SPDR S&P Semiconductor ETF (XSD)

Is State Street SPDR S&P Semiconductor ETF (XSD) a Strong ETF Right Now?

Designed to provide broad exposure to the Technology ETFs category of the market, the State Street SPDR S&P Semiconductor ETF (XSD) is a smart beta exchange traded fund launched on 01/31/2006.

Should You Invest in the State Street SPDR S&P Semiconductor ETF (XSD)?

If you're interested in broad exposure to the Technology - Semiconductors segment of the equity market, look no further than the State Street SPDR S&P Semiconductor ETF (XSD), a passively managed exchange traded fund launched on January 31, 2006.

XSD ETF: Upside Is Exhausted At This Point, But Stay On (Rating Downgrade)

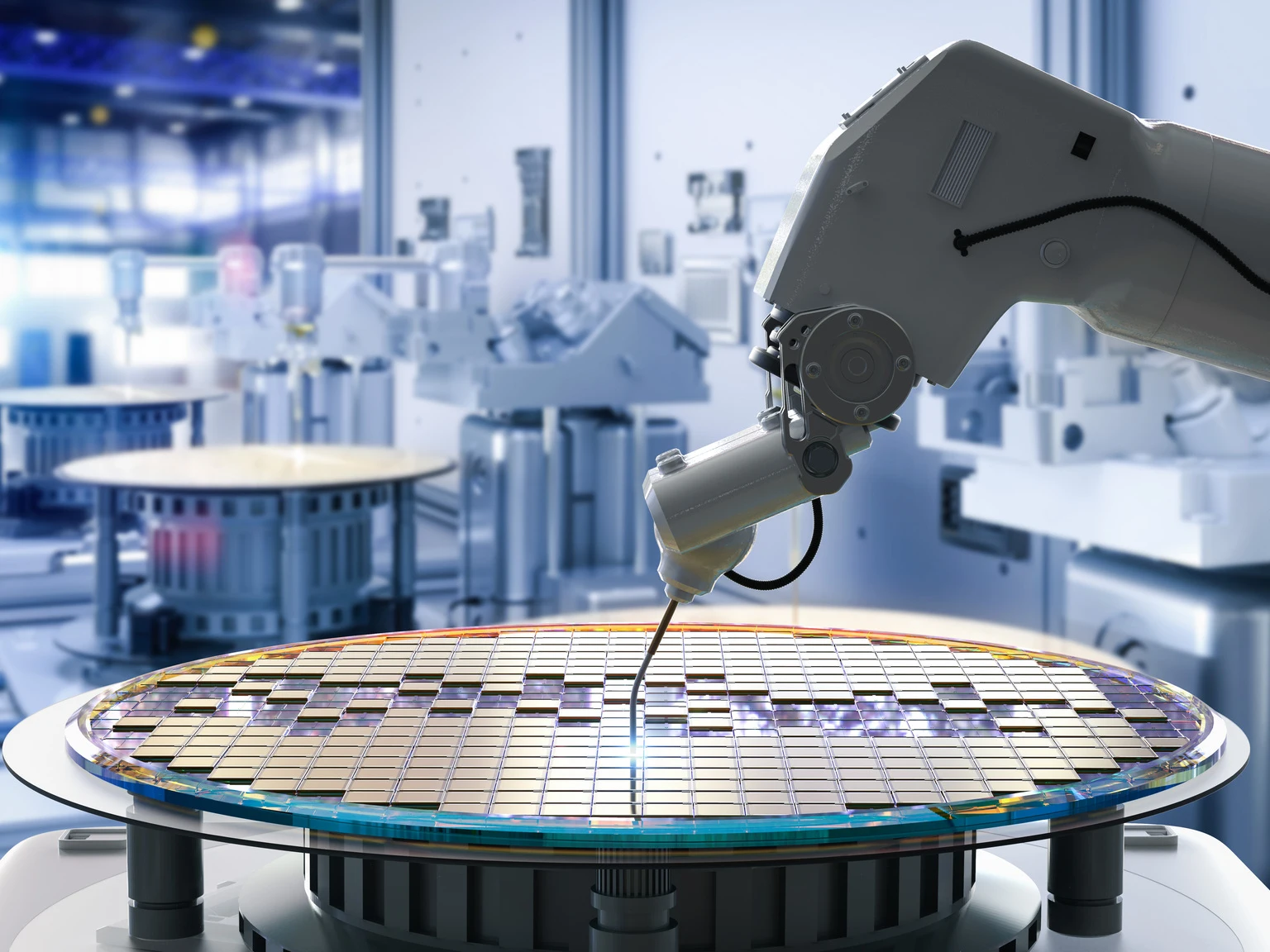

XSD ETF provides a balanced exposure to the U.S. semiconductor market. The fund omits the overweight positions in top-tier chipmakers for the benefit of new disruptive technologies. XSD offers no meaningful upside at this point, but the AI market is evolving faster than expected.

Is SPDR S&P Semiconductor ETF (XSD) a Strong ETF Right Now?

A smart beta exchange traded fund, the SPDR S&P Semiconductor ETF (XSD) debuted on 01/31/2006, and offers broad exposure to the Technology ETFs category of the market.

Should You Invest in the SPDR S&P Semiconductor ETF (XSD)?

The SPDR S&P Semiconductor ETF (XSD) was launched on 01/31/2006, and is a passively managed exchange traded fund designed to offer broad exposure to the Technology - Semiconductors segment of the equity market.

XSD: Relative Strength Emerging In SMID Semis, Reiterate Buy Amid The AI Boom

Small- and mid-cap semiconductor stocks are showing strong relative strength versus mega-cap peers, making SPDR S&P Semiconductor ETF an attractive, diversified industry play. XSD offers unconcentrated exposure across the semiconductor sector, with a tactical tilt toward growth and SMID caps, and less reliance on mega-caps. Despite a high P/E, XSD's robust long-term EPS growth and reasonable PEG ratio support a bullish outlook, especially if the AI trend continues.

