Micron Technology, Inc. (MU)

Micron (MU) Suffers a Larger Drop Than the General Market: Key Insights

Micron (MU) concluded the recent trading session at $420.97, signifying a -1.68% move from its prior day's close.

Why Micron (MU) is a Top Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Micron: The Rare Rally Of Melting Multiples

Micron: The Rare Rally Of Melting Multiples

Here is What to Know Beyond Why Micron Technology, Inc. (MU) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Micron (MU). This makes it worthwhile to examine what the stock has in store.

Could Micron Stock Fall To $280?

Micron Technology (MU) stock has risen 19% over the past month and is presently trading at about $400. Our multi-factor analysis indicates that it might be prudent to decrease exposure to MU stock.

Micron: DDR5 Prices Surge +400% Since September And Could Rise Further In 2026

Micron is still a Strong Buy, as long as current AI demand and supply constraints persist without any exogenous shocks. 79% of total revenue comes from DRAM, whose prices have surged more than 400% since September 2025, and analysts expect they could double again in 2026. Gross margin has surged to a record 68%, and EPS is guided to grow nearly 440% YoY in 2Q, as MU has gained more market share in DRAM and HBM.

Micron (MU) Stock Declines While Market Improves: Some Information for Investors

In the most recent trading session, Micron (MU) closed at $399.78, indicating a -2.89% shift from the previous trading day.

Can AI Memory Demand Sustain Micron's Margin Expansion Ahead?

MU's surging AI memory demand is driving gross margins higher, with Q2 guidance of 68% points for further expansion.

These 2 Computer and Technology Stocks Could Beat Earnings: Why They Should Be on Your Radar

Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

Why The Micron Stock Meltdown Is Overdue

Micron Technology (MU) has faced setbacks in the past. Its stock has declined over 30% within a brief period of less than two months on multiple occasions, up to 10 times in recent years, resulting in billions being lost in market value and significant gains being lost in a single correction.

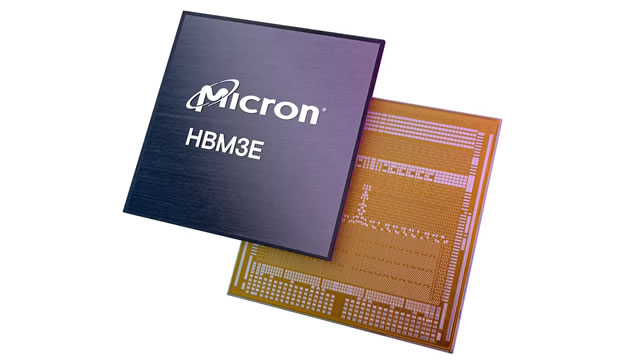

Micron Is Spending $200 Billion to Break the AI Memory Bottleneck

Memory chips used to be considered low-margin commodity products. Now the industry can't make enough to satisfy data centers' hunger.

Micron: Nothing Is Over

Micron Technology remains a 'Buy' as the bullish rally is not yet exhausted, driven by exceptional demand and pricing power. MU is projected to achieve nearly $100 billion in FY2027 revenue with historically high margins, supported by robust supply-demand dynamics in memory chips. Recent exits from consumer retail channels enable MU to redirect supply to higher-margin AI customers, reinforcing the positive earnings outlook.