Coinbase Global, Inc. - Class A (COIN)

Coinbase Global, Inc. (COIN) Q4 Earnings and Revenues Miss Estimates

Coinbase Global, Inc. (COIN) came out with quarterly earnings of $0.66 per share, missing the Zacks Consensus Estimate of $0.92 per share. This compares to earnings of $3.39 per share a year ago.

Coinbase swings to a surprise loss amid flight from crypto

The crypto exchange's stock bounced off a two-year low as it looked to ease investor worries amid a sharp crypto selloff.

Coinbase says some customers were ‘unable to buy, sell, transfer' amid brief Thursday disruption

The service issue comes as the the crypto giant is set to report earnings on Thursday.

Can Coinbase's Subscription Pivot Save It During A Market Crash?

Coinbase Global (COIN) stock has decreased by 11.0% over the past 5 trading days. The recent decline reveals renewed worries about expected lower trading volumes, regulatory ambiguity surrounding stablecoins, and cautious analyst predictions ahead of earnings.

Thinking of Adding COIN Ahead of Q4 Earnings? You Might Want to Wait

COIN heads into Q4 earnings with falling trading volumes, a negative Earnings ESP and a premium valuation-signals that suggest waiting may pay off.

Insights Into Coinbase Global (COIN) Q4: Wall Street Projections for Key Metrics

Evaluate the expected performance of Coinbase Global (COIN) for the quarter ended December 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Earnings Preview: Coinbase Global, Inc. (COIN) Q4 Earnings Expected to Decline

Coinbase Global (COIN) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Coinbase Global, Inc. (COIN) Stock Drops Despite Market Gains: Important Facts to Note

In the most recent trading session, Coinbase Global, Inc. (COIN) closed at $187.86, indicating a -3.53% shift from the previous trading day.

Coinbase Directors and CEO Facing Insider Trading Lawsuit

A judge has allowed an insider trading lawsuit against several Coinbase directors to proceed. The ruling followed an internal investigation clearing the defendants of wrongdoing, Bloomberg News reported Friday (Jan. 30).

COIN vs. ICE: Which Financial Markets Stock is the Better Buy Now?

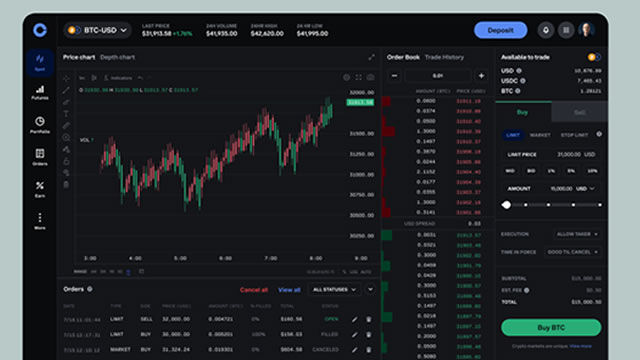

Coinbase ramps up crypto services and M&A moves as it eyes growth beyond trading and bets on a favorable U.S. regulatory shift.

Is It Worth Investing in Coinbase Global (COIN) Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Coinbase Crumbles: Is The Downgrade Justified?

Coinbase Global (COIN) – a provider of crypto financial infrastructure and retail accounts – has experienced a 7-day downturn, with total losses during this period reaching -13%. The company's market capitalization has plunged by approximately $8.5 Billion over the past week, now resting at $56 Billion.