Block Inc. (XYZ)

How XYZ Stock Could Weather An S&P Downturn

Block (XYZ) stock has declined by 13.9% over 21 trading days. This recent downturn indicates growing concerns about sluggish payment volume growth and increasing competition in the fintech space, but sharp declines like this often prompt a vital question: is this weakness only temporary, or does it portend more significant issues within the company?

Is Jack Dorsey the Mysterious Satoshi Nakamoto? The Debate Rages On

A Seaport Research analyst recently revived an old theory that Block CEO Dorsey is the anonymous creator behind Bitcoin.

XYZ Stock Is Crashing, Is It Time To Get In?

Block (XYZ) stock has reached the sixth day of a consecutive downward trend, resulting in a total loss of -14% over this timeframe. The company has experienced a decline of approximately $5.6 billion in value during the past 6 days, with its current market capitalization standing at about $35 billion.

Time To Buy XYZ Stock?

Block stock (NYSE: XYZ) has dropped approximately 14% in a week following downbeat third-quarter results, with both revenue and earnings missing analyst estimates. The company attributed this slowdown to a processing partner change and an increase in lower-margin hardware sales.

Is XYZ Stock a Buy, Hold or Sell After Its 30% Three-Month Rally?

Block's 30% rally highlights margin gains and Cash App growth, but competition and valuation leave XYZ stock a nuanced hold.

Up 76%, This Stock Just Got Added to the S&P 500. Time to Buy?

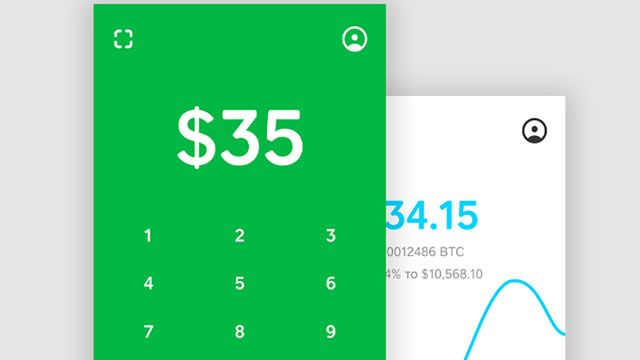

Key Points in This Article: Block (XYZ) plummeted 20% after Q1 earnings due to weak guidance but rebounded 76% in two months, driven by strategic initiatives like Cash App Borrow and Square enhancements.

Could Block's BNPL Moves Reshape Its Financial Ecosystem?

Block's BNPL momentum grows with Cash App integration and strong repayment rates despite rising fintech competition.

Should You Hold Onto XYZ Stock in 2025 Beyond Its 19% QTD Growth?

Block's 19.8% QTD rally outpaces peers, but macro headwinds and valuation spark debate over whether to hold or buy more.

XYZ Strengthens Portfolio With New Square App: Time to Buy the Stock?

Block is suffering from stiff competition despite an expanding partner base and strong positioning in the digital payments industry amid a stretched valuation.

Cash App's Growing Number of Direct Deposits Marks Progress in Expansion Efforts

Block's Cash App is reportedly making progress in its efforts to offer banking services to customers who mostly use the app to make payments. The number of the app's users who have their paychecks directly deposited into their Cash App account rose by 25% year over year to reach 2.

Could Buying Block Stock Today Set You Up for Life?

When you think about stocks that could set you up for life, they usually come in one of two genres: young disruptors that have incredible opportunity, or winners that are already succeeding. Turnaround stories are another category that offers serious potential, but they come with much higher risk.

Options Corner: XYZ (The Fintech Stock Formerly Known as SQ)

Block (XYZ) has gone by many names and ticker symbols. But, as the fintech company embraces its blockchain roots, the analyst community is weighing in as Keefe Bruyette upgraded the stock to an Outperform.