Is SPDR S&P Semiconductor ETF (XSD) a Strong ETF Right Now?

The SPDR S&P Semiconductor ETF (XSD) was launched on 01/31/2006, and is a smart beta exchange traded fund designed to offer broad exposure to the Technology ETFs category of the market.

Should You Invest in the SPDR S&P Semiconductor ETF (XSD)?

Looking for broad exposure to the Technology - Semiconductors segment of the equity market? You should consider the SPDR S&P Semiconductor ETF (XSD), a passively managed exchange traded fund launched on 01/31/2006.

XSD: Semiconductor ETF Is Bouncing Off Lows For The Third Time

Semiconductors are crucial for 21st-century tech growth, driven by AI, smartphones, EVs, and high-speed networking, and more, making them essential for a diversified portfolio. The semiconductor sector's long-term growth potential remains robust, as evidenced by the superior returns of SMH and FSELX compared to broad market indexes. Despite strong fundamentals, XSD's underweighting of large-cap leaders like Nvidia and TSMC has led to lagging performance over the past five years.

Should You Invest in the SPDR S&P Semiconductor ETF (XSD)?

If you're interested in broad exposure to the Technology - Semiconductors segment of the equity market, look no further than the SPDR S&P Semiconductor ETF (XSD), a passively managed exchange traded fund launched on 01/31/2006.

Is SPDR S&P Semiconductor ETF (XSD) a Strong ETF Right Now?

Designed to provide broad exposure to the Technology ETFs category of the market, the SPDR S&P Semiconductor ETF (XSD) is a smart beta exchange traded fund launched on 01/31/2006.

Should You Invest in the SPDR S&P Semiconductor ETF (XSD)?

Launched on 01/31/2006, the SPDR S&P Semiconductor ETF (XSD) is a passively managed exchange traded fund designed to provide a broad exposure to the Technology - Semiconductors segment of the equity market.