JPMorgan Chase & Co. (JPM)

Earnings Growth & Price Strength Make JPMorgan Chase & Co. (JPM) a Stock to Watch

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

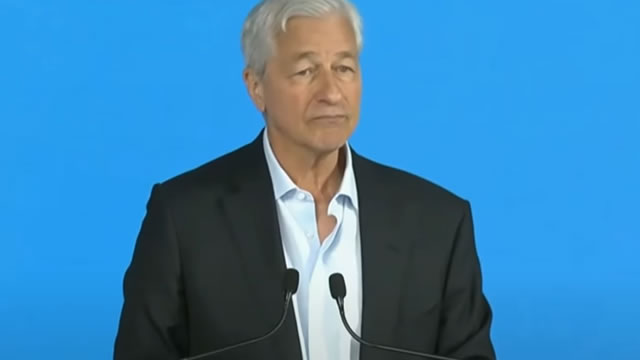

JPMorgan Chase & Co. (JPM) Presents at UBS Financial Services Conference 2026 Transcript

JPMorgan Chase & Co. (JPM) Presents at UBS Financial Services Conference 2026 Transcript

2 stocks to hit $1 trillion market cap in Q1 2026

As equity markets move deeper into 2026, more stocks are showing potential to join the $1 trillion club despite recent volatility.

JPMorgan: An Attractive Long-Term Idea For Income And Capital Gains

JPMorgan: An Attractive Long-Term Idea For Income And Capital Gains

Analysts Upgrade JPM, Stock Unchanged to Start 2026

Rick Ducat turns to the financial space on Friday's Options Corner with a look at JPMorgan Chase (JPM). Shares remain virtually unchanged so far in 2026, though analyst upgrades offer potential for bullish price action.

JPM analysts stay bullish on Rio Tinto in wake of collapsed Glencore merger talks

Analysts at JPMorgan have resumed coverage of Rio Tinto Ltd at 'Overweight' with a £75.00 price target, signaling confidence in the mining giant's strategic positioning even as merger talks with Glencore PLC collapse. The note, a day after Rio Tinto confirmed it is no longer pursuing a merger or business combination with its rival, also saw the American investment bank's UK analyst also brought Glencore back under coverage, with a 'Neutral' rating and a £4.90 price target.

JPMorgan Chase & Co. (JPM) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to JPMorgan Chase & Co. (JPM). This makes it worthwhile to examine what the stock has in store.

JPMorgan's 2026 NII Guide Signals Resilience: Is JPM Stock a Buy Now?

JPM projects 2026 NII of $103B despite rate cuts, banking on loan growth, card balances and deposit gains. Does this justify betting on the stock?

From JPMorgan to Wells Fargo, here's how the biggest banks on Wall Street are using AI

Banks are pouring billions into AI, reshaping jobs, culture, and power on Wall Street. Generative AI is changing how jobs get done— from junior bankers to developers.

Are You Looking for a High-Growth Dividend Stock?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does JPMorgan Chase & Co. (JPM) have what it takes?

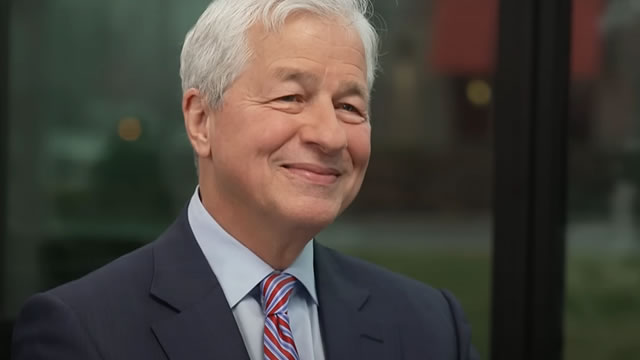

Focus: Trump's JPMorgan lawsuit underscores his growing clash with Wall Street

U.S. President Donald Trump's lawsuit against JPMorgan Chase and its CEO Jamie Dimon highlights a growing, and politically fraught, conflict in the administration's policy agenda for Wall Street, with big banks scoring wins but also facing setbacks.

Explainer: Does Trump have a case against JPMorgan for closing his accounts?

U.S. President Donald Trump filed a $5 billion lawsuit against JPMorgan Chase and its CEO Jamie Dimon on Thursday for closing his accounts allegedly for political reasons.