Aecom (ACM)

Is the Options Market Predicting a Spike in AECOM (ACM) Stock?

Investors need to pay close attention to AECOM (ACM) stock based on the movements in the options market lately.

AECOM (ACM) Leads NYSDOT Bronx River Parkway Bridge Project

AECOM (ACM) leads NYSDOT's Bronx River Parkway bridge project, advancing safety and resilience.

ACM Research: Maintaining Strong Buy Rating After Another Strong Quarter

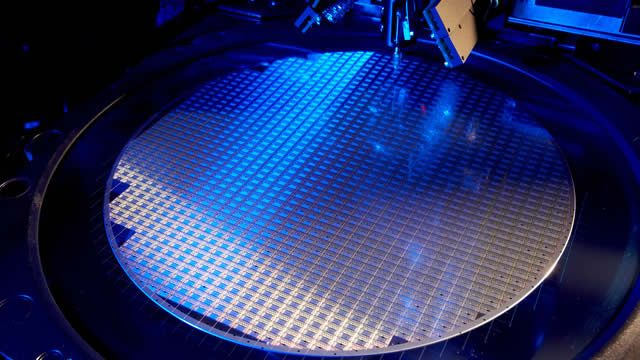

ACMR reported strong Q2 2024 results, with revenue up 40% year-over-year and increased revenue guidance for fiscal year 2024. ACMR's focus on new cleaning products and ECP furnace revenue growth positions them well to penetrate the AI market. Despite risks such as capital allocation and conflicts of interest, ACMR remains significantly undervalued with potential for growth.

ACM Research: A Promising Semiconductor Growth Opportunity Outpacing Risks

ACM Research's stock dropped nearly 40%, but it beat Q2 estimates and raised its fiscal year guidance, showing strong potential for growth. The wafer cleaning equipment market is expected to grow significantly, with ACM Research well-positioned to benefit, especially in China. I have valued the company at $58.6 per share, representing a 233% premium over the current stock price. Even after factoring in the risks, I consider it undervalued.

Why ACM Research Stock Was Climbing Today

ACM Research easily beat estimates on the top and bottom lines. The company continues to see strong demand from China.

AECOM (ACM) Q3 2024 Earnings Call Transcript

AECOM (NYSE:ACM ) Q3 2024 Earnings Conference Call August 6, 2024 8:00 AM ET Company Participants Will Gabrielski - Senior Vice President, Finance, Treasury & Investor Relations Troy Rudd - Chief Executive Officer Lara Poloni - President Gaurav Kapoor - Chief Financial Officer & Chief Operations Officer Conference Call Participants Andrew Wittmann - Baird Jamie Cook - Truist Securities Sangita Jain - KeyBanc Capital Markets Andrew Kaplowitz - Citigroup Michael Dudas - Vertical Research Operator Good morning and welcome to the AECOM Third Quarter 2024 Conference Call. I would like to inform all participants this call is being recorded at the request of AECOM.

AECOM (ACM) Q3 Earnings Surpass Estimates, Backlog Up Y/Y

AECOM's (ACM) third-quarter fiscal 2024 results reflect solid performance in the reportable segments along with growth in NSR.

Aecom Technology (ACM) Earnings Expected to Grow: Should You Buy?

Aecom (ACM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

AECOM: Good Growth Prospects And Attractive Valuation

AECOM is well-positioned for growth with a healthy backlog of $23.7 billion, exposure to high-growth markets, and increasing PFAS-related work. Revenue growth outlook is positive with strong demand in end markets, government infrastructure investments, and incremental projects from disaster-related work. Margins are expected to improve with operational efficiency, cost-saving initiatives, and increasing international margins, making AECOM a buy with growth potential.

ACM Research: Outsized Growth Potential In An Undervalued Small-Cap

ACM Research is undervalued with high growth potential, driven by exposure to AI-driven semiconductor cleaning operations, trading at low valuation multiples compared to peers. Key technologies like SAPS and TEBO, and 97% of revenue from China, position ACMR for growth, supported by forecasts of significant market expansion including global wafer cleaning equipment markets. Success hinges on differentiated technology and strategic partnerships. Despite risks from competitors like Lam Research, ACMR's innovative products and international expansion plans are crucial for long-term growth.

Scoop up These 4 GARP Stocks to Receive Handsome Returns

The GARP strategy helps investors gain exposure to stocks that have impressive prospects and are trading at a discount. BAH, AMP, BAP and ACM are some stocks that hold promise.

AECOM (ACM) Secures Portage Bay Bridge Project Contract

AECOM (ACM) has been selected as the Lead Designer for the Washington State Department of Transportation's SR 520 Portage Bay Bridge and Roanoke Lid Project.