NVIDIA Corporation (NVDA)

Nvidia heads into results week with the numbers almost certain to impress. The question is whether that still moves the stock

Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) reports fourth-quarter results on Tuesday after the US market closes, and Wedbush Securities has a pointed question heading into the numbers: When will investor sentiment actually shift? The US broker maintains its outperform rating and $230 price target, against a current share price of around $190.

Should You Invest in Nvidia (NVDA) Based on Bullish Wall Street Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

AI-Driven Datacenter Chip Demand to Drive NVIDIA's Q4 Earnings

NVDA readies for Q4 results, with $65B revenues in sight, as booming AI datacenter chip demand fuels surging earnings expectations.

Is Nvidia stock a ‘Buy' ahead of this week's earnings?

Despite Nvidia's (NASDAQ: NVDA) $4.3 trillion growth since late 2022 and a history of beating analyst forecasts with its earnings reports, investing in NVDA stock ahead of the filings has become a fraught affair.

The Nvidia Warning: 25x Is Not As Cheap As It Looks

Nvidia's revenue expansion has been remarkable. Sales increased by 114% in FY'25.

Nvidia's Stock May Fall Sharply After Earnings

NVIDIA faces a mechanically unfavorable setup post-earnings due to extremely bullish options positioning and high implied volatility. Implied volatility is expected to collapse from ~60% to ~30% after results, dramatically reducing call and put premiums regardless of earnings outcome. NVDA shares must clear $200 post-earnings for most call options to profit; gamma resistance and market maker hedging flows make this unlikely.

AI predicts Nvidia stock price for March 1, 2026

Insights from OpenAI's artificial intelligence (AI) platform ChatGPT project further upside for Nvidia (NASDAQ: NVDA) heading into early March, with a possible move above $200. The outlook factors in the potential impact of Nvidia's earnings, scheduled for February 25.

What to Expect in Markets This Week: Earnings From Nvidia, Home Depot, Banks, and Berkshire; Trump Speech

Earnings from Nvidia, the world's most valuable company, and President Donald Trump's State of the Union address take center stage this week.

Nvidia Wants to Be the Brain of Consumer PCs Once Again

The move marks a return to the consumer PC market for the leader in AI chips.

NVIDIA Corporation $NVDA Shares Bought by AlphaQuest LLC

AlphaQuest LLC raised its position in shares of NVIDIA Corporation (NASDAQ: NVDA) by 371.2% in the undefined quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 11,417 shares of the computer hardware maker's stock after buying an additional 8,994 shares during the period.

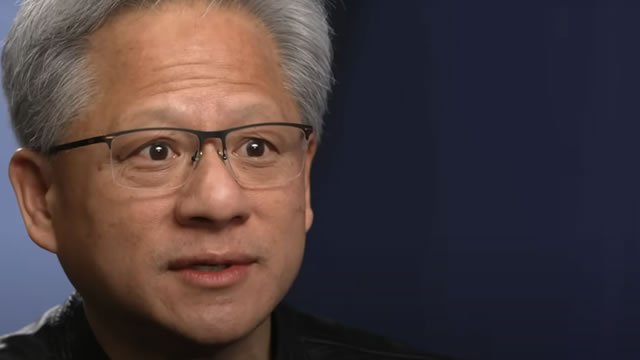

The Artificial Intelligence (AI) Infrastructure Stock That Hyperscalers Are Fighting Over for 2026

Hyperscalers are investing heavily in new data centers to meet the growing demand for AI. CEO Jensen Huang sees the buildout of more AI applications driving more demand for his company's technology.