Wolfspeed Inc. (WOLF)

Wolfspeed: Q1 Earnings Puts The Brakes On The Post-Bankruptcy Renaissance

Wolfspeed which came out of a quick Chapter 11 bankruptcy, was on a fine run until last week when its Q1 results were announced. Positive YoY revenue growth of 1% was the first in 6 quarters, but this appears to be a temporary boost from accelerated purchases that won't be repeated. Softness still continues to dominate WOLF's markets, and the upcoming Q2 revenue of $170m will likely be the lowest print in 18 quarters.

Options Traders Are All Over This Struggling Chip Stock

One of the worst stocks on Wall Street that hardly anybody talked about yesterday was Wolfspeed Inc (NYSE:WOLF), which dropped 18.2% to close at $26.16.

Wolfspeed, Inc. (WOLF) Q1 2026 Earnings Call Prepared Remarks Transcript

Wolfspeed, Inc. ( WOLF ) Q1 2026 Earnings Call October 29, 2025 5:00 PM EDT Company Participants Tyler Gronbach - Vice President of Investor Relations Robert Feurle - CEO & Director Gregor Issum - Executive VP & CFO Presentation Tyler Gronbach Vice President of Investor Relations Good afternoon, everyone. Welcome to Wolfspeed's Fiscal First Quarter 2026 Earnings Conference Call.

Wolfspeed posts weaker profit for first quarter after exiting bankruptcy

Wolfspeed on Wednesday reported a weaker first-quarter profit, highlighting the challenges facing the U.S. chipmaker as it recovers from bankruptcy and confronts subdued demand, sending its shares down more than 7% in extended trading.

Wolfspeed's Bankruptcy Bounceback: Is the Stock a Buy?

In this video, Motley Fool contributor Jason Hall breaks down what investors in Wolfspeed (WOLF -4.44%), freshly emerged from bankruptcy reorganization, need to know about its new structure, management, and prospects to be a winning investment.

What To Know About Wolfspeed Shares Post Reincorporation

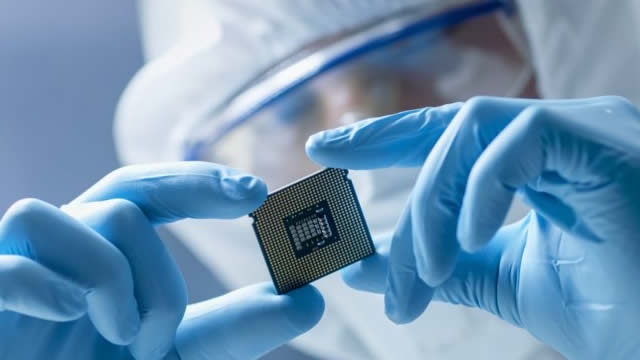

Wolfspeed, Inc. has completed a major restructuring, issuing new shares at a steep exchange ratio and reincorporating in Delaware to streamline future changes. WOLF's rollout of 200mm silicon carbide wafers positions it for growth in EVs, renewables, and data centers, despite ongoing financial strain and heavy debt. The new share structure creates a lean equity base, making WOLF appear deeply undervalued on a price-to-sales basis, but high financial risk remains.

Wolfspeed stock soars as chipmaker emerges from bankruptcy

Wolfspeed Inc (NYSE:WOLF) shares surged 29% to $28.50 in early trading on Tuesday after the chipmaker successfully exited from Chapter 11 bankruptcy with a much-reduced debt load. Wolfspeed announced on Monday it had achieved its goal of reducing overall company debt by about 70%.

Wolfspeed Stock Jumps After Exit From Chapter 11 Bankruptcy. What to Know.

The company said it believes it has “ample liquidity” to continue supplying customers with its silicon carbide chips.

Could Buying Wolfspeed Today Set You Up for Life?

Replacing ordinary silicon with silicon carbide has never been a bad idea. The carbon-toughened version of the simple material can be used for higher voltage applications like solar inverters and electric vehicles, since it tolerates higher levels of heat.

Wolfspeed: What's Happening With WOLF Stock?

Wolfspeed (NYSE: WOLF) shares surged 60% in extended trading on September 9 following court approval of its Chapter 11 reorganization plan. The silicon carbide leader, now at $1.24 and down more than 80% year-to-date, gained creditor support from over 97% of senior secured note holders and 67% of convertible note holders.

Wolfspeed Q4 Earnings Miss Estimates, Revenues Decline Y/Y

WOLF's fourth-quarter fiscal 2025 results reflect weak demand, factory underutilization, and higher losses.

Wolfspeed (WOLF) Reports Q4 Loss, Beats Revenue Estimates

Wolfspeed (WOLF) came out with a quarterly loss of $0.77 per share versus the Zacks Consensus Estimate of a loss of $0.72. This compares to a loss of $0.89 per share a year ago.