Danaos Corporation (DAC)

Danaos: Alaska LNG Investment - Smart Diversification Or Opportunity Cost?

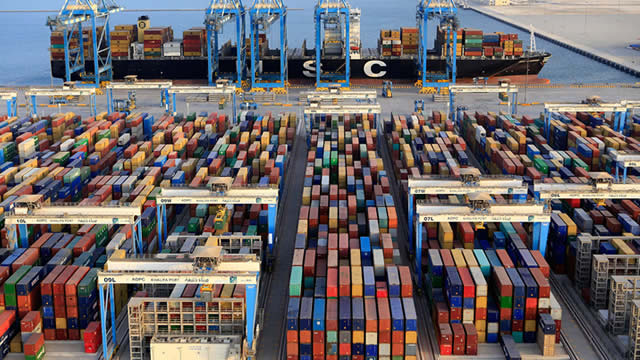

Danaos has surpassed $100/share, posting a record $266M quarter and boasting a $4.3B contracted revenue backlog. DAC's core containership business remains robust, with 100% of 2026 and 87% of 2027 operating days locked at high rates. The $50M Alaska LNG investment marks a strategic diversification but introduces operational risk and a capital allocation debate.

Danaos Corporation (DAC) Q4 2025 Earnings Call Transcript

Danaos Corporation (DAC) Q4 2025 Earnings Call Transcript

Does Rigetti's $8.4M C-DAC Order Strengthen Its Path to Scale?

RGTI's $8.4M C-DAC order for a 108-qubit system signals a shift from experimental cloud access to on-premises government deployments.

Danaos: Severely Undervalued Despite Industry Shifts

Danaos' revenues increased year over year and will likely continue to increase or at least remain stable. Profitability is in decline, but despite this, market cap is still significantly lower than it should be. Danaos' balance sheet gives it plenty of room for growth and flexibility to respond to industry changes.

Danaos Q3: Drybulk Isn't Growing, But The Reasons Seem Valid

Danaos Corp. (DAC) has aggressively executed share buybacks, totaling $213.6 million, capitalizing on its undervalued stock price. DAC's management prudently slowed buybacks as the share price approached $100, aligning with their focus on preserving cashflows. Despite the price increase, DAC's buyback yield remains attractive, supporting the thesis that the stock is still undervalued near $100.

Danaos Corporation (DAC) Q3 2025 Earnings Call Transcript

Danaos Corporation ( DAC ) Q3 2025 Earnings Call November 18, 2025 9:00 AM EST Company Participants Evangelos Chatzis - VP, CFO, Treasurer & Secretary John Coustas - Chairman, President & CEO Conference Call Participants Omar Nokta - Jefferies LLC, Research Division Climent Molins - Value Investor's Edge Presentation Operator Good day, and welcome to the Danaos Corporation conference call to discuss the financial results for the 3 months ended September 30, 2025. As a reminder, today's call is being recorded.

Danaos: A Lot Of Value Even With The Current Scenario

Danaos remains a compelling opportunity, supported by strong financials and a favorable supply-demand gap in maritime transport. 2Q2025 results show revenue growth to $262.15 million, with stable adjusted EBITDA and a growing fleet, highlighting DAC's operational resilience. Valuation using industry multiples (PE, EV/EBITDA, P/CF, P/BV) positions DAC as a leader in margin and financial solvency versus peers.

Danaos: Q2 Shows The Business Is Improving Faster Than The Stock

I continue to lean bullish on Danaos after prior concerns about capital allocation earlier this year. Recent fleet expansion at attractive rates has improved the investment case for DAC. Q2 results showed strong contract coverage, reduced leverage, and clarified the order book and cash position.

Will C-DAC Collaboration Help RGTI Unlock India's Quantum Market?

Rigetti's pact with India's C-DAC aims to co-develop hybrid quantum systems, opening doors to new markets and research opportunities.

Danaos Corporation (DAC) Q2 2025 Earnings Call Transcript

Danaos Corporation (NYSE:DAC ) Q2 2025 Earnings Conference Call August 5, 2025 9:00 AM ET Company Participants Evangelos Chatzis - VP, CFO, Treasurer & Secretary John Koustas - Chairman, President & CEO Conference Call Participants Climent Molins - Unidentified Company Value Investor's Edge - Unidentified Company Omar Mostafa Nokta - Jefferies LLC, Research Division Operator Good day, and welcome to the Danaos Corporation Conference Call to discuss the financial results for the 3 months ending June 30, 2025. As a reminder, today's call is being recorded.

Danaos (DAC) Q2 Earnings and Revenues Miss Estimates

Danaos (DAC) came out with quarterly earnings of $6.36 per share, missing the Zacks Consensus Estimate of $6.52 per share. This compares to earnings of $6.78 per share a year ago.

Occidental Petroleum: Prepare For DAC-Ing

Occidental Petroleum Corporation is heavily U.S. and Permian-focused, lacking both true diversification and pure-play shale status compared to peers. The company's main operational upside lies in Enhanced Oil Recovery, or EOR, using carbon capture, which benefits from lucrative tax credits. Direct Air Capture, or DAC, is a costly, inefficient carbon capture method; cheaper, scalable alternatives exist, making Oxy's heavy DAC investment questionable.