CNH Industrial N.V. (CNH)

DE or CNH: Which Equipment Maker Deserves a Spot in Your Portfolio?

DE and CNH are expected to ride tech and infrastructure megatrends, but weak demand and falling earnings raise big questions for investors.

CNH Industrial Inks Deal With Starlink to Expand Farm Connectivity

CNH signs a deal with Starlink to deliver cutting-edge satellite connectivity to farmers even in the most remote rural areas.

CNH Industrial Q1 Earnings Surpass Expectations, Guidance Revised

CNH reports better-than-expected Q1 results and expects 2025 adjusted EPS in the range of 50-70 cents compared with the previous estimate of 65-75 cents.

CNH Industrial N.V. (CNH) Q1 2025 Earnings Call Transcript

CNH Industrial N.V. (NYSE:CNH ) Q1 2025 Earnings Conference Call May 1, 2025 9:00 AM ET Company Participants Jason Omerza – Vice President-Investor Relations Gerrit Marx – Chief Executive Officer Oddone Incisa – Chief Financial Officer Conference Call Participants Angel Castillo – Morgan Stanley Tim Thein – Raymond James Kristen Owen – Oppenheimer Tami Zakaria – JPMorgan Kyle Menges – Citigroup Daniela Costa – Goldman Sachs Mig Dobre – Baird Jamie Cook – Truist Securities David Raso – Evercore ISI Avi Jaroslawicz – UBS Operator Good morning, and welcome to the CNH 2025 First Quarter Results Conference Call.

CNH (CNH) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for CNH (CNH) give insight into how the company performed in the quarter ended March 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

CNH Industrial (CNH) Q1 Earnings and Revenues Top Estimates

CNH Industrial (CNH) came out with quarterly earnings of $0.10 per share, beating the Zacks Consensus Estimate of $0.09 per share. This compares to earnings of $0.33 per share a year ago.

Analysts Estimate CNH Industrial (CNH) to Report a Decline in Earnings: What to Look Out for

CNH (CNH) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

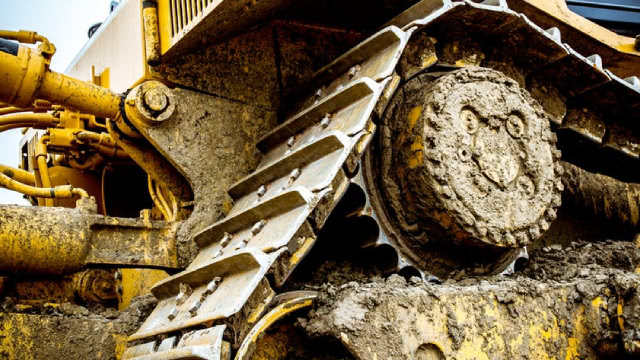

Don't Get Stuck In The Mud: There's A Better Pick Than CNH Industrial

CNH Industrial, the second-largest farming equipment manufacturer, benefited from Deere's unmet demand in 2022-2023 but now faces declining revenues and profitability due to a cyclical downturn. The macroeconomic environment has shifted, with higher interest rates and lower farm income, leading to reduced demand and production cuts, favoring market leader Deere. CNH's Q4 performance was weak, with significant revenue and EBIT declines, inventory reduction efforts, and higher warranty costs impacting financials.

CNH Industrial Q4 Earnings Miss Expectations, Revenues Fall Y/Y

CNH reports lower-than-expected Q4 results and expects 2025 Agriculture & Construction sales to decline 13-18% and 5-10%, respectively.

CNH Industrial N.V. (CNH) Q4 2024 Earnings Call Transcript

CNH Industrial N.V. (NYSE:CNH ) Q4 2024 Earnings Conference Call February 4, 2025 9:00 AM ET Company Participants Jason Omerza - VP of IR Gerrit Marx - CEO Oddone Incisa - CFO Conference Call Participants Tami Zakaria - JPMorgan Mig Dobre - Baird Angel Castillo - Morgan Stanley David Raso - Evercore ISI Tim Thein - Raymond James Jamie Cook - Truist Securities Kyle Menges - Citigroup Joel Jackson - BMO Capital Markets Mike Shlisky - D.A.

Compared to Estimates, CNH (CNH) Q4 Earnings: A Look at Key Metrics

The headline numbers for CNH (CNH) give insight into how the company performed in the quarter ended December 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

CNH Industrial (CNH) Q4 Earnings and Revenues Miss Estimates

CNH Industrial (CNH) came out with quarterly earnings of $0.15 per share, missing the Zacks Consensus Estimate of $0.19 per share. This compares to earnings of $0.42 per share a year ago.