Medtronic plc (MDT)

1 Reason I'd Buy Medtronic Stock and Never Sell

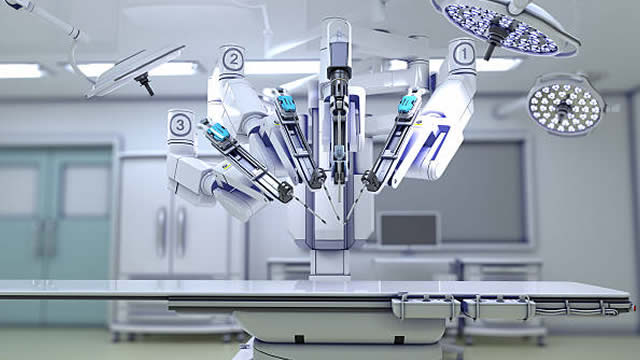

Medtronic is one of the world's largest medical device companies. Its dividend streak speaks volumes about the strength of its business.

Medtronic's “Textbook” Reversal: How High Can It Really Go in 2026?

Medtronic's NYSE: MDT stock price is amid a textbook reversal, having formed a Head & Shoulders Pattern and broken to fresh highs, confirming the baseline as a critical pivot point. The question now is how high the stock might rise.

Medtronic plc (MDT) Q3 2026 Earnings Call Transcript

Medtronic plc (MDT) Q3 2026 Earnings Call Transcript

MDT Stock Up on Q3 Earnings and Revenue Beat, Margins Down

Medtronic tops Q3 revenue and EPS estimates as Cardiovascular and Diabetes drive growth, but margin contraction tempers the upbeat quarter.

Compared to Estimates, Medtronic (MDT) Q3 Earnings: A Look at Key Metrics

The headline numbers for Medtronic (MDT) give insight into how the company performed in the quarter ended January 2026, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Medtronic Just Posted Its Best Quarter in 2.5 Years

Medtronic (NYSE: MDT) delivered its strongest enterprise revenue growth in 10 quarters, posting 8.7% reported growth (6.0% organic) for Q3 fiscal 2026.

Medtronic (MDT) Q3 Earnings and Revenues Top Estimates

Medtronic (MDT) came out with quarterly earnings of $1.36 per share, beating the Zacks Consensus Estimate of $1.33 per share. This compares to earnings of $1.39 per share a year ago.

Medtronic Profit Falls Despite Higher Revenue

Medtronic said profit fell in its fiscal third quarter as costs rose and the company invested more money into the business, offsetting higher revenue.

Medtronic beats quarterly profit estimates on robust demand for heart devices

Medtronic surpassed Wall Street expectations for third-quarter profit on Tuesday, buoyed by strong demand for its heart devices and diabetes monitors.

Medtronic: Navigating Tariffs And Chinese VBP Challenges

Medtronic delivered solid Q2 results with beats on revenue and EPS, but now trades at a 5% premium to fair value. Segment growth was led by Cardiovascular and Diabetes, though headwinds from Chinese procurement, tariffs, and regulatory risks persist. FY26 guidance was modestly raised, but forward EPS growth is just 2.5% and revenue guidance remains below consensus.

Ahead of Medtronic (MDT) Q3 Earnings: Get Ready With Wall Street Estimates for Key Metrics

Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Medtronic (MDT), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended January 2026.

Medtronic (MDT) Stock Dips While Market Gains: Key Facts

Medtronic (MDT) concluded the recent trading session at $101.72, signifying a -1.15% move from its prior day's close.