CNH Industrial N.V. (CNH)

CNH Industrial Analyst Sees 2025 As Pivotal Year For Recovery

Equipment manufacturer CNH Industrial NV's CNH earnings are likely to bottom out in 2025, after around two years of equipment sales declines, according to Oppenheimer.

Earnings Preview: CNH Industrial (CNH) Q4 Earnings Expected to Decline

CNH (CNH) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

CNH Industrial: Near-Term Pessimism Provides Long-Term Opportunity

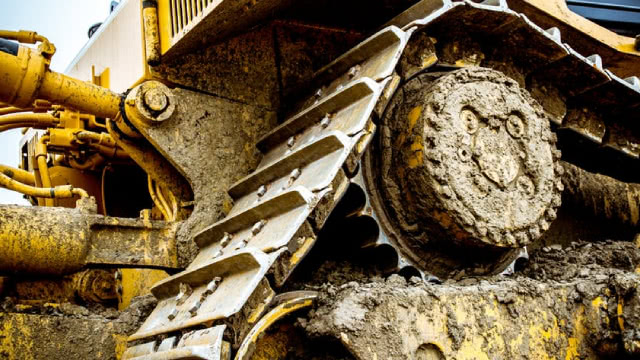

CNH Industrial shares have dropped due to macro concerns, but the company's strong brands and focus on ag equipment offer long-term growth potential. The company is well-managed, with a renewed focus on precision ag technologies and improving margins, despite challenges in the ag and construction markets. CNH's strategic moves and focus on quality and efficiency could enhance returns and shareholder value.

CNH Industrial: Another Guidance Cut, Still A Buy

Q3 results led to revised FY24 targets due to weak demand and high inventories, with further production cuts expected into H1 2025. FY25 is anticipated to mark the bottom of the AG industry's downcycle, with cost-cutting measures and resilient pricing expected to limit downside risks. As industry demand may be nearing its bottom, CNH's efforts to boost its mid-cycle margin structurally may drive a share re-rating. For this reason, we confirm our buy.

Three-Stock Lunch: Wynn Resorts, CNH Industrial, & Tapestry

Matt Maley, chief market strategist at Miller Tabak + Co., joins CNBC's ‘Power Lunch' to discuss outlooks on three stocks: Wynn Resorts, CNH Industrial, and Tapestry.

CNH Industrial Q3 Earnings Miss Expectations, Revenues Fall Y/Y

CNH reports lower-than-expected Q3 results and expects 2024 Agriculture sales to decrease 22-23% compared with the earlier projected decline of 15-20%.

David Einhorn is building new position in CNH Industrial, says agricultural play is 'cheap'

David Einhorn, president at Greenlight Capital, joins CNBC's Delivering Alpha 2024 to discuss why he believes the current market is broken, where he sees a massive investment opportunity, and more.

David Einhorn is building new position in CNH Industrial, says agricultural play is 'cheap'

David Einhorn is building new position in CNH Industrial, says agricultural play is 'cheap'

CNH: Weathering A Storm With 40% EPS Drop

CNH Industrial faces industry-wide challenges with softening demand, higher interest rates, and declining farm income impacting tractor manufacturers. Effective cost-cutting measures have resulted in significant savings, aiding in maintaining profitability amidst a tough market environment. Leadership changes with CEO Scott Wine's resignation and Gerrit Marx's appointment raise concerns about the company's future direction.

CNH Industrial N.V. (CNH) Q3 2024 Earnings Call Transcript

CNH Industrial N.V. (NYSE:CNH ) Q3 2024 Earnings Conference Call November 8, 2024 11:30 AM ET Company Participants Jason Omerza - Vice President, Investor Relations Gerrit Marx - Chief Executive Officer Oddone Incisa - Chief Financial Officer Conference Call Participants Kyle Menges - Citigroup Daniela Costa - Goldman Sachs Steven Fisher - UBS Jamie Cook - Truist Securities Mig Dobre - Baird Kristen Owen - Oppenheimer Tami Zakaria - JPMorgan Mike Shlisky - D.A.

Compared to Estimates, CNH (CNH) Q3 Earnings: A Look at Key Metrics

The headline numbers for CNH (CNH) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

CNH Industrial (CNH) Q3 Earnings and Revenues Lag Estimates

CNH Industrial (CNH) came out with quarterly earnings of $0.24 per share, missing the Zacks Consensus Estimate of $0.28 per share. This compares to earnings of $0.42 per share a year ago.