Merck & Co., Inc. (0QAH)

Summary

0QAH Chart

Merck creates separate oncology arm ahead of Keytruda patent loss

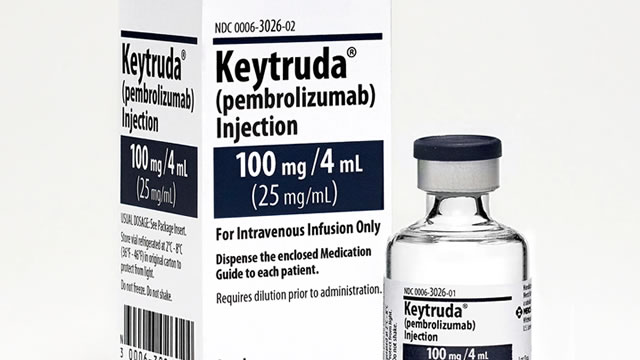

Merck said on Monday that it will split its human-health operations into two separate divisions, a move designed to sharpen focus across its portfolio and ensure smoother launches of new medicines. The move comes as the drugmaker seeks to prepare for mounting sales pressure later this decade, driven by the looming loss of exclusivity for its top-selling cancer drug Keytruda, which will also expose it to lower-cost copycat competition.

Merck reportedly ready to the splits as Keytruda patent cliff looms. Market shrugs

Investors gave a collective meh to news that Merck & Co Inc (NYSE:MRK, XETRA:6MK) is reportedly restructuring its human-health division, with shares marking time in premarket trading despite a reorganisation that signals the US drugmaker is bracing for the biggest revenue hit in its recent history. The Wall Street Journal reported on Monday that Merck plans to separate its human-health operations into two distinct divisions.

Merck to create separate cancer business to offset Keytruda patent loss, WSJ reports

Drugmaker Merck is separating its human-health business into two divisions to offset pressures related to the patent loss of its top-selling drug Keytruda, the Wall Street Journal reported on Monday.

Merck & Co., Inc. (0QAH) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Merck & Co., Inc. ever had a stock split?

Merck & Co., Inc. Profile

| Diversified Consumer Services Industry | Consumer Discretionary Sector | Robert Davis CEO | LSE Exchange | US58933Y1055 ISIN |

| US Country | 73,000 Employees | 16 Mar 2026 Last Dividend | 3 Jun 2021 Last Split | 13 Jan 1978 IPO Date |

Overview

Merck & Co., Inc. is a global healthcare leader focused on innovating new solutions to tackle some of the most serious health challenges. Founded in 1891 and headquartered in Rahway, New Jersey, the company operates worldwide, engaging in the discovery, development, manufacturing, and marketing of pharmaceuticals and animal health products. It operates two main segments: Pharmaceutical and Animal Health. The Pharmaceutical segment is dedicated to developing and offering human health pharmaceutical products across a range of areas including oncology, cardiovascular, and diabetes, among others. The Animal Health segment works on veterinary pharmaceuticals, vaccines, and health management solutions and services. Merck serves a diverse clientele, including drug wholesalers, retailers, hospitals, government agencies, physicians, veterinarians, and pet owners. Notably, the company invests in several strategic collaborations and agreements with other pharmaceutical giants like AstraZeneca PLC and Bayer AG, aiming to enhance its product offerings and harness innovative treatments for multiple diseases.

Products and Services

The products and services offered by Merck & Co., Inc. span a broad spectrum of medical needs in both human and animal health sectors:

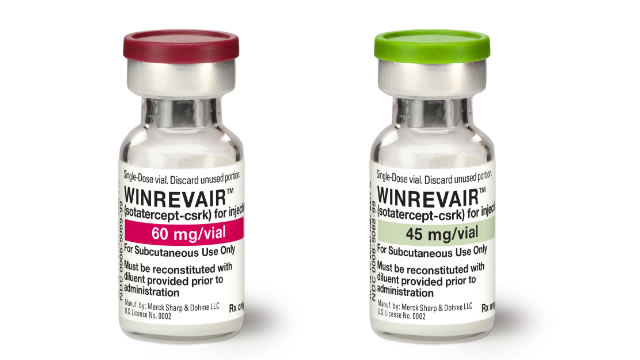

- Keytruda: A forefront immunotherapy for treating various types of cancer.

- Bridion, Adempas, Lagevrio, Belsomra, Simponi, and Januvia: A portfolio of pharmaceuticals addressing hospital acute care, neuroscience, virology, cardiovascular, and diabetes.

- Vaccine Products: Including preventive pediatric, adolescent, and adult vaccines with prominent products like Gardasil/Gardasil 9 for HPV, ProQuad, M-M-R II, and Varivax for measles, mumps, rubella, and chickenpox, RotaTeq for rotavirus, Vaxneuvance for pneumococcal infections, Pneumovax 23 for pneumonia, and Vaqta for hepatitis A.

- Animal Health Solutions: Veterinary pharmaceuticals, vaccines, health management solutions and services, along with digitally connected identification, traceability, and monitoring products aimed at veterinarians, distributors, animal producers, farmers, and pet owners.

In the arena of collaborative efforts, Merck has entered into multiple significant agreements to bolster its product pipeline:

- Daiichi Sankyo's deruxtecan ADC candidates: A development and commercialization agreement covering patritumab deruxtecan, ifinatamab deruxtecan, and raludotatug deruxtecan for treating multiple solid tumors.

- AstraZeneca's Lynparza and Koselugo: Co-development and co-commercialization for multiple cancer types, enhancing Merck's portfolio in oncology.

- Collaborations across the industry: Partnerships with Eisai Co., Ltd., Bayer AG, and Ridgeback Biotherapeutics LP, as well as Moderna, Inc., aiming to explore and bring new treatments and vaccines to market.