Osi Systems Inc. (OSIS)

Here's Why Momentum in OSI (OSIS) Should Keep going

OSI (OSIS) could be a great choice for investors looking to make a profit from fundamentally strong stocks that are currently on the move. It is one of the several stocks that made it through our "Recent Price Strength" screen.

OSIS vs. NVT: Which Stock Is the Better Value Option?

Investors looking for stocks in the Electronics - Miscellaneous Components sector might want to consider either OSI Systems (OSIS) or nVent Electric (NVT). But which of these two companies is the best option for those looking for undervalued stocks?

OSIS or NVT: Which Is the Better Value Stock Right Now?

Investors interested in Electronics - Miscellaneous Components stocks are likely familiar with OSI Systems (OSIS) and nVent Electric (NVT). But which of these two companies is the best option for those looking for undervalued stocks?

Here's Why OSI (OSIS) is Poised for a Turnaround After Losing -13.45% in 4 Weeks

The heavy selling pressure might have exhausted for OSI (OSIS) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

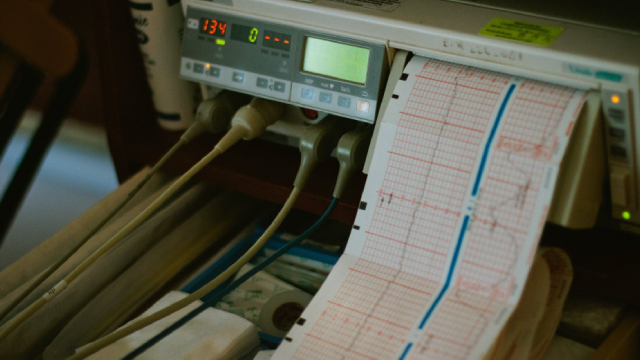

OSI Systems, Inc. (OSIS) Q1 2025 Earnings Call Transcript

OSI Systems, Inc. (NASDAQ:OSIS ) Q1 2025 Earnings Conference Call October 24, 2024 12:00 PM ET Company Participants Alan Edrick - Executive Vice President and Chief Financial Officer Deepak Chopra - President and Chief Executive Officer Conference Call Participants Josh Nichols - B. Riley Mariana Perez Mora - Bank of America Matthew Akers - Wells Fargo Lawrence Solow - CJS Securities Christopher Glynn - Oppenheimer Jeff Martin - Roth Capital Partners Operator Thank you for standing by, and welcome to the OSI Systems First Quarter 2025 Conference Call.

OSI (OSIS) Reports Q1 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for OSI (OSIS) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

OSI Systems (OSIS) Q1 Earnings and Revenues Surpass Estimates

OSI Systems (OSIS) came out with quarterly earnings of $1.25 per share, beating the Zacks Consensus Estimate of $1.06 per share. This compares to earnings of $0.91 per share a year ago.

OSI Systems (OSIS) to Report Q1 Results: Wall Street Expects Earnings Growth

OSI (OSIS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

What Makes OSI (OSIS) a Good Fit for 'Trend Investing'

OSI (OSIS) made it through our "Recent Price Strength" screen and could be a great choice for investors looking to make a profit from stocks that are currently on the move.

OSIS vs. NVT: Which Stock Is the Better Value Option?

Investors with an interest in Electronics - Miscellaneous Components stocks have likely encountered both OSI Systems (OSIS) and nVent Electric (NVT). But which of these two stocks is more attractive to value investors?

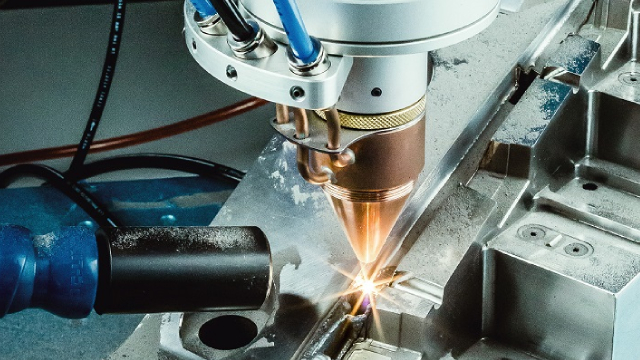

OSIS Expands International Footprint With Operations in Uruguay.

OSI System starts operations through advanced custom screening applications to enhance security at Uruguay's ports and borders.

OSI (OSIS) is on the Move, Here's Why the Trend Could be Sustainable

If you are looking for stocks that are well positioned to maintain their recent uptrend, OSI (OSIS) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.