Luminar Technologies, Inc. (LAZR)

Here's Why Luminar Technologies, Inc. (LAZR) Fell More Than Broader Market

In the latest trading session, Luminar Technologies, Inc. (LAZR) closed at $0.82, marking a -1.07% move from the previous day.

Luminar Technologies, Inc. (LAZR) Increases Despite Market Slip: Here's What You Need to Know

Luminar Technologies, Inc. (LAZR) concluded the recent trading session at $0.89, signifying a +0.87% move from its prior day's close.

Luminar Technologies, Inc. (LAZR) Declines More Than Market: Some Information for Investors

Luminar Technologies, Inc. (LAZR) closed the most recent trading day at $0.91, moving -0.94% from the previous trading session.

Luminar Technologies Surged Today on Potential Trade Protections

Luminar Technologies shares jumped after the Biden administration proposed restrictions on Russian and Chinese vehicle software. The U.S. is pushing to ban software and hardware from China and Russia, hoping to protect the U.S. auto industry and the autonomous driving sector.

Luminar Technologies reduces workforce by 30% this year

Luminar Technologies , a maker of lidar sensors for self-driving cars, said on Monday it has cut about 30% of its workforce since the beginning of 2024, from the previously announced 20%, as part of a restructuring plan.

Luminar Technologies, Inc. (LAZR) Stock Slides as Market Rises: Facts to Know Before You Trade

In the closing of the recent trading day, Luminar Technologies, Inc. (LAZR) stood at $0.79, denoting a -0.03% change from the preceding trading day.

Wall Street Analysts See Luminar Technologies (LAZR) as a Buy: Should You Invest?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Luminar Technologies (LAZR) Forms 'Hammer Chart Pattern': Time for Bottom Fishing?

Luminar Technologies (LAZR) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. This coupled with an upward trend in earnings estimate revisions could mean a trend reversal for the stock in the near term.

Luminar Technologies (LAZR) Moves to Buy: Rationale Behind the Upgrade

Luminar Technologies (LAZR) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Luminar: Darkest Before The Dawn

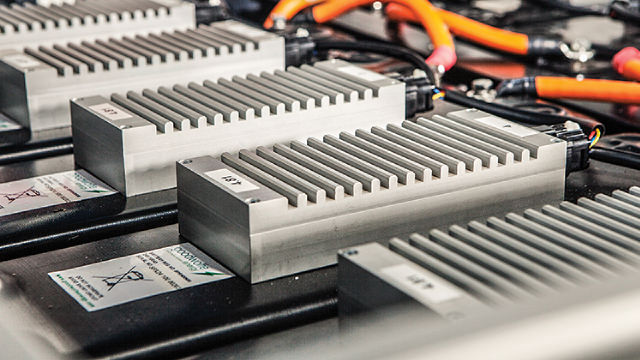

Luminar Technologies, Inc. continues to face delays in revenue growth due to production issues with Volvo, falling short of quarterly revenue targets. Despite struggles, the Luminar Semiconductor unit shows promise with over 100 customers and $100+ million in external lifetime orders. The company raised $100 million in capital and extended debt maturities, but faces challenges with high interest rates and the need for additional funding to reach profitability.

Why Luminar Stock Crashed Today

Luminar's Q2 sales and earnings missed Wall Street's targets. The company also issued disappointing sales guidance.

Luminar Delays Growth Plan Again

Luminar Technologies' Q2 results showed a 22% sequential revenue decline, along with more large losses and cash burn. The company's share count continues to surge due to a variety of items, and the balance sheet needs further help. A new debt deal was announced to help push back some maturities, but it is very costly in the near term.