effect.

Walmart Stock's Recent Pullback: Should Investors Buy Now or Wait?

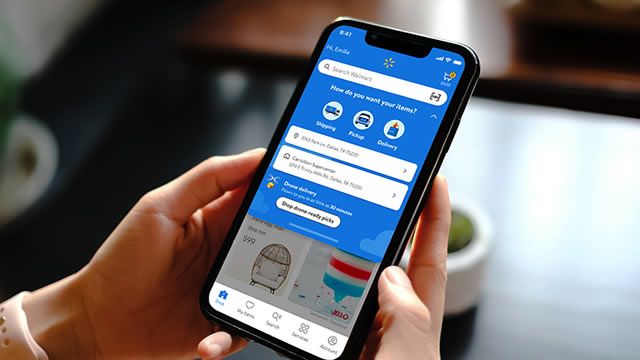

Despite macroeconomic challenges, WMT's strategic investments in e-commerce and delivery support its long-term growth outlook.

Walmart is facing tariffs and recession fears. It may have a secret weapon to keep growing

Walmart+ members drove nearly half of the total spent across Walmart's website and app in the U.S. in the most recent fiscal year, the company told CNBC. The membership program is an example of the newer moneymakers that have allowed Walmart to grow profits faster than sales.